Please use a PC Browser to access Register-Tadawul

The Simple 'Squeeze' Strategy That Earned a Trader $18.2 Million in a Year! — Full Method Revealed

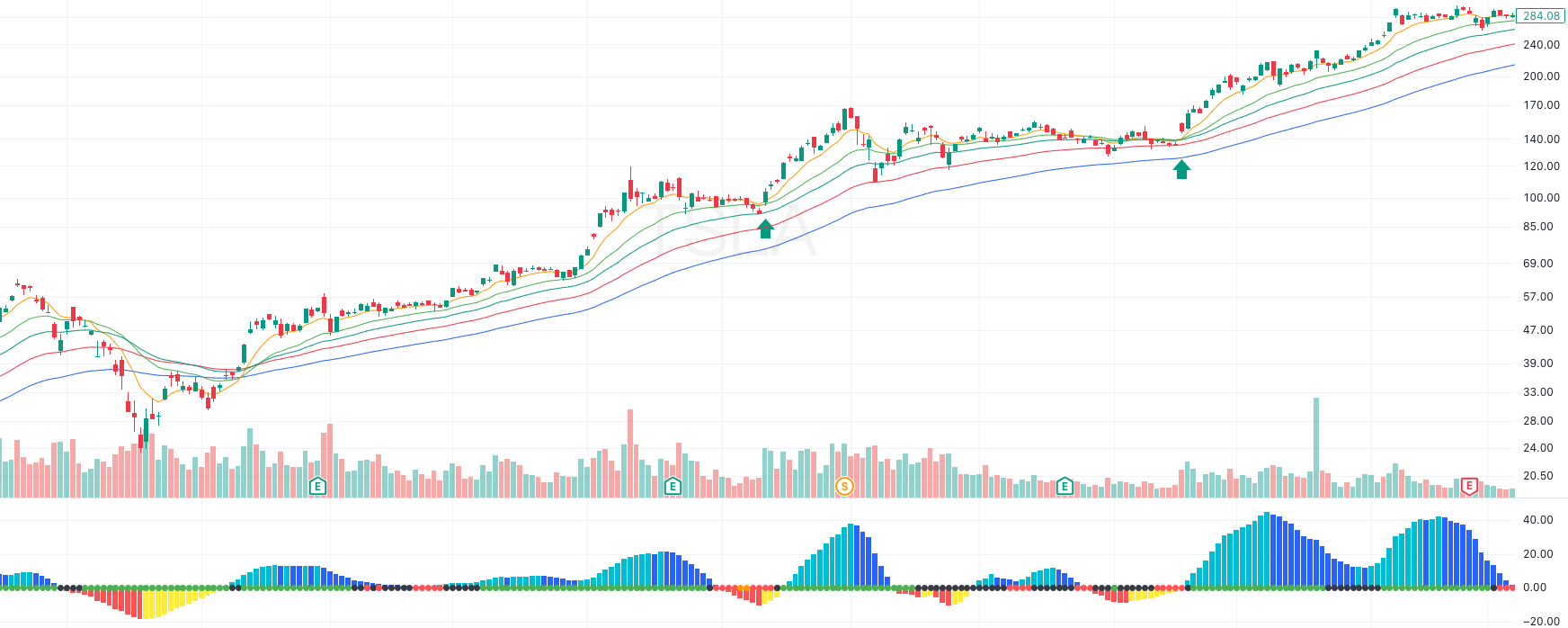

Tesla Motors, Inc. TSLA | 411.11 | +3.50% |

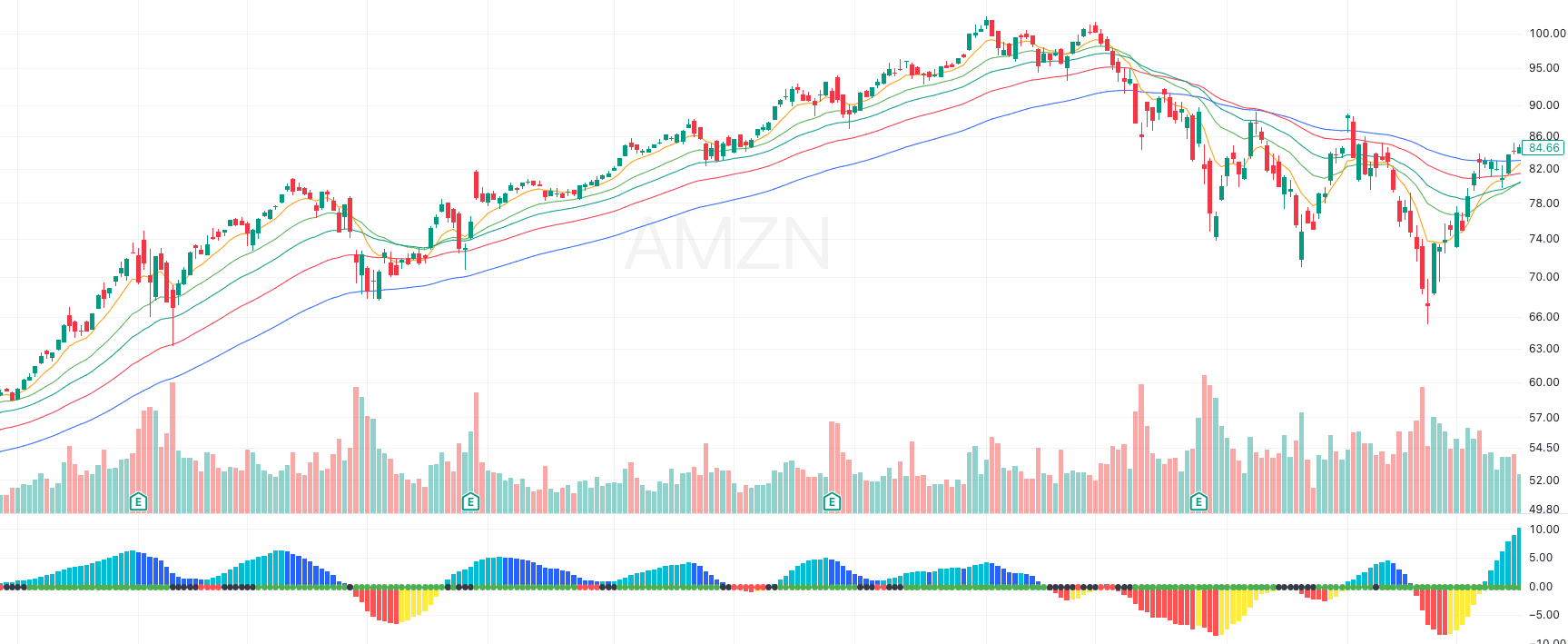

Amazon.com, Inc. AMZN | 210.32 | -5.55% |

Netflix, Inc. NFLX | 82.20 | +1.64% |

PowerShares QQQ Trust,Series 1 QQQ | 609.65 | +2.11% |

ETF-S&P 500 SPY | 690.62 | +1.92% |

This content is provided solely for educational and informational purposes and does not constitute any form of investment advice. The personal experiences, trading strategies, and profit cases discussed herein occurred under specific market conditions and are rare exceptions rather than general patterns. They do not guarantee similar outcomes in the future. Financial market trading—especially in derivatives such as options—carries a high level of risk and may result in the total loss of capital. Before making any investment decisions, you are strongly advised to conduct independent research and consult a qualified financial advisor.

John Carter, author of Mastering the Trade and a full-time trader since the 1990s, has built a reputation for his disciplined approach to trading. He is known for identifying high-probability opportunities and maintaining a stoic mindset, even during extreme market volatility.

Let’s dive into his journey, his core philosophy, and the powerful strategy that has defined his career.

"The market is going to be open tomorrow. Be patient. Wait for your pitch." — John Carter

The Spark and the Scar: A Trader's Origin

Every trader has an origin story. Carter’s began at a cookie shop in the mall. As a high school student earning minimum wage, he saved up $1,000. One evening, he overheard his father discussing Intel call options. Though he didn't understand what options were, he was captivated by the idea of making money with his mind, not just his hands.

He invested his $1,000. A few weeks later, he got his money back, plus an extra $800. He was hooked.

But the path wasn't a straight line to success. Years later, a devastating $150,000 loss right before he was about to buy a house taught him a lesson he never forgot: risk management is everything. This principle would become the bedrock of his entire trading philosophy.

His key early lessons were:

- Risk Management is Paramount: Early mistakes taught him that structured risk control is not optional.

- Constant Presence is Key: The truly great opportunities only come a few times a year, and a trader must be ready.

