Please use a PC Browser to access Register-Tadawul

T-Mobile US (TMUS) Valuation Check After Launch Of Better Value Family Plan

T-Mobile US, Inc. TMUS | 185.26 | +0.91% |

T-Mobile US (TMUS) has drawn fresh investor attention after launching its limited time Better Value family plan. The plan targets multi line customers with premium 5G data, entertainment perks and international features at a lower entry price.

The Better Value launch comes as T-Mobile US shares trade at US$189.67, with a 90 day share price return showing a decline of 16.32% and a 1 year total shareholder return showing a decline of 10.06%, while the 3 and 5 year total shareholder returns of 33.57% and 51.19% respectively point to stronger longer term momentum.

If this kind of plan refresh has you thinking about where growth could show up next in connectivity and data, it may be worth scanning high growth tech and AI stocks as a starting point.

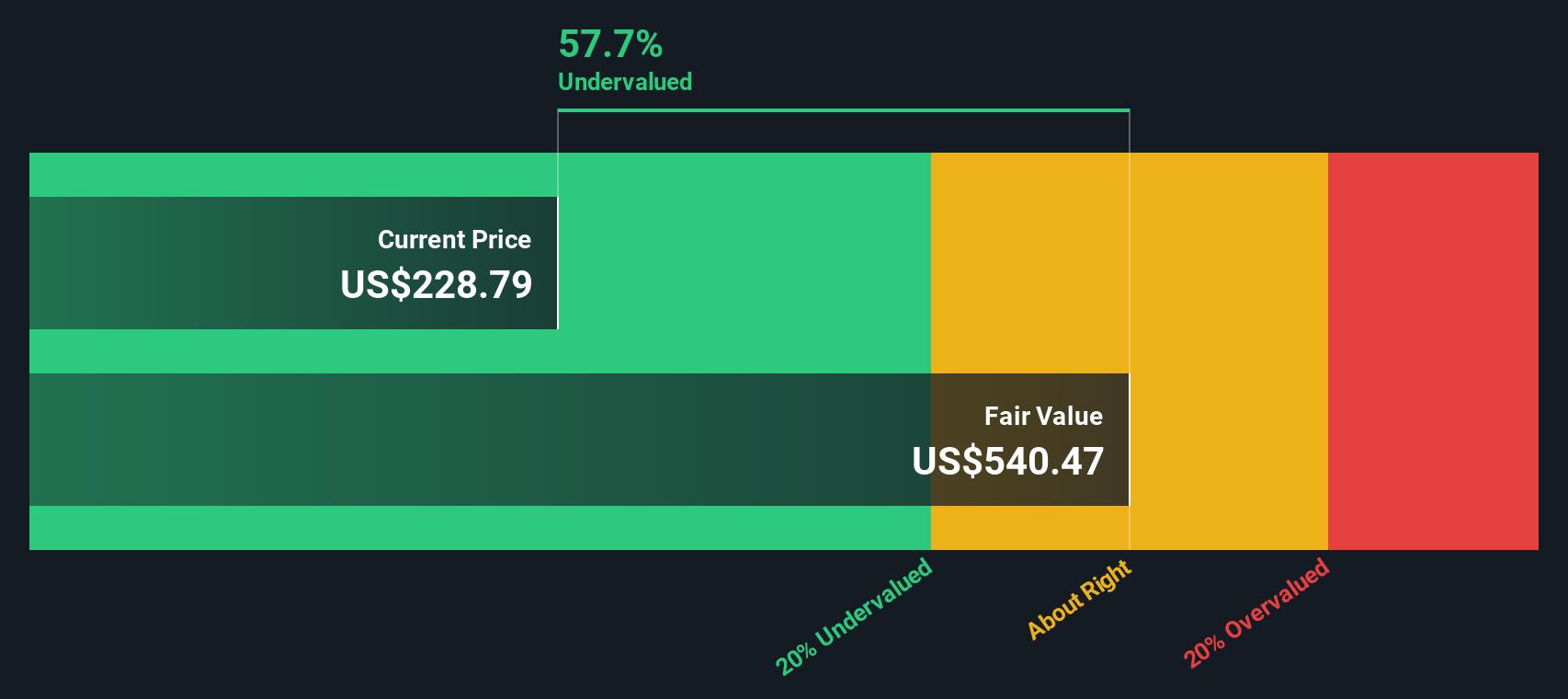

With TMUS trading at US$189.67, an intrinsic discount estimate of 64% and a value score of 5, the key question is whether recent share weakness signals mispricing or if the market already reflects the company’s future growth potential.

Most Popular Narrative: 31.5% Undervalued

With T-Mobile US last closing at US$189.67 against a most followed narrative fair value of about US$277.08, the gap depends on how future growth, margins and valuation multiples develop over the next few years.

The launch and expansion of T-Fiber following the acquisition of Lumos, along with further expansion plans via Metronet, could lead to incremental service revenue growth and enhance long-term profitability.

Curious what kind of revenue trajectory, margin lift and future P/E multiple need to align for that fair value? The full narrative walks through the earnings bridge, the role of fiber and 5G, and how these moving parts factor into the valuation math.

Result: Fair Value of $277.08 (UNDERVALUED)

However, there are still watchpoints, including the risk that heavier competitor promotions or higher handset tariffs could squeeze margins and challenge the current earnings narrative.

Another Angle On Valuation

Our SWS DCF model presents a very different picture from the narrative fair value. With TMUS at US$189.67 and a DCF fair value estimate of US$527.21, the model suggests the shares may be deeply undervalued. This raises a simple question for you: are the cash flow assumptions too generous, or is the market too cautious?

Build Your Own T-Mobile US Narrative

If you look at the numbers and reach a different conclusion, or prefer to test your own assumptions, you can build a full view in a few minutes by starting with Do it your way.

A great starting point for your T-Mobile US research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If T-Mobile US has sparked your interest, do not stop here. Use the Simply Wall St Screener to quickly surface focused ideas that match your own thesis.

- Spot potential value in beaten down names by scanning these 3533 penny stocks with strong financials that pair lower prices with underlying financial strength.

- Target future facing themes by checking out these 25 AI penny stocks pushing boundaries in artificial intelligence and related technologies.

- Prioritise price discipline by reviewing these 884 undervalued stocks based on cash flows that currently screen as cheap against their cash flow profiles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.