Please use a PC Browser to access Register-Tadawul

The Price Is Right For Western Digital Corporation (NASDAQ:WDC)

Western Digital Corporation WDC | 281.58 | -0.89% |

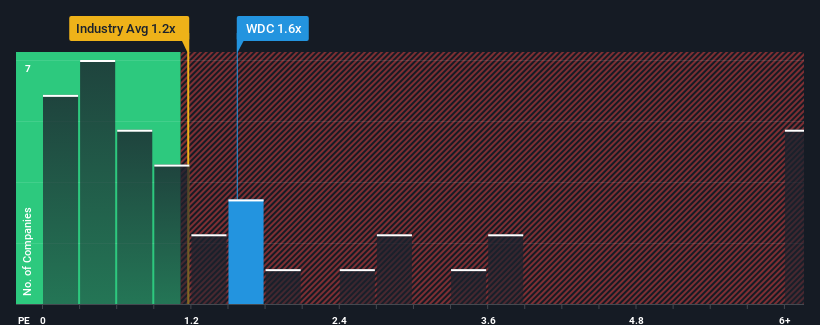

With a median price-to-sales (or "P/S") ratio of close to 1.2x in the Tech industry in the United States, you could be forgiven for feeling indifferent about Western Digital Corporation's (NASDAQ:WDC) P/S ratio of 1.6x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

What Does Western Digital's P/S Mean For Shareholders?

With revenue growth that's superior to most other companies of late, Western Digital has been doing relatively well. It might be that many expect the strong revenue performance to wane, which has kept the P/S ratio from rising. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

Keen to find out how analysts think Western Digital's future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The P/S?

Western Digital's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 26%. Despite this strong recent growth, it's still struggling to catch up as its three-year revenue frustratingly shrank by 21% overall. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenues over that time.

Shifting to the future, estimates from the analysts covering the company suggest revenue should grow by 9.3% per annum over the next three years. Meanwhile, the rest of the industry is forecast to expand by 7.6% per annum, which is not materially different.

With this in mind, it makes sense that Western Digital's P/S is closely matching its industry peers. It seems most investors are expecting to see average future growth and are only willing to pay a moderate amount for the stock.

What We Can Learn From Western Digital's P/S?

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

A Western Digital's P/S seems about right to us given the knowledge that analysts are forecasting a revenue outlook that is similar to the Tech industry. Right now shareholders are comfortable with the P/S as they are quite confident future revenue won't throw up any surprises. Unless these conditions change, they will continue to support the share price at these levels.

You need to take note of risks, for example - Western Digital has 3 warning signs (and 1 which is a bit unpleasant) we think you should know about.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.