Please use a PC Browser to access Register-Tadawul

"The Chinese Warren Buffett" Duan Yongping’s Proven Strategy—Using Covered Call ETFs to Shield Against US Stock Volatility

J.P. MORGAN NASDAQ EQUITY PREMIUM INCOME ETF JEPQ | 0.00 | |

JPMORGAN EQUITY PREMIUM INCOME ETF JEPI | 0.00 | |

PowerShares QQQ Trust,Series 1 QQQ | 0.00 | |

ETF-S&P 500 SPY | 0.00 | |

Horizons Etf Trust I Horizons Nasdaq 100 Covered Call Etf QYLD | 0.00 |

How can investors effectively allocate ETF assets to avoid becoming casualties of U.S. stock market volatility? This article offers insights to help you navigate these challenges.

Since peaking at the start of the year, U.S. stocks have been rattled by the rise of Deepseek and negative impacts from Trump's tariff policies, leading to ongoing market volatility.

Reflecting on April, the Nasdaq saw a dramatic drop of over 14% due to erratic tariff policies, only to rebound and close the month higher. The Volatility Index (VIX) remained above 20 throughout, with this roller-coaster market leaving investors feeling dizzy.

In the era of Trump's 2.0 chaotic policies and the AI revolution, investors are caught between fears of significant market pullbacks due to tariff wars and the desire to capitalize on the tech boom driven by AI. This environment creates a risk of getting caught in a cycle of "buying high and selling low" amidst market upheavals.

Duan Yongping Sees Nearly $300,000 in Paper Gains: Covered Call ETFs Shine in Volatile Markets

Duan Yongping is a legendary figure often called the "Godfather of Industry" and the "Chinese Buffett." He founded well-known companies such as Xiaobawang, BBK, OPPO, and vivo. Duan has also mentored prominent entrepreneurs like Chen Mingyong of OPPO, Shen Wei of vivo, and Huang Zheng of Pinduoduo.

As the "Chinese Buffett," Duan adheres to value investing principles and has made significant investments in companies like NetEase, Apple, and Kweichow Moutai, reaping substantial returns. In the 2025 Hurun Global Rich List, he ranked 2575th with a visible wealth of 10 billion yuan. However, his broader wealth portfolio is much larger, with stocks valued at 183.7 billion yuan through H&H International Investment Fund, placing him near the 70th position globally and 6th in China.

In March, as Nvidia's stock price fell, Duan bought the stock and sold call options at $116. Despite Nvidia's current price of $117 amidst volatility, Duan has profited approximately $278,000 from option premiums.

While average investors may not achieve the same returns due to operational and capital barriers, this strategy of stable cash flow with growth potential is particularly advantageous in volatile markets. Covered Call ETFs are gaining popularity among investors.

These ETFs hold stock positions and sell call options, protecting during market swings while offering regular option premium dividends, akin to landlords collecting rent.

For example, the largest Covered Call ETFs, J.P. MORGAN NASDAQ EQUITY PREMIUM INCOME ETF(JEPQ.US) and JPMORGAN EQUITY PREMIUM INCOME ETF(JEPI.US), have seen billions in net inflows over the past quarter despite market pullbacks, ranking among the largest active ETFs in the U.S. in 2024.

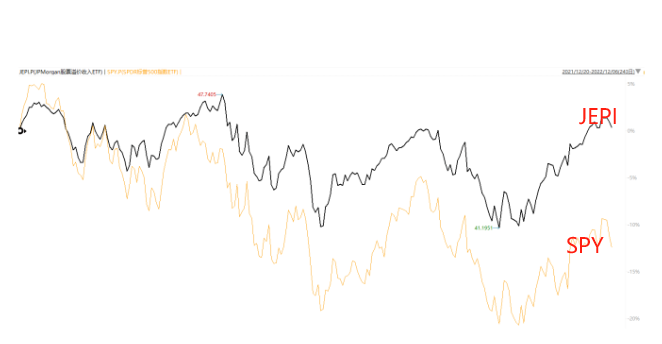

Performance of U.S. Covered Call ETFs

| ETF | 2024 Gain | 2022 Bear Market Decline |

|---|---|---|

| J.P. MORGAN NASDAQ EQUITY PREMIUM INCOME ETF(JEPQ.US) | 24.85% | -16.74% (annualized) |

| PowerShares QQQ Trust,Series 1(QQQ.US) | 25.75% | -33.2% |

| JPMORGAN EQUITY PREMIUM INCOME ETF(JEPI.US) | 13.76% | -4.44% |

| ETF-S&P 500(SPY.US) | 25.26% | -19.53% |

Data Source: Sahm, Bloomberg; as of 2025.5.8

Advantages of Covered Call ETFs:

