Please use a PC Browser to access Register-Tadawul

Strong week for CareDx (NASDAQ:CDNA) shareholders doesn't alleviate pain of five-year loss

CareDx, Inc. CDNA | 20.56 20.56 | +3.84% 0.00% Pre |

Ideally, your overall portfolio should beat the market average. But even the best stock picker will only win with some selections. At this point some shareholders may be questioning their investment in CareDx, Inc (NASDAQ:CDNA), since the last five years saw the share price fall 40%.

While the stock has risen 7.2% in the past week but long term shareholders are still in the red, let's see what the fundamentals can tell us.

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

CareDx became profitable within the last five years. That would generally be considered a positive, so we are surprised to see the share price is down. Other metrics may better explain the share price move.

Revenue is actually up 12% over the time period. So it seems one might have to take closer look at the fundamentals to understand why the share price languishes. After all, there may be an opportunity.

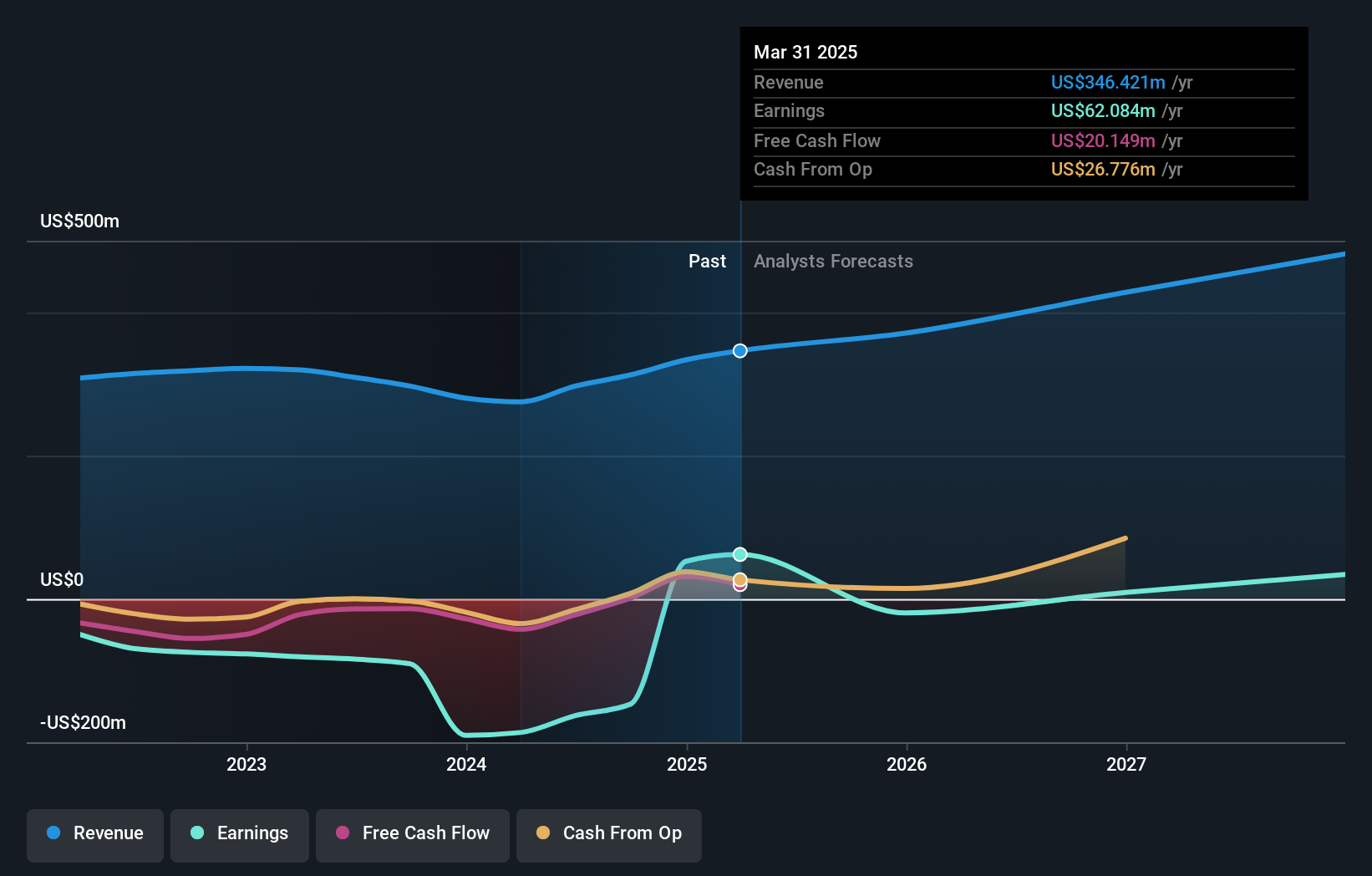

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

We know that CareDx has improved its bottom line lately, but what does the future have in store? So we recommend checking out this free report showing consensus forecasts

A Different Perspective

We're pleased to report that CareDx shareholders have received a total shareholder return of 31% over one year. That certainly beats the loss of about 7% per year over the last half decade. This makes us a little wary, but the business might have turned around its fortunes. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Like risks, for instance.

We will like CareDx better if we see some big insider buys.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.