Please use a PC Browser to access Register-Tadawul

The Market Doesn't Like What It Sees From Sally Beauty Holdings, Inc.'s (NYSE:SBH) Earnings Yet As Shares Tumble 28%

Sally Beauty Holdings, Inc. SBH | 15.50 | -0.32% |

Sally Beauty Holdings, Inc. (NYSE:SBH) shareholders that were waiting for something to happen have been dealt a blow with a 28% share price drop in the last month. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 25% in that time.

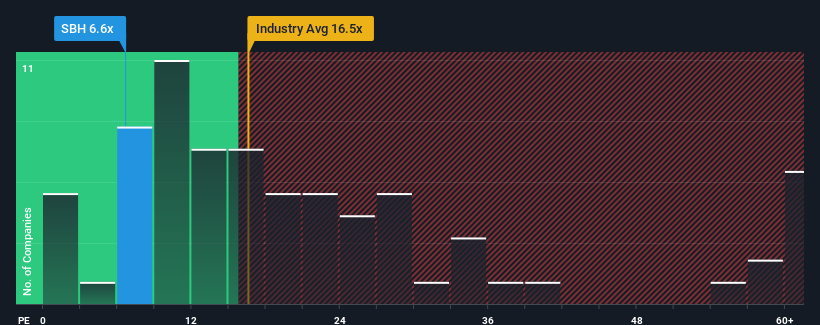

In spite of the heavy fall in price, Sally Beauty Holdings' price-to-earnings (or "P/E") ratio of 6.6x might still make it look like a strong buy right now compared to the market in the United States, where around half of the companies have P/E ratios above 19x and even P/E's above 34x are quite common. However, the P/E might be quite low for a reason and it requires further investigation to determine if it's justified.

Sally Beauty Holdings hasn't been tracking well recently as its declining earnings compare poorly to other companies, which have seen some growth on average. The P/E is probably low because investors think this poor earnings performance isn't going to get any better. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Does Growth Match The Low P/E?

In order to justify its P/E ratio, Sally Beauty Holdings would need to produce anemic growth that's substantially trailing the market.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 14%. This means it has also seen a slide in earnings over the longer-term as EPS is down 29% in total over the last three years. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Shifting to the future, estimates from the six analysts covering the company suggest earnings should grow by 7.4% per year over the next three years. That's shaping up to be materially lower than the 11% each year growth forecast for the broader market.

In light of this, it's understandable that Sally Beauty Holdings' P/E sits below the majority of other companies. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Bottom Line On Sally Beauty Holdings' P/E

Sally Beauty Holdings' P/E looks about as weak as its stock price lately. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As we suspected, our examination of Sally Beauty Holdings' analyst forecasts revealed that its inferior earnings outlook is contributing to its low P/E. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. It's hard to see the share price rising strongly in the near future under these circumstances.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.