Please use a PC Browser to access Register-Tadawul

Subdued Growth No Barrier To Nextdoor Holdings, Inc. (NYSE:NXDR) With Shares Advancing 42%

Nextdoor Holdings, Inc. Class A NXDR | 1.74 | 0.00% |

Nextdoor Holdings, Inc. (NYSE:NXDR) shares have had a really impressive month, gaining 42% after a shaky period beforehand. But the gains over the last month weren't enough to make shareholders whole, as the share price is still down 6.3% in the last twelve months.

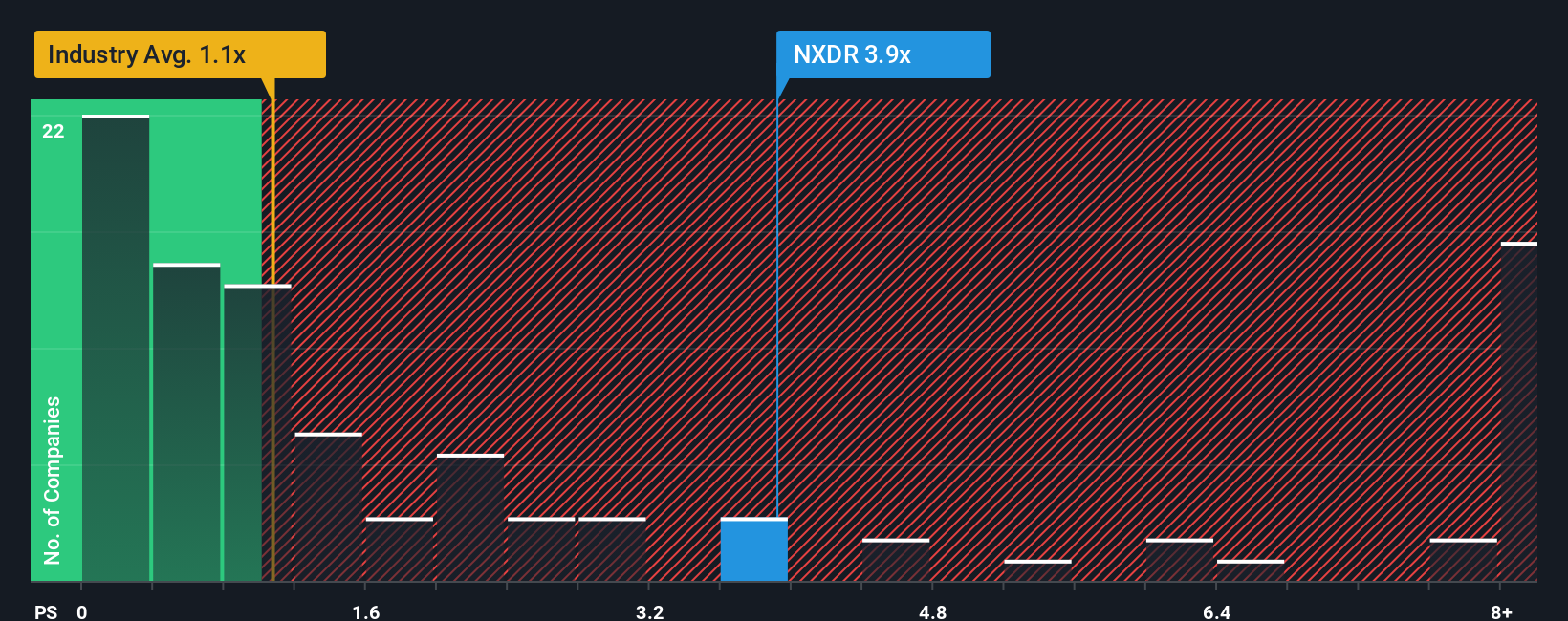

Since its price has surged higher, you could be forgiven for thinking Nextdoor Holdings is a stock to steer clear of with a price-to-sales ratios (or "P/S") of 3.9x, considering almost half the companies in the United States' Interactive Media and Services industry have P/S ratios below 1.1x. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

How Nextdoor Holdings Has Been Performing

Nextdoor Holdings could be doing better as it's been growing revenue less than most other companies lately. One possibility is that the P/S ratio is high because investors think this lacklustre revenue performance will improve markedly. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on analyst estimates for the company? Then our free report on Nextdoor Holdings will help you uncover what's on the horizon.Is There Enough Revenue Growth Forecasted For Nextdoor Holdings?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Nextdoor Holdings' to be considered reasonable.

Retrospectively, the last year delivered a decent 6.6% gain to the company's revenues. The latest three year period has also seen a 16% overall rise in revenue, aided somewhat by its short-term performance. So we can start by confirming that the company has actually done a good job of growing revenue over that time.

Shifting to the future, estimates from the six analysts covering the company suggest revenue should grow by 7.8% each year over the next three years. With the industry predicted to deliver 14% growth each year, the company is positioned for a weaker revenue result.

With this information, we find it concerning that Nextdoor Holdings is trading at a P/S higher than the industry. Apparently many investors in the company are way more bullish than analysts indicate and aren't willing to let go of their stock at any price. There's a good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

The Key Takeaway

The strong share price surge has lead to Nextdoor Holdings' P/S soaring as well. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've concluded that Nextdoor Holdings currently trades on a much higher than expected P/S since its forecast growth is lower than the wider industry. The weakness in the company's revenue estimate doesn't bode well for the elevated P/S, which could take a fall if the revenue sentiment doesn't improve. At these price levels, investors should remain cautious, particularly if things don't improve.

Having said that, be aware Nextdoor Holdings is showing 1 warning sign in our investment analysis, you should know about.

If you're unsure about the strength of Nextdoor Holdings' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.