Please use a PC Browser to access Register-Tadawul

Stocks to Watch | Key Insights Ahead of Netflix's Tuesday Earnings Release

Netflix, Inc. NFLX | 95.19 | +1.17% |

Amazon.com, Inc. AMZN | 226.19 | -1.78% |

Apple Inc. AAPL | 278.28 | +0.09% |

Walt Disney Company DIS | 111.60 | +0.13% |

T-Rex 2X Long NFLX Daily Target ETF NFLU | 33.77 | +2.18% |

On Tuesday, after the U.S. stock market closes, streaming giant Netflix, Inc.(NFLX.US) is set to release its fiscal year 2024 annual report. Market forecasts anticipate Netflix to achieve fourth-quarter revenue of $10.118 billion, marking a year-on-year increase of 14.55%. Earnings per share are expected to stand at $4.19, reflecting an impressive 98.7% year-on-year growth.

Over the past month, Netflix's stock has seen a nearly 5% decline, primarily driven by broader market sell-off pressures amidst macroeconomic uncertainties. Nevertheless, Netflix's stock has demonstrated a strong performance throughout 2024, maintaining an upward trajectory and appreciating by 83.07% in 2024. The stock reached a historic high of $941.75 on December 11, 2024.

Performance Outlook for Fiscal Year 2024

As investors and analysts eagerly await Netflix's earnings report, they are poised to scrutinize any shifts in the company narrative.

Netflix will cease disclosing user numbers in its first quarter 2025 earnings, transitioning its focus from user growth to financial metrics. Achieving this financial growth will require boosting advertising revenue contributions, enhancing user retention, and optimizing the content strategy in 2025.

Shift from User Growth to Financial Metrics

In Q3 2024, Netflix added 5.1 million net new subscribers, bringing the total to 283 million, surpassing analyst expectations. The subscriber count was 260 million at the end of 2023.

Macquarie analysts project that Netflix will gain over 33 million new subscribers globally throughout 2024, totaling 293 million. They argue this figure could be exceeded due to successful events and shows such as the Paul/Tyson boxing match, NFL Christmas events, and the second season of "Squid Game."

Starting Q1 2025, Netflix will no longer report new subscriber numbers or Average Revenue Per User (ARPU) to investors, emphasizing a strategic pivot from quarterly net user additions to overall revenue growth. This marks the last annual performance report to include user numbers.

The narrative shift began in 2023 when Netflix started cracking down on password sharing and introduced a paid sharing model, allowing account holders to pay extra for service to members outside their household. Investors are closely watching for signs of whether these measures will positively impact revenue growth.

Goldman Sachs highlights that Netflix's ad-supported strategy and pricing are pivotal for FY2025 ARM (Average Revenue per Member). Investors should monitor the pace and frequency of price increases in mature markets and the year-on-year revenue growth following these pricing adjustments.

Key Metrics: Advertising Revenue Contribution, User Retention

In Q3 2024, over 50% of new subscribers opted for the ad-supported plan, with related user numbers growing 35% quarter-on-quarter.

To shift its earnings narrative, Netflix will prioritize enhancing its ad products, aiming for a significant uplift in overall financial performance from increased advertising revenue.

Netflix plans to boost user engagement and reduce churn by diversifying its entertainment offerings, including more live events, and investing in content creation. Recent ventures into sports streaming, such as NFL game broadcasts and the Paul vs. Tyson event, have seen increased online engagement.

Netflix's 2025 content lineup includes WWE programming and new seasons of popular shows like "Stranger Things" and "Wednesday." Balancing content investment with cost management will support the company's goal of expanding profit margins in 2025.

Furthermore, Netflix is expanding its business scope, exploring new areas such as gaming, and leveraging its vast content library. This diversification, combined with a flexible pricing model, including ad-supported tiers, is aimed at attracting a broad user base while steadily increasing prices.

Challenges: Increasing Competition, Cost Pressures

Although Netflix remains on a growth track, potential stumbling blocks persist. With the stabilization of the paid sharing measures' impact, subscription growth may decelerate.

Barclays points out that Netflix's progress in expanding its ad-supported user base has been slow, with only 9% of subscribers using the ad-supported plan compared to 30% for Disney+. This disparity is attributed to traditional media companies leveraging their established advertising infrastructures, whereas Netflix lacks a competitive edge.

Moreover, the increasing ad inventory across the streaming sector may keep CPM (Cost Per Thousand Impressions) under pressure, potentially moderating Netflix's ad revenue growth.