- Operational Advantage: Managed by Wall Street institutions, these ETFs follow standardized processes, such as selling at-the-money options monthly, ensuring disciplined execution and avoiding errors due to inexperience or emotional biases.

- Cost Advantage: Holding diversified index components, these ETFs naturally mitigate single-stock risk and significantly reduce trading costs and tax burdens through bulk operations.

- High Liquidity Advantage: In extreme market conditions, these ETFs effectively execute strategies, avoiding the black swan events or liquidity crises individual investors might face due to concentrated stock holdings.

Timing and Suitability for Investing in Covered Call ETFs

When is it advantageous to invest in Covered Call ETFs like JPMORGAN EQUITY PREMIUM INCOME ETF(JEPI.US)?

Typically, during periods of economic uncertainty, when the market is expected to see modest gains or remain volatile, JPMORGAN EQUITY PREMIUM INCOME ETF(JEPI.US)'s high-dividend strategy and covered call options can offer relatively stable returns. However, if the market is projected to rise significantly, $JEPI may not be recommended due to its capped upside potential.

In summary, Covered Call ETFs like JPMORGAN EQUITY PREMIUM INCOME ETF(JEPI.US) are ideal for investors who prefer low volatility, have a conservative approach, and are willing to sacrifice some potential gains for steady cash flow. This includes retirees, those with loan obligations, and parents who need to provide regular financial support to their children.

Core Index and Stock Covered Call ETFs Overview

Here's a snapshot of key data for 10 popular, highly liquid ETFs in the U.S. market as of May 7, 2025:

| ETF | Benchmark | 1-Year Total Return | 3-Year Annualized Return | Current Dividend Yield | Size (USD) |

|---|---|---|---|---|---|

| JPMORGAN EQUITY PREMIUM INCOME ETF(JEPI.US) | S&P 500 Index | 14.27% | 8.17% | 8.07% | $39.14B |

| J.P. MORGAN NASDAQ EQUITY PREMIUM INCOME ETF(JEPQ.US) | Nasdaq Index | 23.84% | N/A | 11.53% | $24.49B |

| Horizons Etf Trust I Horizons Nasdaq 100 Covered Call Etf(QYLD.US) | Nasdaq Index | 20.02% | 6.07% | 13.75% | $8.24B |

| GLOBAL X FDS S&P 500 COVERED CALL ETF(XYLD.US) | S&P 500 Index | 20.37% | 6.45% | 12.98% | $3.06B |

| YieldMax NVDA Option Income Strategy ETF(NVDY.US) | Nvidia | 71.30% | N/A | 103.20% | $1.36B |

| GLOBAL X FDS RUSSELL 2000 COVERED CALL ETF(RYLD.US) | Russell 2000 Index | 15.27% | 3.35% | 13.28% | $1.30B |

| iShares 20+ Year Treasury Bond BuyWrite Strategy ETF(TLTW.US) | 20+ Year Treasury ETF | 4.03% | N/A | 15.93% | $1.03B |

| YieldMax TSLA Option Income Strategy ETF(TSLY.US) | Tesla | 37.38% | N/A | 121.12% | $0.99B |

| YieldMax COIN Option Income Strategy ETF(CONY.US) | Coinbase | 36.41% | N/A | 182.50% | $0.97B |

Source: Sahm, Bloomberg Terminal; Data as of May 8, 2025

Risk Warnings:

- Strategy Limitations: Covered Call ETFs may underperform in bull markets, missing out on explosive growth.

- Market Volatility: In a declining market, option income might not fully offset losses, leading to potential ETF NAV declines.

- Tax Implications: Option income is taxed at ordinary income rates, potentially reducing net returns.