Please use a PC Browser to access Register-Tadawul

Stocks to Watch | Trump Shakes Up the Market Again! A Look Back at April's Crash: Is "TACO" Trading Set for a Comeback?

Oracle Corporation ORCL | 183.74 | -3.28% |

Broadcom Limited AVGO | 349.56 | -2.88% |

Taiwan Semiconductor Manufacturing Co., Ltd. Sponsored ADR TSM | 293.20 | +0.40% |

NVIDIA Corporation NVDA | 178.19 | +1.81% |

Tesla Motors, Inc. TSLA | 475.38 | +3.58% |

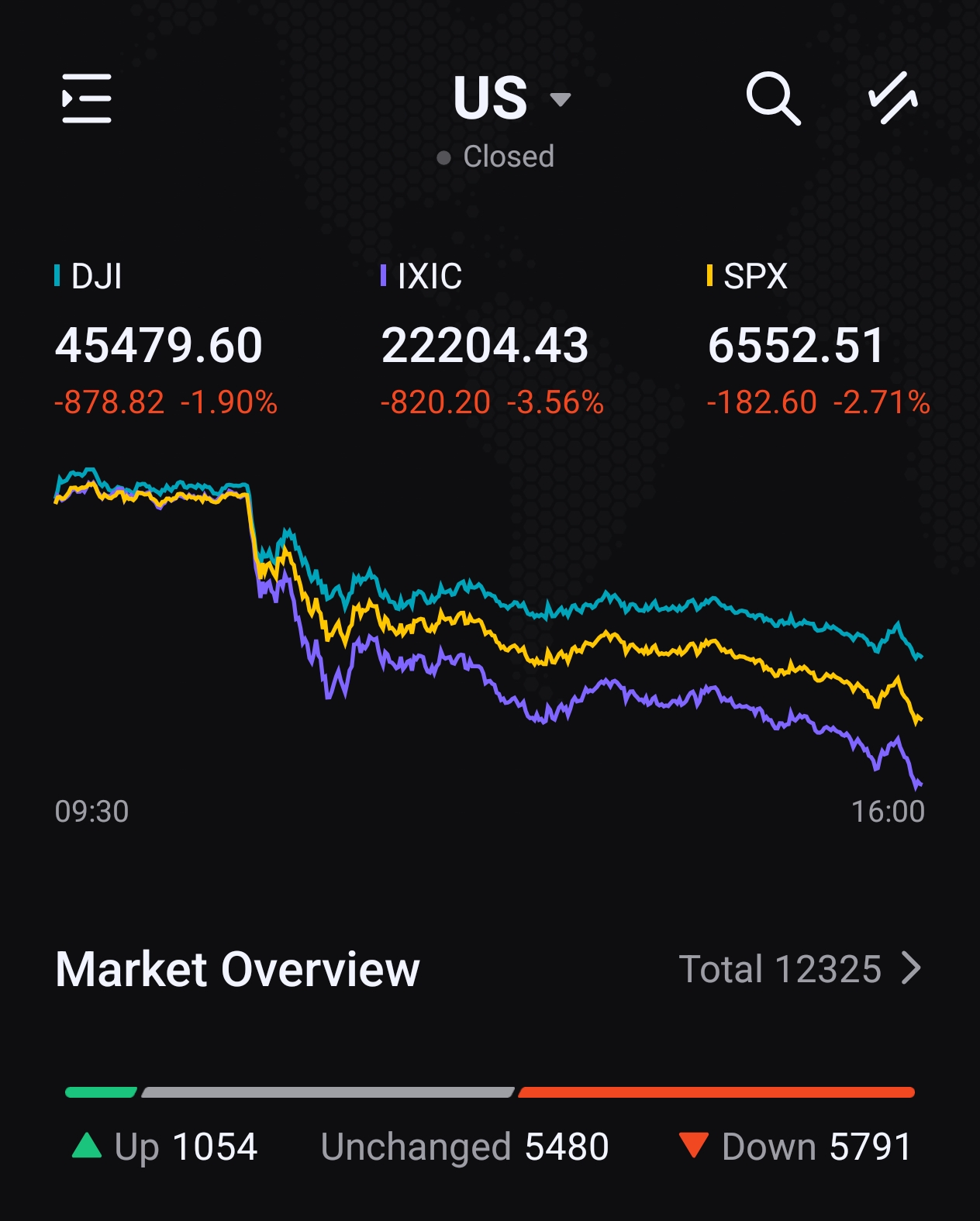

On Friday, U.S. stocks experienced a sharp decline reminiscent of April's market drop six months ago, driven by Trump's tariff threats. High-risk assets like cryptocurrencies, along with key economic indicators such as oil and copper, took a dive, while U.S. Treasury bonds and gold saw price increases.

Currently, the market is interpreting events through the lens of April's scenario, anticipating the reemergence of the "TACO trade," which stands for "Trump Always Chickens Out."

Throughout this year, Wall Street has developed a profitable strategy in response to Trump's tariff policies, known as the "TACO trade."

Looking back at the market's performance earlier this year, the "TACO trade" has repeatedly showcased cycles of euphoria followed by panic. At the start of the year, expectations of deregulation and tax cuts with Trump's return to the White House propelled the stock market, with the S&P 500 hitting a record high in February.

However, this optimism was short-lived. As Trump prioritized tariff issues, investor enthusiasm quickly waned. By mid-March, following Trump's announcement of large-scale tariffs, the S&P 500 fell into a technical correction, dropping over 10% from its peak.