Rising content costs amid stiff competition from Disney+, Amazon.com, Inc.(AMZN.US)Prime Video, HBO Max, and Apple TV+ also present challenges. Disney+ recently announced plans to expand into live sports, while Amazon Prime Video is enhancing global reach through localized content.

With Hollywood ramping up production post-strike, Netflix's content spending is expected to surge. Despite an impressive $17 billion budget for 2024, analysts caution that maintaining a robust content pipeline will require substantial investment. Rising production costs, inflation, and global economic uncertainty further complicate the landscape.

Wall Street Analysts Remain Optimistic

- KeyBanc analyst Justin Patterson maintains an "Overweight" rating on Netflix, raising the target price from $785 to $1,000.

- Goldman Sachs maintains a "Neutral" rating, increasing the target price from $750 to $850.

- BMO Capital Markets' analyst Brian J. Pitz continues to rate Netflix as "Outperform", raising the target price from $825 to $1,000.

- Wedbush analyst Michael Pachter holds a "Buy" rating with a target price of $950.

- JPMorgan's analyst Doug Anmuth remains bullish with a "Buy" rating, setting a target price of $1,000.

- UBS analyst John Hodulik also retains a "Buy" rating, targeting $1,040.

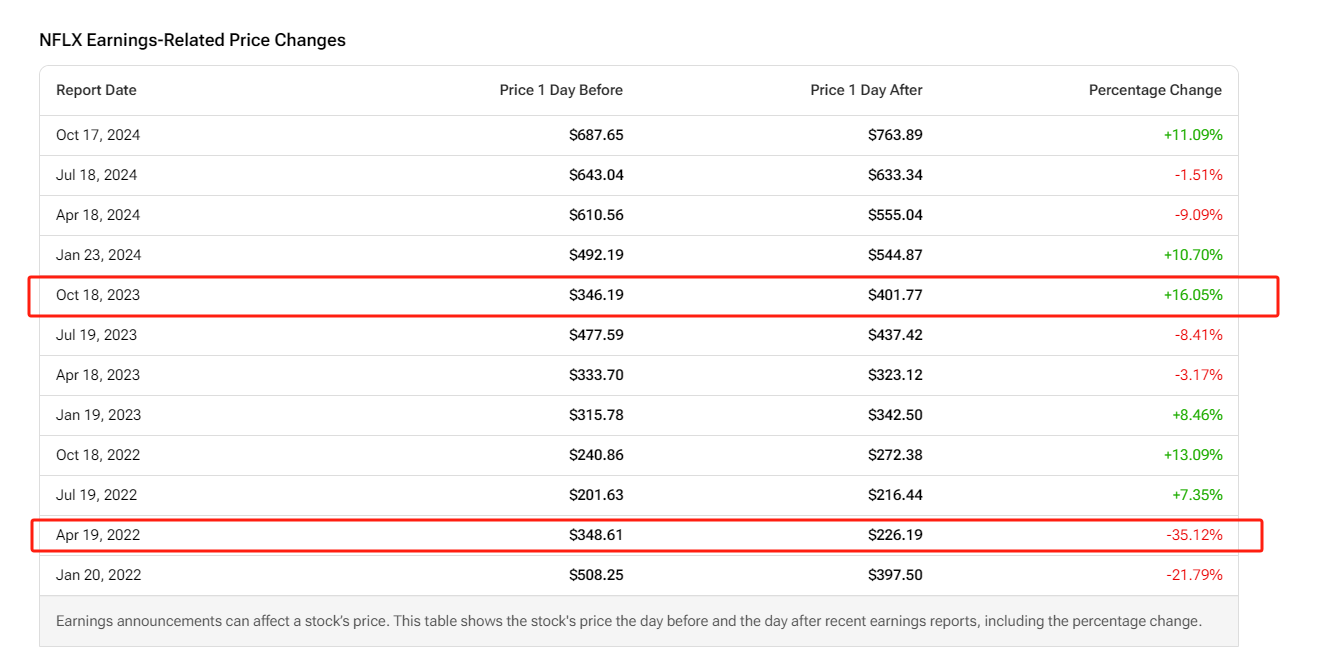

Historical Performance on Earnings Days

According to Tipranks, over the past 12 earnings periods, Netflix shares have seen an average movement of ±12.2% on earnings day, with the largest increase being 16.05% and the largest decline 35.12%.

Currently, Netflix's implied volatility stands at ±8.87%, suggesting the options market is pricing in an 8.7% single-day post-earnings movement. Comparatively, the average movement over the last four quarters was ±8.1%, indicating a potentially higher volatility expectation this earnings season.