Please use a PC Browser to access Register-Tadawul

SPS Commerce (SPSC) Earnings Growth Outpaces Revenue Expectations And Tests Bullish Narratives

SPS Commerce, Inc. SPSC | 57.95 | -0.69% |

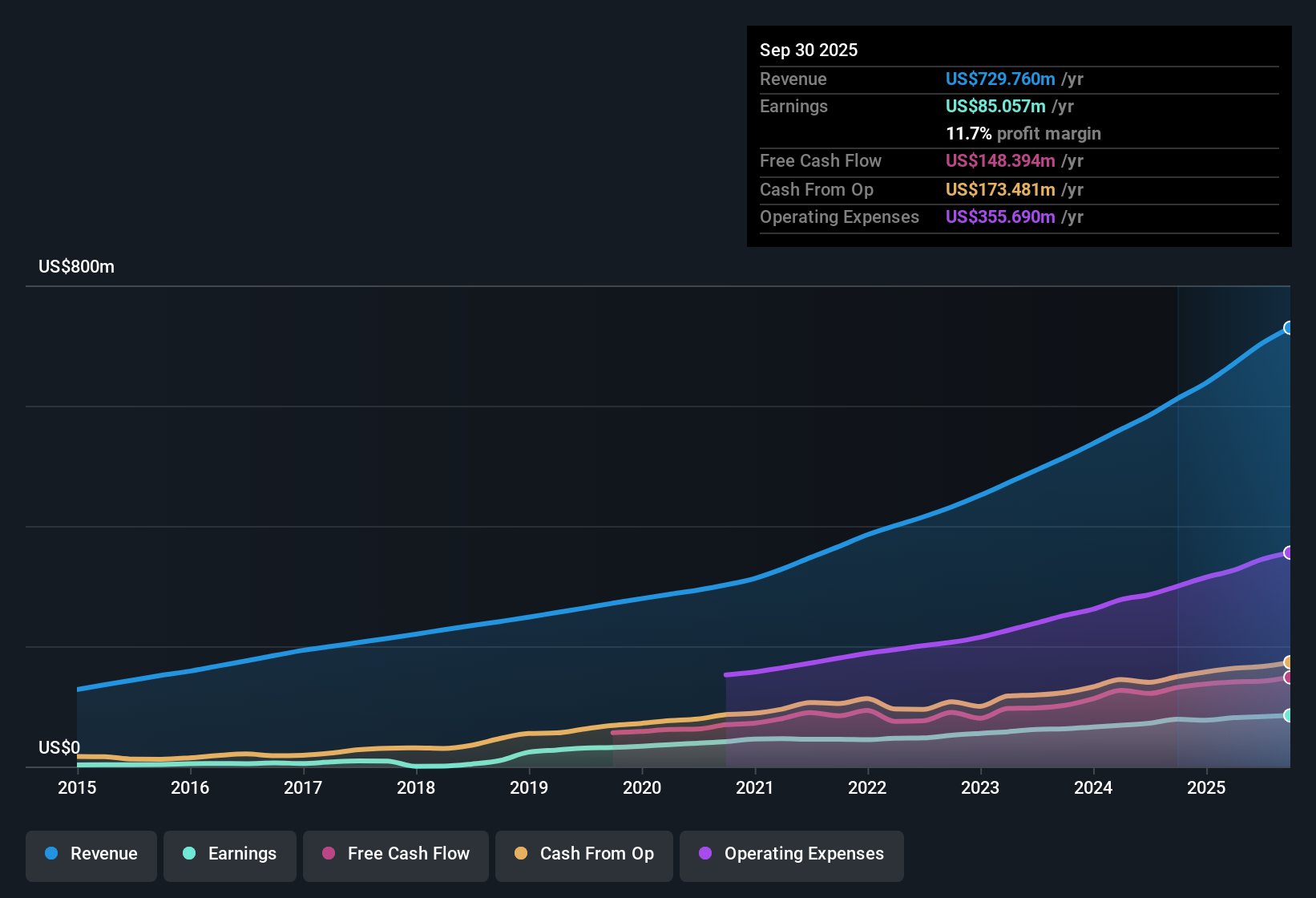

SPS Commerce (SPSC) has just wrapped up FY 2025 with fourth quarter revenue of US$192.7 million and basic EPS of US$0.69, alongside net income of US$25.8 million. This gives investors a clear snapshot of how the year closed out. The company has seen revenue move from US$170.9 million in Q4 2024 to US$192.7 million in Q4 2025, while quarterly basic EPS has shifted from US$0.47 to US$0.69 over the same period. This was supported by trailing twelve month EPS of US$2.46 on revenue of US$751.5 million as the latest marker of earnings power. With earnings up 21.1% over the last year and margins sitting at 12.4%, the results frame a story where profitability trends are central to how investors may read this update.

