Please use a PC Browser to access Register-Tadawul

Tesla Q3 Revenue Expected to Rebound! Stock Surges 40% in the Quarter, Analysts Claim It's Still Seriously Undervalued

Tesla Motors, Inc. TSLA | 458.96 464.09 | +2.70% +1.12% Pre |

SAMSUNG ELECTRONICS CO SSNLF | 65.21 65.21 | 0.00% 0.00% Pre |

PANASONIC CORP PCRFY | 9.36 9.36 | 0.00% 0.00% Pre |

BHP Billiton Limited Sponsored ADR BHP | 59.64 59.64 | -2.10% 0.00% Pre |

STMicroelectronics NV ADR RegS STM | 26.00 26.47 | -0.99% +1.81% Pre |

Tesla Motors, Inc.(TSLA.US) is set to release its Q3 2025 earnings report after the market closes on October 22. Bloomberg analysts forecast Tesla's Q3 revenue to be $26.16 billion, marking a 4% year-over-year increase. Adjusted net profit is expected to be $1.89 billion, a 24% decrease compared to the previous year.

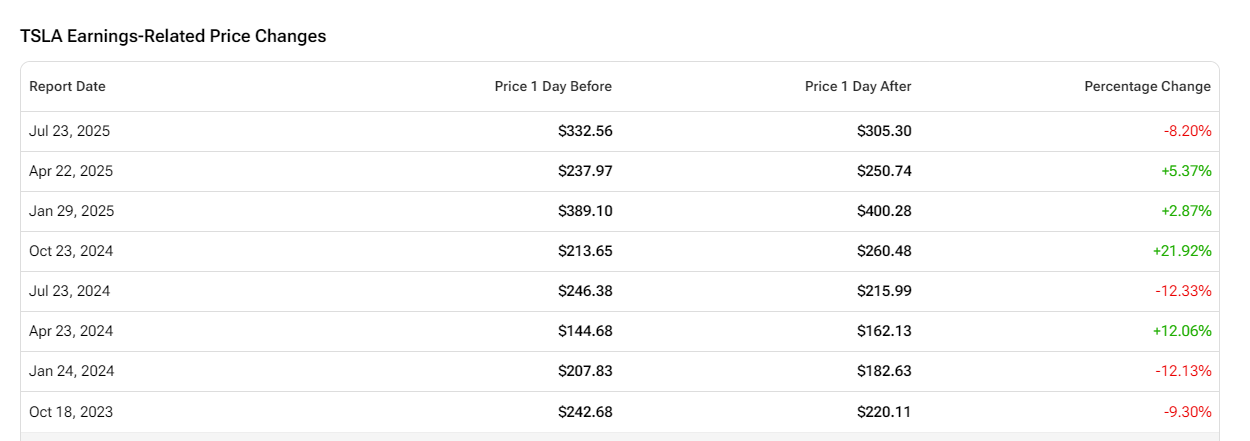

According to TipRanks, over the past eight quarters, Tesla has exceeded earnings per share expectations only twice. On average, the stock price fluctuated by ±10.52% following earnings announcements, with the largest increase at +21.9% and the largest decrease at -12.3%. The probability of the stock price rising on the first trading day after the earnings release is 50%.

Tesla Stock Soars 40% in Q3 as Elon Musk Leads the Charge in Buying Back Shares

Tesla’s stock experienced a remarkable 40% surge in the third quarter, driven by multiple positive developments. The stock came close to reaching an all-time high, rebounding over 100% from its lowest point earlier this year.

One key driver was Tesla's record-breaking global deliveries in Q3, which reached 497,000 units—a 7.4% year-over-year increase and well above Wall Street’s estimate of 448,000 units. Adding to the momentum, Tesla introduced several new models during the quarter, including the six-seater Model YL, as well as lower-priced versions of the Model Y and Model 3.

