Please use a PC Browser to access Register-Tadawul

Stocks to Watch | Amazon Earnings This Week: AWS and Ads Drive Growth, Capital Spending in Focus

Amazon.com, Inc. AMZN | 222.56 225.11 | +0.01% +1.15% Pre |

Alphabet Inc. Class A GOOGL | 306.57 307.23 | -0.54% +0.22% Pre |

Meta Platforms META | 657.15 656.99 | +1.49% -0.02% Pre |

Apple Inc. AAPL | 274.61 275.05 | +0.18% +0.16% Pre |

PowerShares QQQ Trust,Series 1 QQQ | 611.75 613.54 | +0.20% +0.29% Pre |

Amazon.com, Inc.(AMZN.US) is set to report its Q4 earnings on February 6 after the U.S. market close. Consensus expectations from analysts suggest Amazon will achieve revenue of $187.25 billion for Q4 2024, marking a year-over-year increase of 10.17%, with expected earnings per share (EPS) of $1.49, up 48.51% from the same period last year.

So far this year, Amazon's stock has shown a volatile upward trend, with an overall year-to-date gain of 8.34%, at one point hitting a record high.

Looking ahead to the fourth quarter, market focus remains on Amazon's two major growth engines: AWS cloud services and its advertising business. Additionally, as DeepSeek makes waves in the global market, capital expenditures have also become a key area of interest for investors.

- AWS Cloud Services:

Amazon Web Services (AWS) is the most closely watched segment of the market. Analysts expect AWS to continue being Amazon’s primary growth driver, with forecasted revenue growth of 19%-20% for the fourth quarter. Jefferies highlights the strong demand for generative AI and the accelerated shift of operations to the cloud as key drivers for AWS’s revenue growth.

Moreover, some market perspectives suggest that AWS's growth could reaccelerate due to Amazon’s increased investments in related projects and heightened collaborations with AI companies, coupled with the boost from Trump’s $500 billion investment plan for data centers and cloud providers. This is expected to lead to an overall rise in Amazon’s profit margins and valuation.

- Advertising Business:

Amazon’s advertising segment is seen as one of its most promising growth areas. Market forecasts project Q4 advertising revenue to grow 19%-21% year-over-year, outpacing competitors like Alphabet Inc. Class A(GOOGL.US) and Meta Platforms(META.US). The high profitability of the advertising business makes it a crucial revenue source for Amazon, especially with the integration of ads into Prime Video and increasing retail ad demand. Barclays analysts believe that advertising revenue can further enhance the company's overall profit margins.

Amazon’s advertising revenue has recently been a powerful growth engine, with Q3 revenue up 18.8% year-over-year, significantly boosting the company’s profitability, a trend likely to continue into the fourth quarter.

Additionally, strong consumer spending during the holiday season is expected to significantly boost Amazon's e-commerce revenue. According to Adobe Analytics, U.S. online sales during the 2024 holiday season are projected to grow 6.1% year-over-year, with Amazon expected to capture nearly 40% of the market share.

Analysts expect Amazon's "Prime Big Deal Days" to perform strongly, with the company's increasingly efficient delivery services likely contributing significantly to revenue during the holiday season.

Jefferies forecasts that Amazon’s Q4 results will exceed market expectations, driven primarily by robust growth in AWS and advertising. Analysts anticipate that holiday season sales will push total revenue to new highs.

- Capital Expenditures:

In terms of capital expenditure, Amazon expects its Q4 capital expenditures to be $23 billion, with a full-year figure of $75 billion, over half of which is related to AWS. Amazon executives have indicated that the return on capital expenditures for AI is very high, emphasizing the importance of early investment in AI infrastructure to reap significant returns during the boom period.

Morgan Stanley points out that Amazon’s capital expenditures could reach $95-$100 billion this year, as the company ramps up investments in data centers, GPUs, servers, and energy storage generation, laying the groundwork for its AI and cloud business and maintaining its leading position.

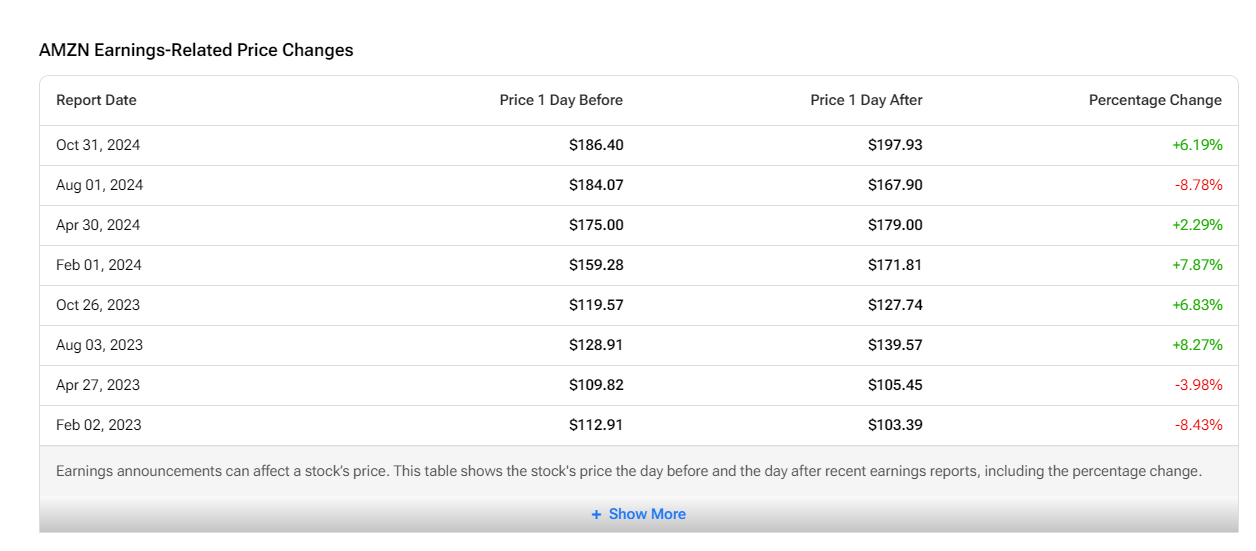

- Historical Stock Performance on Earnings Days:

Currently, Amazon's implied volatility is ±6.7%, suggesting that the options market is betting on a single-day post-earnings price move of 6.7%. By comparison, the average single-day price movement post-earnings for the previous four quarters has been ±6.53%.