Please use a PC Browser to access Register-Tadawul

Talkspace (NASDAQ:TALK) shareholder returns have been impressive, earning 288% in 3 years

Talkspace, Inc. TALK | 4.99 | +3.31% |

The most you can lose on any stock (assuming you don't use leverage) is 100% of your money. But when you pick a company that is really flourishing, you can make more than 100%. For example, the Talkspace, Inc. (NASDAQ:TALK) share price has soared 288% in the last three years. That sort of return is as solid as granite. On top of that, the share price is up 28% in about a quarter. This could be related to the recent financial results, released recently - you can catch up on the most recent data by reading our company report.

After a strong gain in the past week, it's worth seeing if longer term returns have been driven by improving fundamentals.

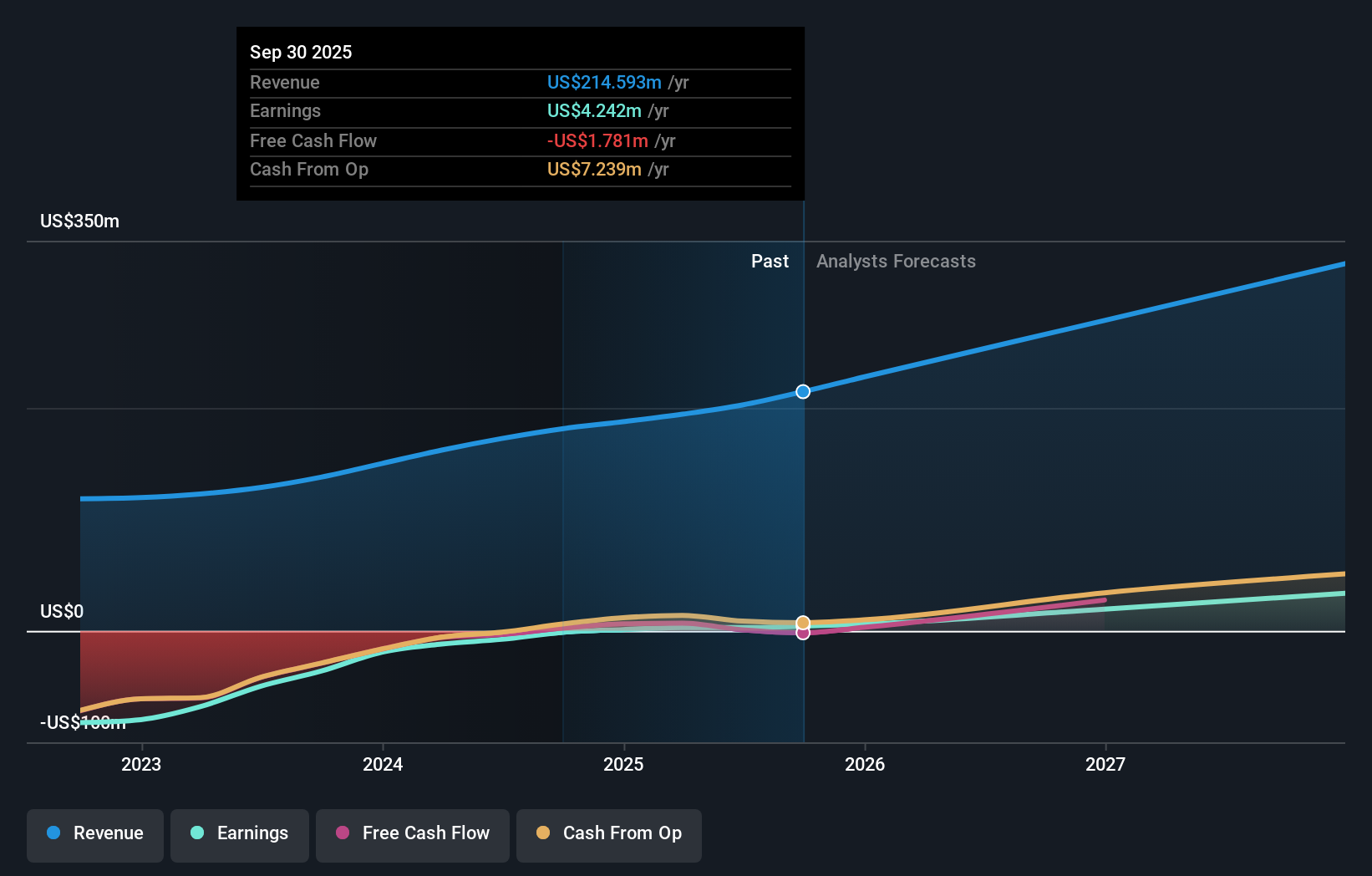

We don't think that Talkspace's modest trailing twelve month profit has the market's full attention at the moment. We think revenue is probably a better guide. Generally speaking, we'd consider a stock like this alongside loss-making companies, simply because the quantum of the profit is so low. For shareholders to have confidence a company will grow profits significantly, it must grow revenue.

Talkspace's revenue trended up 21% each year over three years. That's well above most pre-profit companies. Along the way, the share price gained 57% per year, a solid pop by our standards. But it does seem like the market is paying attention to strong revenue growth. Nonetheless, we'd say Talkspace is still worth investigating - successful businesses can often keep growing for long periods.

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

We consider it positive that insiders have made significant purchases in the last year. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. So we recommend checking out this free report showing consensus forecasts

A Different Perspective

Investors in Talkspace had a tough year, with a total loss of 1.7%, against a market gain of about 14%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. However, the loss over the last year isn't as bad as the 11% per annum loss investors have suffered over the last half decade. We would want clear information suggesting the company will grow, before taking the view that the share price will stabilize. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: most of them are flying under the radar).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.