As anticipated by Wall Street, Trump later paused or reduced some tariff measures, leading to a brief market rebound. Yet, this rebound was fleeting—on April 2, Trump's announcement of reciprocal tariffs pushed the benchmark index back to the brink of a bear market.

On April 9, Trump tweeted that it was a good time to buy, pausing the Liberation Day tariffs. This sparked a strong market rally, with the S&P 500 surging over 35% from April 9 to October 9.

Following the "TACO trade" and AI-driven trading trends, tech giants have experienced varying degrees of rebound since April 9:

- Oracle Corporation(ORCL.US), Broadcom Limited(AVGO.US), and Taiwan Semiconductor Manufacturing Co., Ltd. Sponsored ADR(TSM.US) have all doubled in value compared to April 8.

- NVIDIA Corporation(NVDA.US) and Tesla Motors, Inc.(TSLA.US) saw gains of over 90%.

- Alphabet Inc. Class C(GOOG.US), Microsoft Corporation(MSFT.US), Apple Inc.(AAPL.US), Meta Platforms(META.US), and Amazon.com, Inc.(AMZN.US) increased by 30% to 66%.

| Name/Code | Decline After Reciprocal Tariff Signed (04/03-04/08) | Rise After Reciprocal Tariff Suspended (04/09-10/09) |

|---|---|---|

| Oracle Corporation(ORCL.US) | -14.64% | 140.30% |

| Broadcom Limited(AVGO.US) | -9.33% | 122.02% |

| Taiwan Semiconductor Manufacturing Co., Ltd. Sponsored ADR(TSM.US) | -17.03% | 113.54% |

| NVIDIA Corporation(NVDA.US) | -12.79% | 99.99% |

| Tesla Motors, Inc.(TSLA.US) | -21.54% | 96.31% |

| Alphabet Inc. Class C(GOOG.US) | -7.73% | 65.59% |

| Microsoft Corporation(MSFT.US) | -7.22% | 47.85% |

| Apple Inc.(AAPL.US) | -22.99% | 47.70% |

| Meta Platforms(META.US) | -12.58% | 43.91% |

| Amazon.com, Inc.(AMZN.US) | -12.93% | 33.45% |

As markets face renewed tariff tensions, how do current conditions differ from those in April? What should investors focus on next, and how should they position themselves? Let’s break it down step by step.

