Strong week for Gevo (NASDAQ:GEVO) shareholders doesn't alleviate pain of three-year loss

Gevo, Inc. GEVO | 0.00 |

It's nice to see the Gevo, Inc. (NASDAQ:GEVO) share price up 11% in a week. But the last three years have seen a terrible decline. The share price has sunk like a leaky ship, down 89% in that time. So we're relieved for long term holders to see a bit of uplift. But the more important question is whether the underlying business can justify a higher price still. We really hope anyone holding through that price crash has a diversified portfolio. Even when you lose money, you don't have to lose the lesson.

On a more encouraging note the company has added US$15m to its market cap in just the last 7 days, so let's see if we can determine what's driven the three-year loss for shareholders.

See our latest analysis for Gevo

Gevo wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Shareholders of unprofitable companies usually desire strong revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

Over three years, Gevo grew revenue at 86% per year. That's well above most other pre-profit companies. So why has the share priced crashed 24% per year, in the same time? The share price makes us wonder if there is an issue with profitability. Ultimately, revenue growth doesn't amount to much if the business can't scale well. Unless the balance sheet is strong, the company might have to raise capital.

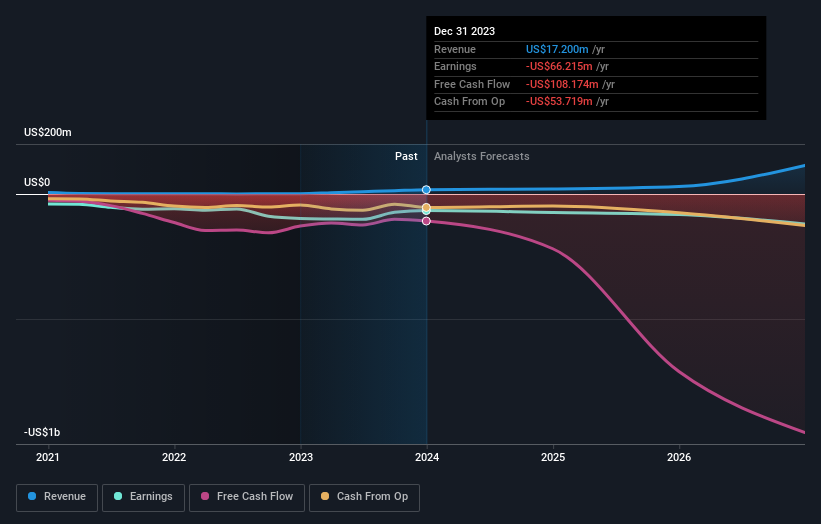

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

This free interactive report on Gevo's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

Investors in Gevo had a tough year, with a total loss of 42%, against a market gain of about 26%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 11% per year over five years. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For instance, we've identified 2 warning signs for Gevo that you should be aware of.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Recommend

- Sahm Platform 02/12 05:56

SMX (Security Matters) Shares Resume Trade

Benzinga News 02/12 15:50Southwest Airlines Partners with Condor to Expand Transatlantic Travel Options

Reuters 02/12 16:00P/E Ratio Insights for Antero Midstream

Benzinga News 02/12 16:00Roth Capital Maintains Buy on Credo Technology Group, Raises Price Target to $250

Benzinga News 02/12 16:58Goldman Sachs Maintains Neutral on Bristol-Myers Squibb, Raises Price Target to $57

Benzinga News 02/12 18:13Event Reminder | Get Ready for 04:15 PM Today (Wed., Dec. 3th)

Sahm Platform 03/12 09:50US Market Preview | VRAX Surges 108.0%; ADP Jobs Data Misses Expectations, Futures Rise; NVDA's OpenAI Investment Pending

Sahm Platform 03/12 13:59