Tesla also made significant progress in its highly anticipated robotics business. The company announced plans to scale up production of humanoid robots, aiming to launch its third-generation model by the end of 2025 and begin mass production in 2026. CEO Elon Musk has projected an annual production capacity of 1 million units by 2030.

Another major boost came from Musk himself, who purchased $1 billion worth of Tesla shares in the third quarter. This marks the first time in years that Musk has made such a large-scale buyback in the open market. The move has been interpreted as a strong vote of confidence in Tesla’s future, further bolstering investor sentiment.

Key Focus Areas for Tesla's Q3 Earnings Report

- Sustainability of Delivery Growth

Tesla's Q3 deliveries reached 497,099 vehicles, thanks largely to a strong rebound in the Chinese market and a surge in U.S. demand ahead of expiring EV tax credits, according to Wedbush analysts. However, this growth might not be sustainable. Tesla's multiple purchase incentives also contributed to the boost, with Wells Fargo estimating a slight quarter-over-quarter decline in average order prices, particularly a 1% drop in Model Y/3 pricing. They suggest that Q3 may be Tesla’s strongest delivery quarter for a while, and maintaining this scale will require ongoing attractive incentives and discounts to offset the impact of the $7,500 tax credit expiration.

- Progress on Optimus Production

Elon Musk has been vocal about the Optimus project, emphasizing its importance in Tesla's "Master Plan 4.0" and his personal incentive proposals, which aim to deliver 1 million humanoid robots over the next decade. According to Dongfang Securities, this goal could lead to increased investment in robotics, with significant production growth expected by 2026. Kaiyuan Securities estimates that delivering 1 million Optimus units could correspond to a market value of $500 billion.

- Expansion of Robotaxi Services

Tesla is expanding its Robotaxi testing across several states, having launched services in Austin and beginning road trials for autonomous ride-hailing in Arizona during Q3. Support from the government could further accelerate the rollout of these services.

Wall Street Raises Price Targets for Tesla Ahead of Earnings, Citing Undervalued Transformation Potential

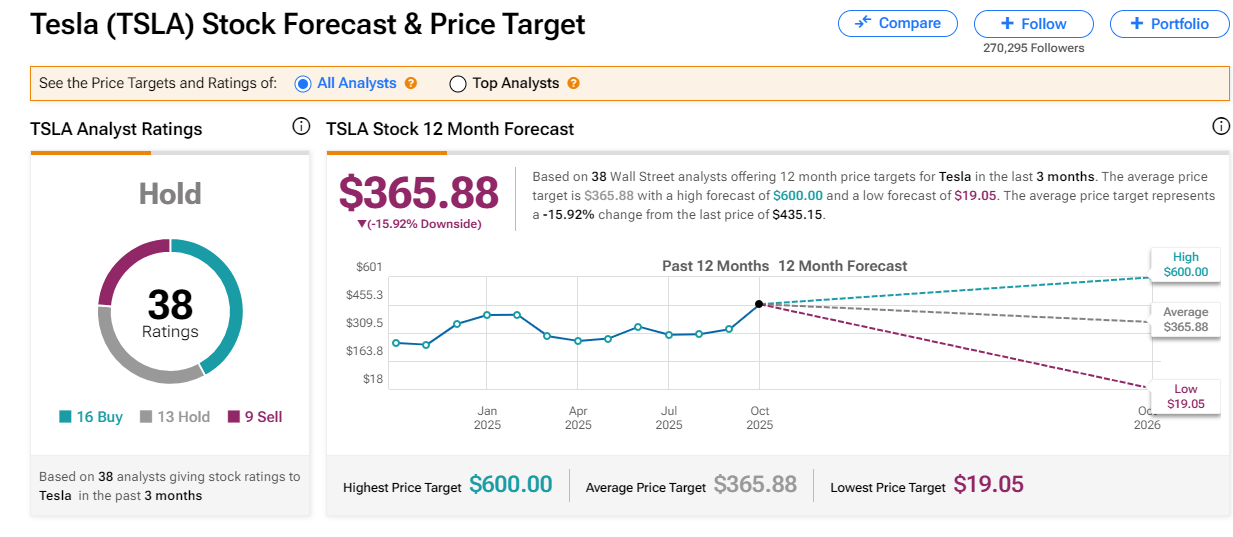

Recent data from TipRanks shows a mixed outlook on Tesla, with only 42% of institutions giving a "buy" rating. The average price target is $365.88, below the current market price, with the highest target at $600 per share.