See our full analysis for SPS Commerce.With the headline numbers on the table, the next step is to see how this earnings profile lines up against the prevailing narratives around SPS Commerce, and where the data either backs or challenges those stories.

21.1% earnings growth anchors the story

- On a trailing twelve month basis, SPS Commerce earned US$93.3 million of net income on US$751.5 million of revenue, with Basic EPS of US$2.46 and a net margin of 12.4% compared with 12.1% a year ago, alongside 21.1% earnings growth over that period.

- What bullish investors focus on here is how that 21.1% earnings growth and 12.4% margin line up with their view that cloud based supply chain demand and acquisitions can keep supporting recurring revenue and margins. At the same time, the actual trailing revenues of US$751.5 million and steady quarterly EPS in 2025 show the business already operating at a scale that fits that story.

- The bullish narrative talks about an US$11.1b addressable market and room to grow via acquisitions like SupplyPike and Carbon6. The current US$751.5 million of trailing revenue gives a concrete starting point for that expansion argument.

- The move from a 12.1% to 12.4% net margin is also consistent with bulls pointing to automation and efficiency gains as levers that can support higher long term earnings even if revenue growth is more measured.

Valuation signals versus 25x P/E

- The shares trade on a trailing P/E of 25x against a US Software industry average of 26.7x and a peer average of 69.6x, while the supplied DCF fair value of US$125.55 sits well above the current share price of US$61.92.

- Critics who lean bearish tend to argue that slower revenue expansion could limit how far the market is willing to rerate that 25x multiple. The forecasts of about 6.9% revenue growth alongside 16.6% earnings growth highlight the tension between a relatively low P/E and the idea that earnings can still compound from here.

- The bearish narrative talks about elongated sales cycles and pressure on average revenue per user, and the 6.9% revenue growth forecast, which is below the 10.3% US market revenue forecast, fits that more cautious stance.

- The 16.6% forecast earnings growth and current 12.4% net margin show that, so far, profitability metrics remain solid relative to those concerns. This is why some investors may look twice at a P/E that is below peers and a DCF fair value that is more than double the current price.

Forecast growth slower on revenue than earnings

- Forward looking figures in the dataset point to forecast revenue growth of about 6.9% per year compared with a 10.3% US market forecast, while earnings are projected to grow around 16.6% per year versus a 15.7% market earnings forecast, and the company’s five year earnings growth rate is cited at 15.8% per year.

- Analysts in the balanced view lean on this gap, arguing that SPS Commerce may not chase the highest top line growth but could still see EPS grow faster than the market if margins keep improving. The current 12.4% net margin and consistent quarterly EPS in 2025 align with that focus on earnings quality rather than headline revenue expansion.

- The consensus narrative highlights operational efficiency work, including automation and onboarding improvements, and the slight margin uptick alongside US$93.3 million of trailing net income shows those efforts feeding into profitability.

- The revenue growth forecast lagging the broader US market also supports the idea that SPS Commerce is more of a steady compounder than a hyper growth story, which is important context when you are weighing the 25x P/E against the earnings and revenue profiles provided.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for SPS Commerce on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

See the numbers differently? If this earnings story points you in another direction, shape that view into your own narrative in just a few minutes: Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding SPS Commerce.

See What Else Is Out There

SPS Commerce’s revenue growth forecast of 6.9% per year, which trails the broader US market’s 10.3% forecast, may leave growth focused investors wanting more.

If that slower top line outlook has you thinking about stronger growth profiles, run your eye over our screener containing 23 high quality undiscovered gems to spot companies with the potential to surprise you.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.