Please use a PC Browser to access Register-Tadawul

The Price Is Right For The Estée Lauder Companies Inc. (NYSE:EL) Even After Diving 28%

Estee Lauder Companies Inc. Class A EL | 104.10 | -1.38% |

The Estée Lauder Companies Inc. (NYSE:EL) shareholders that were waiting for something to happen have been dealt a blow with a 28% share price drop in the last month. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 63% loss during that time.

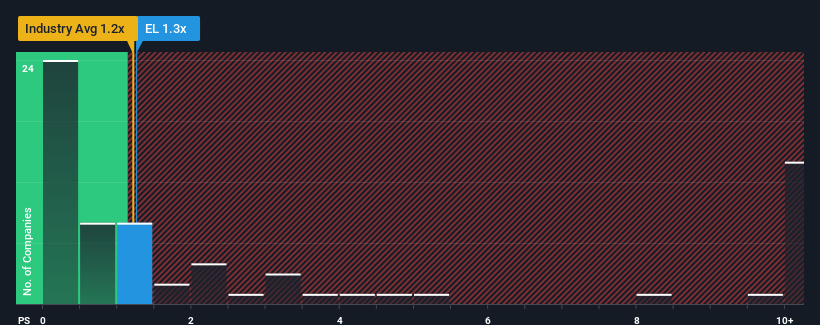

Even after such a large drop in price, it's still not a stretch to say that Estée Lauder Companies' price-to-sales (or "P/S") ratio of 1.3x right now seems quite "middle-of-the-road" compared to the Personal Products industry in the United States, where the median P/S ratio is around 1.2x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

What Does Estée Lauder Companies' P/S Mean For Shareholders?

With revenue growth that's inferior to most other companies of late, Estée Lauder Companies has been relatively sluggish. It might be that many expect the uninspiring revenue performance to strengthen positively, which has kept the P/S ratio from falling. If not, then existing shareholders may be a little nervous about the viability of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Estée Lauder Companies .How Is Estée Lauder Companies' Revenue Growth Trending?

In order to justify its P/S ratio, Estée Lauder Companies would need to produce growth that's similar to the industry.

Retrospectively, the last year delivered virtually the same number to the company's top line as the year before. This isn't what shareholders were looking for as it means they've been left with a 14% decline in revenue over the last three years in total. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Turning to the outlook, the next three years should generate growth of 2.5% per annum as estimated by the analysts watching the company. That's shaping up to be similar to the 3.7% per annum growth forecast for the broader industry.

In light of this, it's understandable that Estée Lauder Companies' P/S sits in line with the majority of other companies. It seems most investors are expecting to see average future growth and are only willing to pay a moderate amount for the stock.

The Final Word

Estée Lauder Companies' plummeting stock price has brought its P/S back to a similar region as the rest of the industry. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've seen that Estée Lauder Companies maintains an adequate P/S seeing as its revenue growth figures match the rest of the industry. Right now shareholders are comfortable with the P/S as they are quite confident future revenue won't throw up any surprises. All things considered, if the P/S and revenue estimates contain no major shocks, then it's hard to see the share price moving strongly in either direction in the near future.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.