Please use a PC Browser to access Register-Tadawul

Texas Instruments (TXN): Margin Decline Challenges Bullish Narrative on Profit Resilience

Texas Instruments Incorporated TXN | 179.42 | -1.24% |

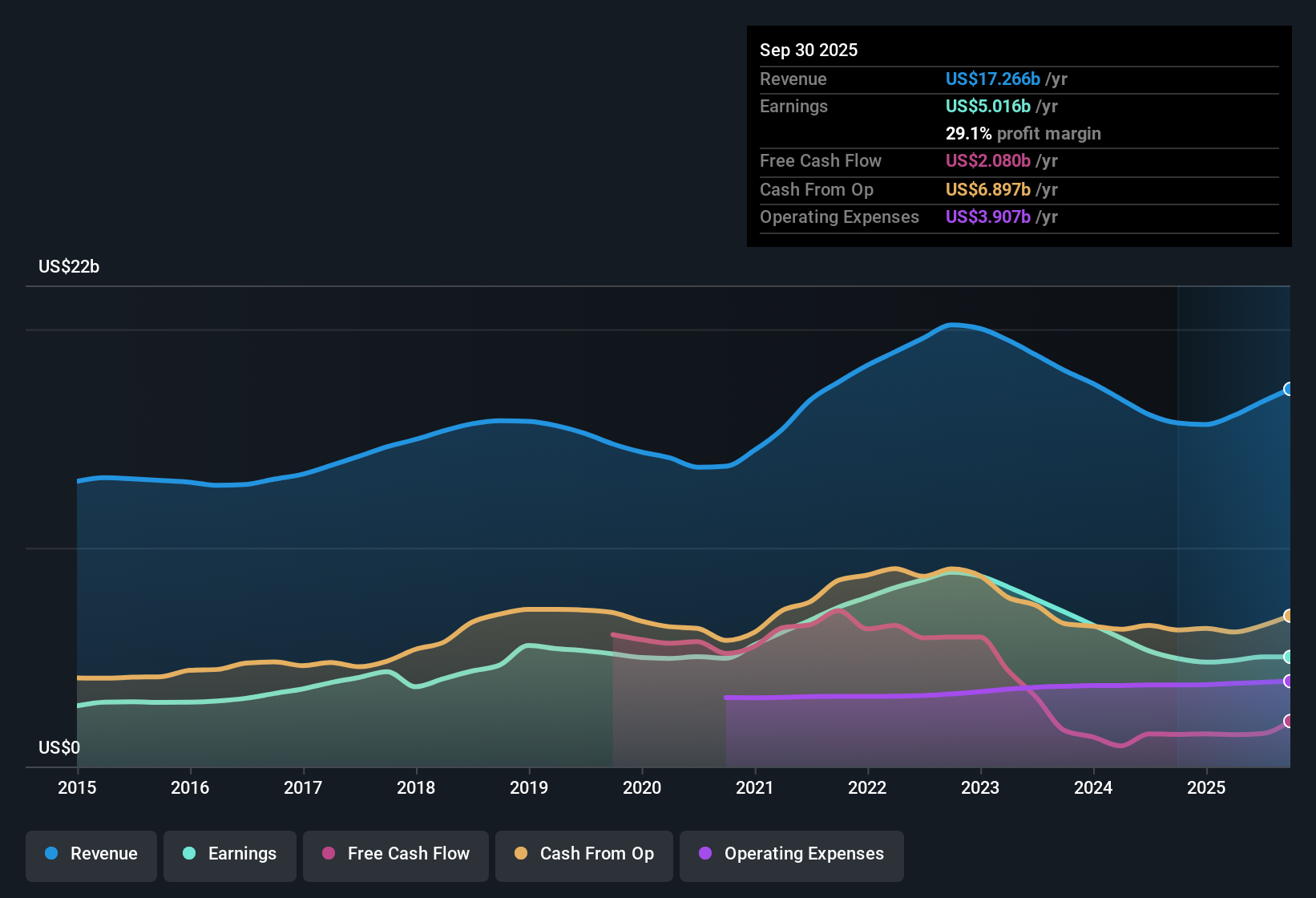

Texas Instruments (TXN) reported revenue forecasted to grow at 8.6% per year, trailing the broader US market’s 10% growth rate. EPS is expected to increase by 13.3% per year, also lagging the US market average of 15.5%. Net profit margin dipped to 29.1%, down from 31.4% last year. However, annual earnings growth over the most recent year showed a 1.5% improvement compared to a five-year average decline of 5.9%. Shares are currently priced at $169.13, which is above an internal fair value estimate of $155.56. This makes valuation and margin trends a focal point for investors.

See our full analysis for Texas Instruments.Now, let’s see how Texas Instruments’ latest earnings compare to the broader market narratives. Some expectations may be confirmed, while others could face a reality check.

Profit Margins Remain Industry Standout at 29.1%

- Texas Instruments reported a net profit margin of 29.1%, down from 31.4% last year but still above what most semiconductor peers deliver.

- Bulls argue that this strong starting point, combined with unique U.S. manufacturing investments and a head-start on onshoring, set the stage for margin acceleration as more contracts shift to domestic suppliers.

- With peers lagging in U.S.-based capacity, bullish investors highlight Texas Instruments' five-year lead and contend this will draw higher-margin, less price-sensitive contracts tied to industrial and auto recoveries.

- Bulls point to projected margin expansion, expecting profit margins to climb from 30.1% to 41.9% within three years, outpacing typical industry trends as U.S. federal tax incentives feed into free cash flow.

Dividend Sustainability Flagged as a Key Risk

- Concerns are growing over the long-term sustainability of Texas Instruments' dividend, especially as falling margins and heavy capital spending bite into cash available for payouts.

- Bears caution that mounting capex and elevated regulatory pressures could restrain free cash flow, challenging the narrative that Texas Instruments can keep returning capital at historical rates.

- Bearish commentary points directly to the net margin slip from 31.4% to 29.1% year-over-year and argues this hints at early margin erosion just as higher manufacturing investments are ramping up.

- Bears emphasize that further deterioration in financial position could force management to reconsider the current dividend policy, especially if global end-market growth underwhelms or cost inflation persists.

Undervalued Versus Peers, But Trades Above DCF Fair Value

- Texas Instruments’ price-to-earnings ratio stands at 30.6x, which is lower than sector and peer averages. However, with shares at $169.13, the stock trades at an 8.7% premium to its DCF fair value of $155.56.

- According to analysts' consensus view, the company’s blend of strong historical profitability and sector-low valuation multiples may support medium-term upside, even as future growth lags the broadest U.S. semiconductor benchmarks.

- Consensus points to a three-year annual revenue growth forecast of 10.1%, with margins expected to improve from 30.1% to 35.7%, helping offset the slower pace versus the broader market.

- The modest share price premium over DCF fair value suggests that much of the high quality is already priced in by investors who prize stability and cash flow above headline growth.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Texas Instruments on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Noticing a different story in the numbers? Share your perspective and craft your own narrative in just a few minutes: Do it your way

A great starting point for your Texas Instruments research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

Texas Instruments’ margin compression, rising capex, and flagged dividend sustainability point to cash flow and payout risks, even though the company holds a leadership position.

If reliable income matters most, find companies with healthier and more dependable yields by using these 1989 dividend stocks with yields > 3% as your next research step.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.