Please use a PC Browser to access Register-Tadawul

The Bull Case For Empire State Realty Trust (ESRT) Could Change Following Rolex Tourneau Lease In Williamsburg

Empire State Realty Trust, Inc. Class A ESRT | 5.93 | -2.15% |

- Empire State Realty Trust recently signed a lease with Tourneau, LLC for a 3,767 sq ft Rolex retail store at 86 North Sixth Street in Williamsburg, Brooklyn, and previously announced that its fourth-quarter 2025 results will be released on February 17, 2026, followed by a conference call on February 18, 2026.

- The addition of a high-profile luxury tenant to ESRT's North Sixth Street Collection underscores the appeal of its Williamsburg retail cluster to premium brands and may reinforce the company’s efforts to attract quality tenants across its portfolio.

- Next, we’ll examine how landing a luxury Rolex tenant in Williamsburg could influence Empire State Realty Trust’s existing investment narrative.

We've found 12 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Empire State Realty Trust Investment Narrative Recap

To own Empire State Realty Trust, you need to be comfortable with a REIT whose story leans on high quality New York assets, a recovering Observatory business and selective diversification into retail and multifamily. The Rolex lease in Williamsburg is a positive signal for ESRT’s retail strategy, but on its own it does not materially change the near term focus on stabilizing Observatory NOI or the key risk from higher operating costs that have recently outpaced revenue.

The most relevant recent announcement here is ESRT’s plan to release fourth quarter 2025 results on February 17, 2026, followed by a conference call. That update should give investors a clearer read on how new leases like Rolex and prior office expansions are flowing through to revenue, margins and capital spending needs, all of which sit at the heart of the current catalyst and risk balance for the stock.

But investors also need to keep a close eye on rising operating expenses and what they could mean for...

Empire State Realty Trust's narrative projects $797.6 million revenue and $13.7 million earnings by 2028. This implies 1.5% yearly revenue growth but a $26.7 million earnings decrease from $40.4 million today.

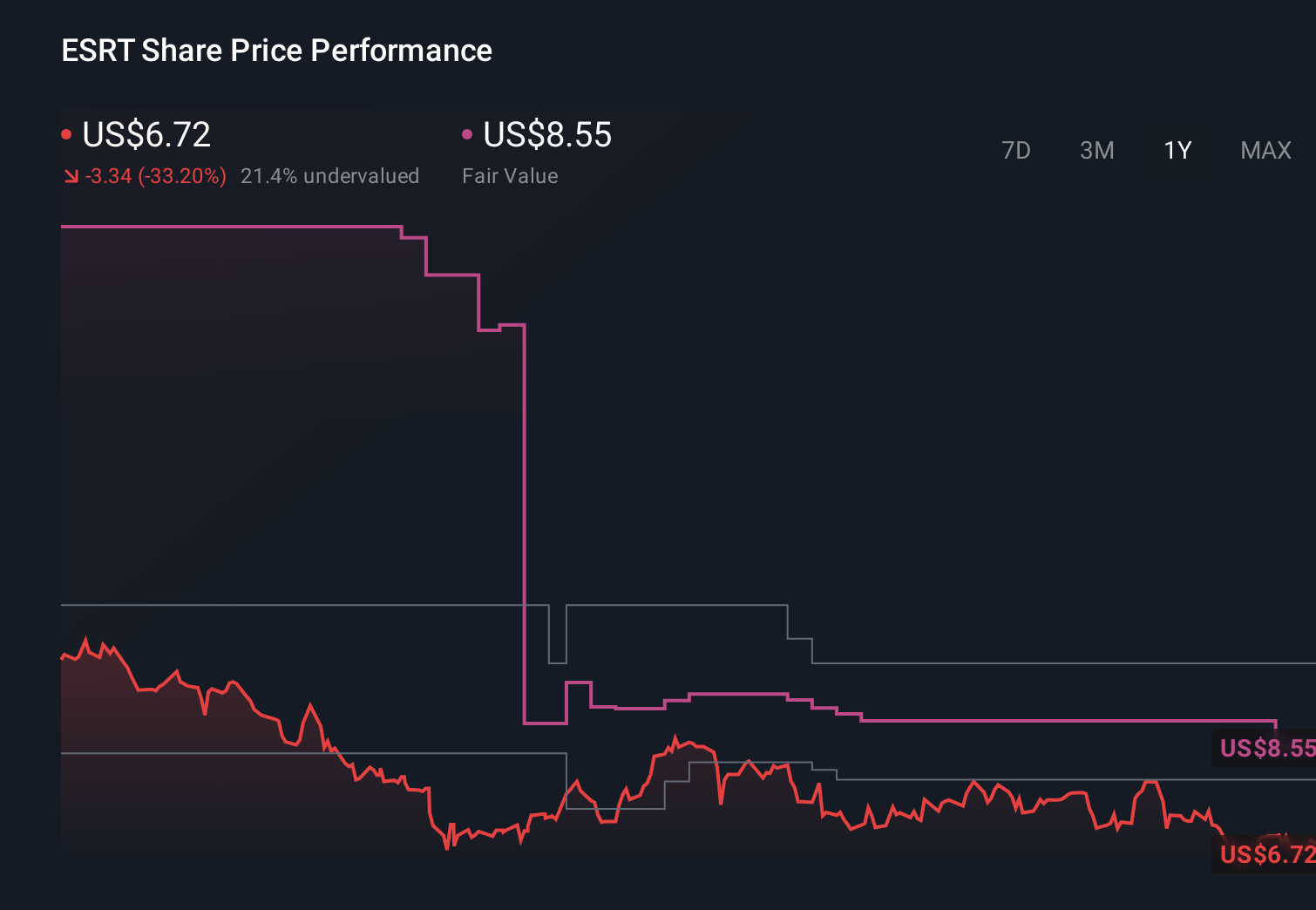

Uncover how Empire State Realty Trust's forecasts yield a $8.36 fair value, a 31% upside to its current price.

Exploring Other Perspectives

Two members of the Simply Wall St Community see ESRT’s fair value between US$5.39 and US$8.36, reflecting very different expectations. Against that backdrop, the pressure from rising operating expenses and Observatory volatility gives you more reason to compare several viewpoints before forming your own.

Explore 2 other fair value estimates on Empire State Realty Trust - why the stock might be worth as much as 31% more than the current price!

Build Your Own Empire State Realty Trust Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Empire State Realty Trust research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

- Our free Empire State Realty Trust research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Empire State Realty Trust's overall financial health at a glance.

Looking For Alternative Opportunities?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 39 companies in the world exploring or producing it. Find the list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.