- Wedbush: Market Underestimates Tesla’s Transformation Potential

Wedbush has significantly raised its price target for Tesla to $600, arguing that the market is underestimating Tesla's transformation potential. They see autonomous driving and robotics as core strategic pillars by 2026, which will be game-changers for the company. In a bullish scenario, Wedbush believes Tesla could reach a $2 trillion market cap by early 2026, potentially rising to $3 trillion by year-end as mass production of autonomous and robotic technologies ramps up.

- Stifel: Increases Tesla Price Target to $483, Confidence in FSD and Robotaxi

Stifel has raised its price target from $440 to $483, citing progress in Tesla's Full Self-Driving (FSD) and Robotaxi initiatives. They express growing confidence in these areas, anticipating the launch of "unsupervised mode full self-driving" in the U.S. by the end of 2025. Stifel also sees strong growth potential in the Robotaxi and Optimus humanoid robot businesses.

Canaccord: Boosts Tesla Price Target to $490, Optimistic on Deliveries and Energy Business

Canaccord Genuity has increased its price target from $333 to $490, maintaining a buy rating. This adjustment is based on improved delivery trends, new product launches, and a reassessment of Tesla’s energy storage prospects. They expect stronger momentum in energy storage, driven by increased demand from utilities and large-scale data centers. With growing resistance to reliance on the grid, "energy storage will play a crucial role in behind-the-meter solutions."

Focus on Related Investment Opportunities

As Tesla's earnings report approaches, which related stocks in Tesla's supply chain should investors pay attention to?

Tesla Interior Modules - Related Listed Companies

Battery Pack:

- SAMSUNG ELECTRONICS CO(SSNLF.US)

- PANASONIC CORP(PCRFY.US)

- BHP Billiton Limited Sponsored ADR(BHP.US)

- STMicroelectronics NV ADR RegS(STM.US)

- Texas Instruments Incorporated(TXN.US)

- TE Connectivity Ltd.(TEL.US)

Thermal Management:

Smart Cockpit and ADAS:

- ON Semiconductor Corporation(ON.US)

- Mobileye(MBLY.US)

- VALEO(VLEEY.US)

- AT&T Inc.(T.US)

- Advanced Micro Devices, Inc.(AMD.US)

- NVIDIA Corporation(NVDA.US)

- Texas Instruments Incorporated(TXN.US)

- Corning Incorporated(GLW.US)

- SHARP CORP(SHCAY.US)

Chassis and Body:

Interior and Exterior:

- Magna International Inc.(MGA.US)

- Lear Corporation(LEA.US)

- Adient plc(ADNT.US)

- Avery Dennison Corporation(AVY.US)

- Autoliv Inc.(ALV.US)

Tesla Robotaxi Related Companies:

Tesla-Related ETFs to Watch

Here are some Tesla-related ETFs that investors might want to keep an eye on:

- AXS TSLA BEAR DAILY ETF(TSLQ.US)

- Direxion Shares ETF Trust Direxion Daily TSLA Bear 1X Shares(TSLS.US)

- GRANITESHARES 1.25X LONG TESLA DAILY ETF(TSL.US)

- Direxion Shares ETF Trust Direxion Daily TSLA Bull 2X Shares(TSLL.US)

Do savvy investors have confidence in Tesla's performance this quarter? Feel free to share your thoughts in the comments.