Please use a PC Browser to access Register-Tadawul

Take Care Before Diving Into The Deep End On Evolent Health, Inc. (NYSE:EVH)

Evolent Health Inc Class A EVH | 3.35 | +4.21% |

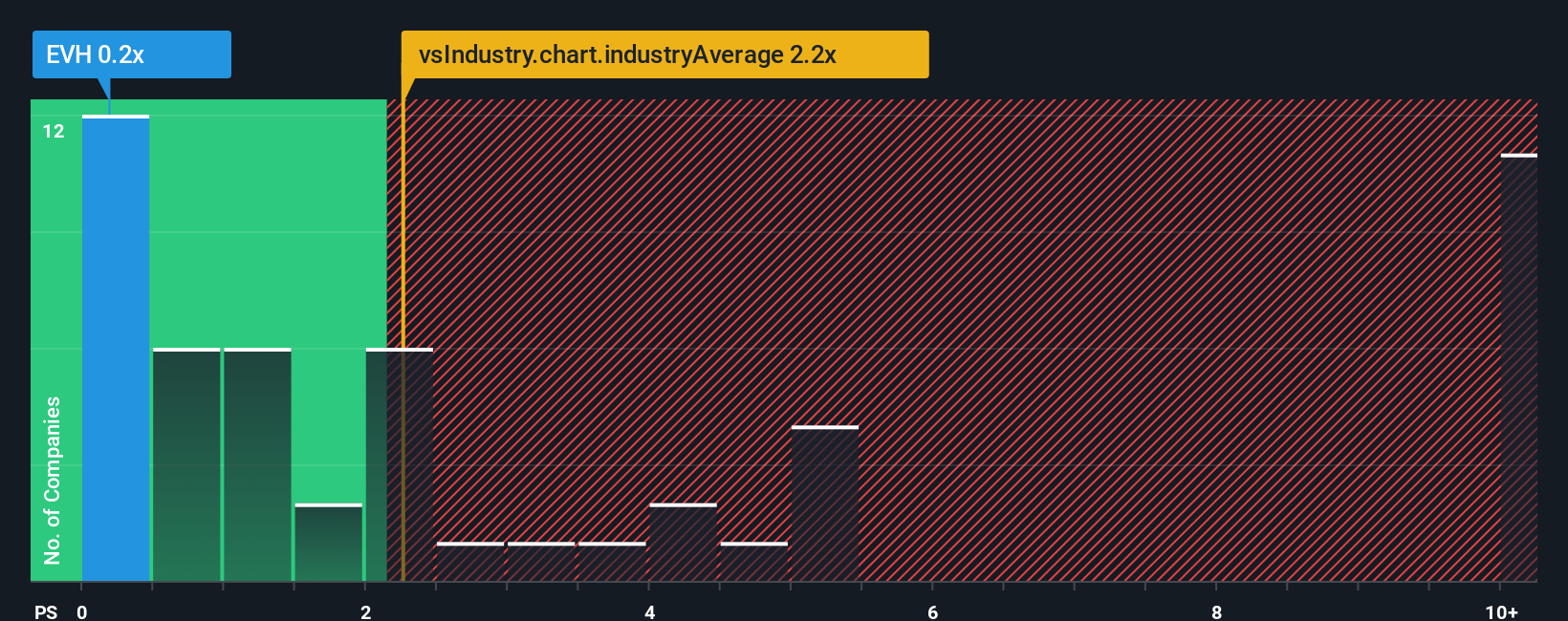

You may think that with a price-to-sales (or "P/S") ratio of 0.2x Evolent Health, Inc. (NYSE:EVH) is definitely a stock worth checking out, seeing as almost half of all the Healthcare Services companies in the United States have P/S ratios greater than 2.2x and even P/S above 11x aren't out of the ordinary. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so limited.

What Does Evolent Health's Recent Performance Look Like?

Evolent Health could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. Perhaps the P/S remains low as investors think the prospects of strong revenue growth aren't on the horizon. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Evolent Health.How Is Evolent Health's Revenue Growth Trending?

There's an inherent assumption that a company should far underperform the industry for P/S ratios like Evolent Health's to be considered reasonable.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 17%. Still, the latest three year period has seen an excellent 69% overall rise in revenue, in spite of its unsatisfying short-term performance. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

Shifting to the future, estimates from the ten analysts covering the company suggest revenue should grow by 14% per year over the next three years. With the industry predicted to deliver 13% growth per year, the company is positioned for a comparable revenue result.

With this in consideration, we find it intriguing that Evolent Health's P/S is lagging behind its industry peers. It may be that most investors are not convinced the company can achieve future growth expectations.

The Final Word

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our examination of Evolent Health's revealed that its P/S remains low despite analyst forecasts of revenue growth matching the wider industry. Despite average revenue growth estimates, there could be some unobserved threats keeping the P/S low. At least the risk of a price drop looks to be subdued, but investors seem to think future revenue could see some volatility.

Plus, you should also learn about this 1 warning sign we've spotted with Evolent Health.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.