Please use a PC Browser to access Register-Tadawul

Telesat's (NASDAQ:TSAT) Returns On Capital Tell Us There Is Reason To Feel Uneasy

Telesat Corp. TSAT | 35.56 35.56 | +5.30% 0.00% Post |

What underlying fundamental trends can indicate that a company might be in decline? More often than not, we'll see a declining return on capital employed (ROCE) and a declining amount of capital employed. This indicates the company is producing less profit from its investments and its total assets are decreasing. Having said that, after a brief look, Telesat (NASDAQ:TSAT) we aren't filled with optimism, but let's investigate further.

Return On Capital Employed (ROCE): What Is It?

If you haven't worked with ROCE before, it measures the 'return' (pre-tax profit) a company generates from capital employed in its business. Analysts use this formula to calculate it for Telesat:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.013 = CA$90m ÷ (CA$6.9b - CA$204m) (Based on the trailing twelve months to September 2025).

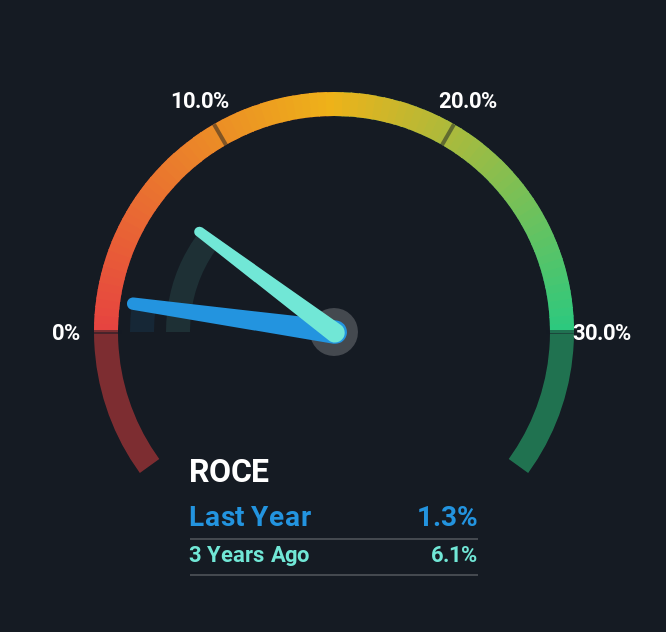

Thus, Telesat has an ROCE of 1.3%. Ultimately, that's a low return and it under-performs the Telecom industry average of 7.2%.

Above you can see how the current ROCE for Telesat compares to its prior returns on capital, but there's only so much you can tell from the past. If you're interested, you can view the analysts predictions in our free analyst report for Telesat .

The Trend Of ROCE

In terms of Telesat's historical ROCE movements, the trend doesn't inspire confidence. About five years ago, returns on capital were 7.1%, however they're now substantially lower than that as we saw above. And on the capital employed front, the business is utilizing roughly the same amount of capital as it was back then. This combination can be indicative of a mature business that still has areas to deploy capital, but the returns received aren't as high due potentially to new competition or smaller margins. If these trends continue, we wouldn't expect Telesat to turn into a multi-bagger.

Our Take On Telesat's ROCE

All in all, the lower returns from the same amount of capital employed aren't exactly signs of a compounding machine. The market must be rosy on the stock's future because even though the underlying trends aren't too encouraging, the stock has soared 380%. Regardless, we don't feel too comfortable with the fundamentals so we'd be steering clear of this stock for now.

If you'd like to know more about Telesat, we've spotted 3 warning signs, and 2 of them are significant.

While Telesat may not currently earn the highest returns, we've compiled a list of companies that currently earn more than 25% return on equity.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.