Please use a PC Browser to access Register-Tadawul

TAL Education Group (NYSE:TAL) grows 3.8% this week, taking three-year gains to 109%

TAL Education Group Sponsored ADR Class A TAL | 11.51 11.51 | +3.69% 0.00% Pre |

The most you can lose on any stock (assuming you don't use leverage) is 100% of your money. But if you buy shares in a really great company, you can more than double your money. To wit, the TAL Education Group (NYSE:TAL) share price has flown 109% in the last three years. That sort of return is as solid as granite. It's also good to see the share price up 12% over the last quarter. But this move may well have been assisted by the reasonably buoyant market (up 7.9% in 90 days).

After a strong gain in the past week, it's worth seeing if longer term returns have been driven by improving fundamentals.

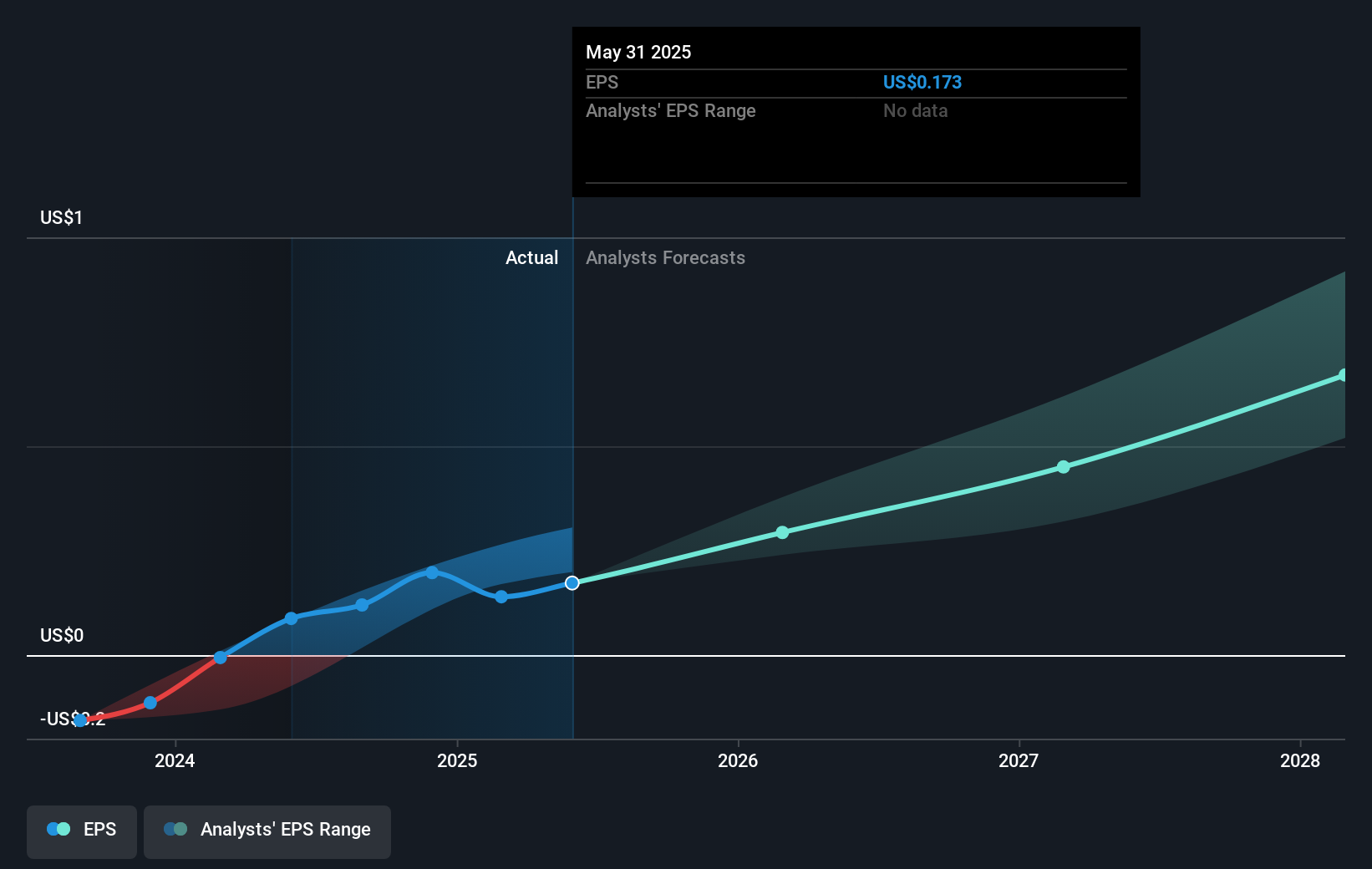

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

TAL Education Group became profitable within the last three years. That kind of transition can be an inflection point that justifies a strong share price gain, just as we have seen here.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

It is of course excellent to see how TAL Education Group has grown profits over the years, but the future is more important for shareholders.

A Different Perspective

While the broader market gained around 20% in the last year, TAL Education Group shareholders lost 7.7%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Unfortunately, longer term shareholders are suffering worse, given the loss of 13% doled out over the last five years. We'd need to see some sustained improvements in the key metrics before we could muster much enthusiasm. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too.

We will like TAL Education Group better if we see some big insider buys.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.