Key Differences Between Now and April:

According to research from CICC (China International Capital Corporation), there are several notable differences between the current situation and early April during the last round of reciprocal tariffs:

1. Degree of Surprise

This time, the market is less shocked compared to April 2, when the announcement of reciprocal tariffs was completely unexpected. Having gone through a similar situation before, investors are now psychologically more prepared, making this the biggest difference.

2. Scope of Tariffs

In April, the U.S. imposed tariffs on nearly all global markets. This time, the focus is primarily on China. While U.S.-China relations are the most critical, the narrower scope explains why Friday’s "triple sell-off" in stocks, bonds, and currencies was less pronounced compared to April. The reaction was mostly limited to equity sell-offs, with U.S. Treasuries and the dollar showing less volatility.

3. Future Outlook

During April’s tariff announcement, the market was completely uncertain about how events would unfold, akin to "driving in the fog." While significant uncertainties remain this time, there is a clearer timeline ahead, with tariffs set to take effect on November 1. Additionally, the upcoming APEC summit (October 31–November 1) could encourage a wait-and-see approach, as Trump has not ruled out the possibility of meeting with Chinese officials.

4. Preparation and Context

The readiness and circumstances of the U.S. have changed significantly since April:

- The U.S. has already reached agreements with most markets, except India.

- A ceasefire in the Middle East appears to have been achieved.

- The Federal Reserve has cut interest rates and may continue to do so.

- The "Big Beauty Act" has passed.

- Concerns over the AI bubble caused by DeepSeek’s sudden rise earlier this year have dissipated.

5. Market Positioning

U.S. markets now have significant unrealized gains and higher valuations compared to April.

- U.S. Markets:

The "Magnificent Seven" stocks have been in a correction phase since February, after DeepSeek’s emergence disrupted the U.S.’s dominance in AI. Current valuations for the "Magnificent Seven" stand at 31x earnings, below the peak of 33.7x seen late last year and earlier this year, but higher than April’s pre-tariff level of 26.8x. After April’s sell-off, valuations bottomed at 23x. - Broad Market Indices:

The S&P 500 is trading at a valuation of 21x earnings, compared to last year’s high of 22x. Before April’s tariffs, it was at 20.5x, and after the sell-off, it hit a low of 18x.

Key Focus Areas Moving Forward

According to CICC, the primary factor driving market movements remains the progress of tariff negotiations, particularly any compromises reached before the APEC summit (October 31–November 1) and the scheduled tariff implementation date of November 1. These developments will be critical in shaping market sentiment.

Beyond macro-level factors, investors should also pay attention to key technical support levels for the indices.

CICC’s research highlights that after the reciprocal tariffs on April 2, the VIX index surged to 60, while its current level is 21.7. During the April sell-off, the S&P 500 stabilized at its 120-week moving average, which now corresponds to 5,420 points (17% below current levels). Before reaching this level, key support points lie at 6,500 and 6,200.

How Should Investors Respond?

From a market perspective, compared to early April, the current situation is relatively "less favorable" due to higher valuations and more significant unrealized gains. This increases the likelihood of profit-taking and short-term volatility.

However, this is primarily a short-term concern. On the positive side, the level of panic in the market is lower, and both the U.S. and China are better prepared this time. Additionally, the trends in the AI industry are clearer, and U.S. monetary and fiscal policies are gradually providing support. For volatility and panic similar to April to recur, the market would need to firmly believe that a compromise in tariff negotiations is entirely out of reach.

CICC’s preliminary assessment suggests that short-term, sentiment-driven volatility may be unavoidable, but markets will closely monitor negotiation progress ahead of November.

For investors who have already reduced their positions:

It may be prudent to wait for better opportunities to re-enter high-quality sectors at lower costs.

For investors who have not adjusted their positions:

There may be no need to act during the initial panic. Instead, wait for a rebound after the fear subsides slightly and adjust as needed.

Do you think TACO will make a comeback?