Please use a PC Browser to access Register-Tadawul

Spectral AI, Inc. (NASDAQ:MDAI) Stock Catapults 29% Though Its Price And Business Still Lag The Industry

Spectral AI, Inc. Class A MDAI | 1.75 | -3.31% |

Spectral AI, Inc. (NASDAQ:MDAI) shareholders are no doubt pleased to see that the share price has bounced 29% in the last month, although it is still struggling to make up recently lost ground. Notwithstanding the latest gain, the annual share price return of 4.0% isn't as impressive.

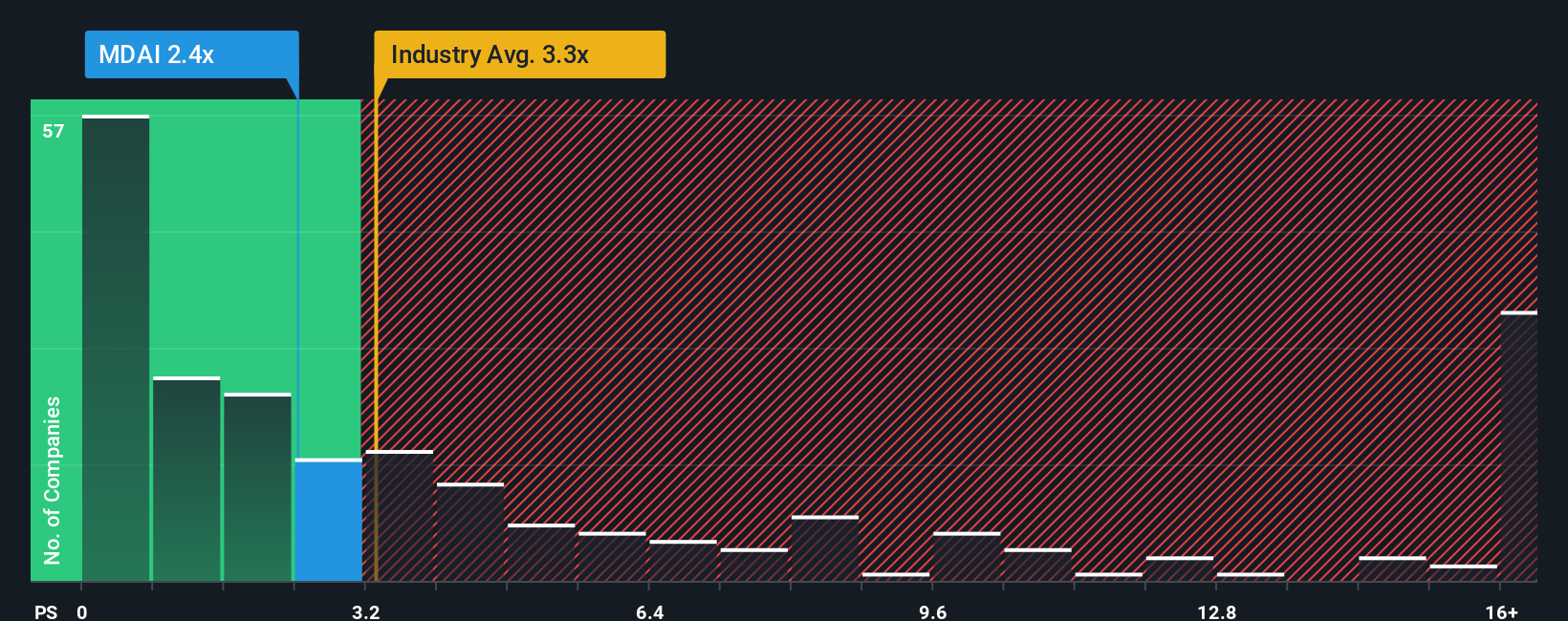

Even after such a large jump in price, Spectral AI's price-to-sales (or "P/S") ratio of 2.4x might still make it look like a buy right now compared to the Medical Equipment industry in the United States, where around half of the companies have P/S ratios above 3.3x and even P/S above 9x are quite common. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

How Has Spectral AI Performed Recently?

While the industry has experienced revenue growth lately, Spectral AI's revenue has gone into reverse gear, which is not great. It seems that many are expecting the poor revenue performance to persist, which has repressed the P/S ratio. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Spectral AI.How Is Spectral AI's Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as low as Spectral AI's is when the company's growth is on track to lag the industry.

Retrospectively, the last year delivered a frustrating 15% decrease to the company's top line. This has erased any of its gains during the last three years, with practically no change in revenue being achieved in total. Therefore, it's fair to say that revenue growth has been inconsistent recently for the company.

Turning to the outlook, the next three years should generate growth of 11% per year as estimated by the four analysts watching the company. With the industry predicted to deliver 122% growth per annum, the company is positioned for a weaker revenue result.

With this in consideration, its clear as to why Spectral AI's P/S is falling short industry peers. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

What We Can Learn From Spectral AI's P/S?

The latest share price surge wasn't enough to lift Spectral AI's P/S close to the industry median. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As we suspected, our examination of Spectral AI's analyst forecasts revealed that its inferior revenue outlook is contributing to its low P/S. Shareholders' pessimism on the revenue prospects for the company seems to be the main contributor to the depressed P/S. It's hard to see the share price rising strongly in the near future under these circumstances.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.