The 38% return this week takes Toro's (NASDAQ:TORO) shareholders one-year gains to 12%

Toro Corp. - Common stock TORO | 0.00 |

It is a pleasure to report that the Toro Corp. (NASDAQ:TORO) is up 57% in the last quarter. But that is minimal compensation for the share price under-performance over the last year. The cold reality is that the stock has dropped 22% in one year, under-performing the market.

While the stock has risen 38% in the past week but long term shareholders are still in the red, let's see what the fundamentals can tell us.

Toro wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In the last twelve months, Toro increased its revenue by 0.4%. That's not a very high growth rate considering it doesn't make profits. Given this lacklustre revenue growth, the share price drop of 22% seems pretty appropriate. It's important not to lose sight of the fact that profitless companies must grow. But if you buy a loss making company then you could become a loss making investor.

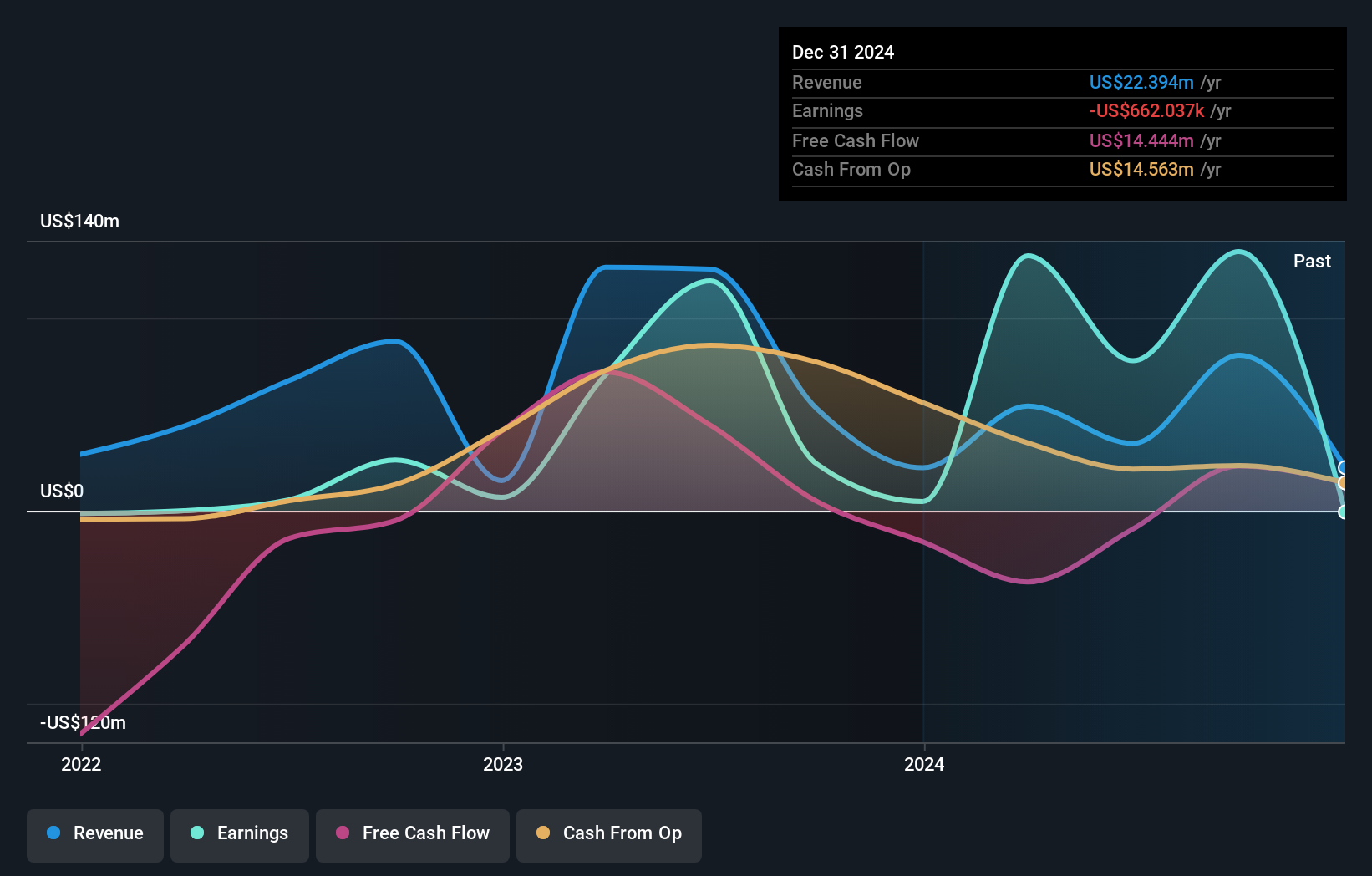

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. As it happens, Toro's TSR for the last 1 year was 12%, which exceeds the share price return mentioned earlier. This is largely a result of its dividend payments!

A Different Perspective

With a TSR of 12% over the last year, Toro shareholders would be reasonably content, given that's not far from the broader market return of 13%. A substantial portion of that gain has come in the last three months, with the stock up 57% in that time. This suggests the share price maintains some momentum, and investors are taking a more positive view of the stock. It's always interesting to track share price performance over the longer term. But to understand Toro better, we need to consider many other factors.

But note: Toro may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Recommend

- Benzinga News 19/11 15:02

Earnings Preview For Tsakos Energy Navigation

Benzinga News 19/11 16:01How Teekay Tankers’ (TNK) Strong Q3 Results Could Shift Investor Sentiment and Outlook

Simply Wall St 20/11 02:35Tsakos Energy Navigation Q3 EPS $1.05 Beats $0.80 Estimate, Sales $186.228M Beat $178.092M Estimate

Benzinga News 20/11 13:31ExxonMobil Acquires 40% Stake In Enterprise's Bahia NGL Pipeline

Benzinga News 20/11 15:24Why Is Tsakos Energy Navigation Stock Gaining Thursday?

Benzinga News 20/11 16:27Jefferies Maintains Hold on Tsakos Energy Navigation, Maintains $24 Price Target

Benzinga News 20/11 20:49RBC Capital Maintains Outperform on MPLX, Raises Price Target to $60

Benzinga News 13m