Please use a PC Browser to access Register-Tadawul

Subdued Growth No Barrier To Canadian General Medical Center Complex Company (TADAWUL:9518) With Shares Advancing 26%

Canadian Medical Center Co. 9518.SA | 9.05 | Delist |

The Canadian General Medical Center Complex Company (TADAWUL:9518) share price has done very well over the last month, posting an excellent gain of 26%. Looking back a bit further, it's encouraging to see the stock is up 57% in the last year.

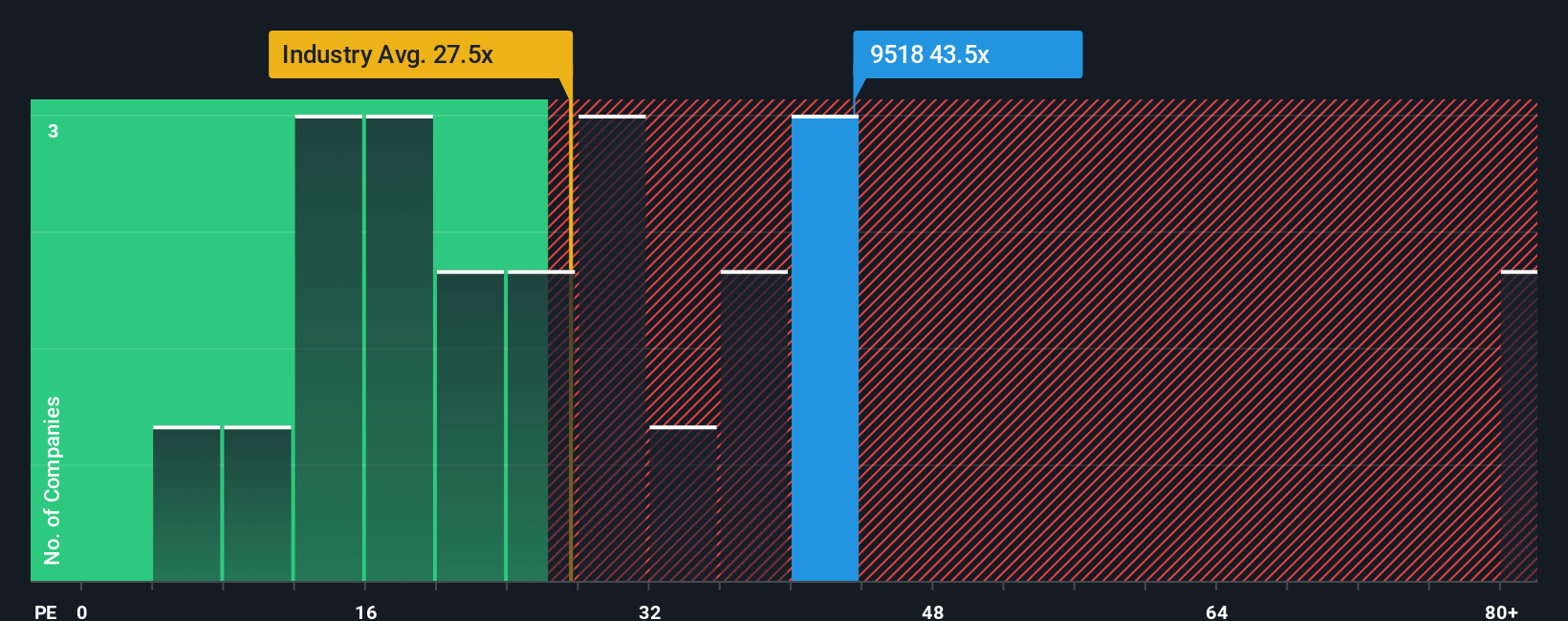

Following the firm bounce in price, given close to half the companies in Saudi Arabia have price-to-earnings ratios (or "P/E's") below 21x, you may consider Canadian General Medical Center Complex as a stock to avoid entirely with its 43.5x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

With earnings growth that's exceedingly strong of late, Canadian General Medical Center Complex has been doing very well. It seems that many are expecting the strong earnings performance to beat most other companies over the coming period, which has increased investors’ willingness to pay up for the stock. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Does Growth Match The High P/E?

In order to justify its P/E ratio, Canadian General Medical Center Complex would need to produce outstanding growth well in excess of the market.

Retrospectively, the last year delivered an exceptional 37% gain to the company's bottom line. Still, incredibly EPS has fallen 11% in total from three years ago, which is quite disappointing. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Weighing that medium-term earnings trajectory against the broader market's one-year forecast for expansion of 12% shows it's an unpleasant look.

With this information, we find it concerning that Canadian General Medical Center Complex is trading at a P/E higher than the market. It seems most investors are ignoring the recent poor growth rate and are hoping for a turnaround in the company's business prospects. Only the boldest would assume these prices are sustainable as a continuation of recent earnings trends is likely to weigh heavily on the share price eventually.

The Final Word

The strong share price surge has got Canadian General Medical Center Complex's P/E rushing to great heights as well. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our examination of Canadian General Medical Center Complex revealed its shrinking earnings over the medium-term aren't impacting its high P/E anywhere near as much as we would have predicted, given the market is set to grow. Right now we are increasingly uncomfortable with the high P/E as this earnings performance is highly unlikely to support such positive sentiment for long. Unless the recent medium-term conditions improve markedly, it's very challenging to accept these prices as being reasonable.

If you're unsure about the strength of Canadian General Medical Center Complex's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.