Please use a PC Browser to access Register-Tadawul

The Greatest Technical Analysis Master Uses One Chart to Show You Which Swing Trades Are the Easiest to Profit From

Tadawul All Shares Index TASI.SA | 10414.06 | -0.37% |

S&P 500 index SPX | 6721.43 | -1.16% |

NASDAQ IXIC | 22693.32 | -1.81% |

Dow Jones Industrial Average DJI | 47885.97 | -0.47% |

The author of this text, Welles J. Wilder, is hailed as "the greatest technical analysis master of the last century." In the realm of technical trading, he can be considered a "pioneer," renowned for many innovative and original concepts. In 1978, he invented the famous Relative Strength Index (RSI), as well as ATR, ADX, Parabolic SAR, MOM, ADI, and others. Many of these remain popular technical indicators among numerous investors in today's investment markets. However, in his later years, the author abandoned the technical analysis indicators he had developed, stating that "no technical indicator in the world can accurately predict the direction of stock prices," and introduced the "Adam Theory" as a replacement.

The tops and bottoms of trends are the archenemies of technical analysts. Why is that? Because all traders want to confirm the tops and bottoms, but the number of traders who have suffered huge losses trying to pick tops and bottoms is greater than the total number of those who have lost money for all other reasons combined. Attempting to confirm tops and bottoms actually violates the "Adam Theory." Predicting tops and bottoms is illogical; it assumes that the market should behave in a certain way, which is the opposite of trend-following.

Those who try to pick tops and bottoms are essentially saying, "I know better than the market, I know better than other investors, I am smarter than everyone else." Such arrogance can lead to temporary profits, but in the long run, it will result in significant losses. Ultimately, the ones who make money are those who approach the market with humility.

To put it bluntly, stop trying to pick tops and bottoms. When trading, you should act as if the trend will never end! Does that sound alarming? Let's put it another way: let the market prove that it has topped or bottomed out. The Adam Theory can never predict tops and bottoms, but when they do occur, it will signal that it's time to quickly exit your positions.

I know some traders who occasionally get it right and become addicted to predicting tops and bottoms, as if they were hooked. Even if it's deadly, they still try to pick tops and bottoms. So, please honestly ask yourself, "Can I trade without trying to predict tops and bottoms?" If the answer is no, I beg you to do yourself a favor, put down this book, and stop trading immediately. Unless you have too much money, you can't afford this habit.

Good investors make good use of direction and duration, not turning points.

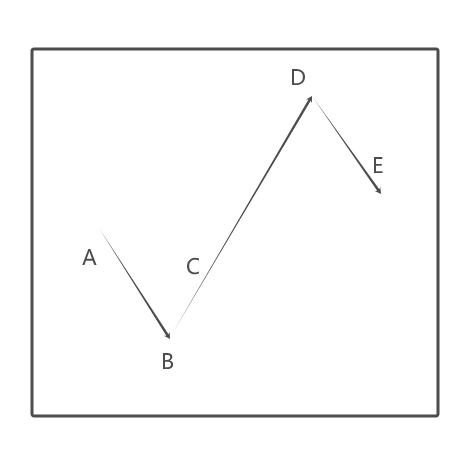

Remember, the Adam Theory can never predict tops and bottoms, but it is very useful in between. Let's talk about tops and bottoms (for long positions; the reverse applies for short positions). Please see the figure below:

In fact, all our profits are made between points C and E. Why is that?

First of all, of course, we don't want to buy at point A. Why go long when the market is still in a downtrend?

Let's imagine again the metaphor of the hobo and the train. The hobo wants to catch a train heading west. If he gets on a train heading east, he will have to wait for the train to slow down, stop, turn around, and then accelerate westward. That's ridiculous. Why not just get on a westbound train from the start?

No sane hobo would do such a thing, but I have seen many traders go long at point A. I have done this many times myself and paid the price. The reason I did this was because I used to hear people say to buy on dips, but that's nonsense; I did it because some analysts told me the market was about to rebound; I did it because I thought the market had "bottomed out" or "fallen enough."

If we could be sure that the bottom (point B) was near (don't be silly), it wouldn't be too bad to buy at that time, but in fact, point B is often still very far away. How many times have I gone long before the price had finished falling and then prayed for a rebound?

Going long at point B is not much better because we can't be sure that point B is the bottom until the market rises to point C. Point B might be the bottom, but the market could still continue to fall for a long time. I know this because I've seen it happen too many times.

Even if point B is truly the bottom, buying at that time is still not a good trade because only when the market rises to point C can we really confirm that point B was the bottom. Therefore, buying at point B is equivalent to predicting market movements, which is not a wise approach.

(Yes, sometimes the market's movements can be predicted, but it is still unwise because trend-following is much more effective. Moreover, just trying to predict the market's direction is already a wrong idea.)

Trend-following means buying in a bull market and selling in a bear market.

So, the proper approach is to buy at point C, that is, when the market has fully turned and begun to accelerate in the direction we want (Why should we jump on the train only after it has started heading west? Because there is only one way to be sure that the market's trend is upward: it is already rising).

So, never try to pick tops and bottoms. Let the tops and bottoms reveal themselves. We can remind ourselves with a saying: those who try to pick tops and bottoms will end up with nothing.

My colleague William once said to me, "Who am I to confirm tops and bottoms? I'm not that smart. Why should I do this?"

This is a statement from a very capable investor.

Bernard Baruch, who made $30 million in the market (a value about ten times higher than in 1987), said:

"Except for fraudsters, I don't believe anyone has the ability to confirm tops and bottoms. I only trade the middle 50% of the uptrend. That's enough."

In other words: never try to time a reversal.

Follow the direction of the market and never try to time a reversal.

Trend is your friend.

A very successful investor, who thoroughly studied the market with a computer, said this:

"I fed a lot of numbers into the computer, all of which were trades that had made a lot of money in the past. I tried to clarify some of the trading methods I had heard of and test them on the computer. I found that very few of the profit-making methods that others said were useful... well, if I have to explain how to operate effectively, the conclusion I drew from those numbers is: trend is your friend."

The implicit meaning is that the only important information is the price. When observing the market, all other information is irrelevant because all information has already been reflected in the price, all of it.

If that hobo wants to catch a westbound train, he only needs to see the direction of the train's movement and whether the train is going fast enough. He doesn't need to know how the train was made, how many people are on it, or what the power source is. None of that information is important. He only needs to see the direction of the train's movement.

The investor who did the computer analysis summarized his feelings about what is important and unimportant in the market in one sentence: "The current situation is already reflected in the price."

To make a profit, there is only one way: to follow the direction of the trend from entry to exit.