- Emotional Detachment is a Superpower: Inspired by Mark Douglas's Trading in the Zone, he learned to separate his emotions from his decisions.

The lessons Carter learned from his substantial losses reflect the harsh realities all market participants must eventually confront. This is not merely a personal anecdote—it aligns with broader statistical evidence. Multiple studies and brokerage data consistently show that the vast majority of retail traders—commonly estimated at 80% to 95%—incur losses over the long term. Success in the markets is not just about finding a working strategy, but more importantly, about surviving the inevitable drawdowns. For the average investor, recognizing and accepting this high failure rate is the first step toward developing a rational and resilient trading mindset.

The 'Squeeze': Carter's Signature Strategy

Carter is most famous for his "Squeeze" strategy—a setup that identifies periods of price consolidation just before a major breakout. The core idea is simple: low volatility breeds high volatility. When a stock trades sideways in a narrow range, it's building energy. The Squeeze helps traders get in before that energy is released.

How the Squeeze Works:

The setup is identified when the Bollinger Bands contract and move inside the Keltner Channels. This indicates the market is in a low-volatility state, or "in a Squeeze." On Carter's indicator, a red dot appears, signaling a potential high-probability trade.

When the Bollinger Bands expand and break out of the Keltner Channels, the Squeeze has "fired," and the price often makes a powerful, sustained move in one direction.

How to Identify an A+ Squeeze:

Not all Squeezes are created equal. Carter looks for these confirming factors:

- Price Trend: The stock is trading above the 21-day EMA for a bullish setup (or below for bearish).

- Stacked EMAs: For a long trade, the moving averages are aligned in order: 8 > 21 > 34 > 55 > 89 EMA.

- Momentum: The momentum histogram is starting to shift in the anticipated direction.

- Duration: The Squeeze has been building for 5 to 8 periods (red dots), indicating sufficient energy is stored.

- Relative Strength: The stock is visibly stronger than the broader market (e.g., the S&P 500).

How Carter Trades the Squeeze: Carter’s edge comes from entering before the breakout, not chasing it.

- Primary Entry: Buy during a pullback to the 21-day EMA while the Squeeze is still active.

- Confirmation: Use a shift in the momentum indicator as the trigger to enter.

- Secondary Entry: For those more risk-averse, enter after the Squeeze fires and the price retraces to the initial breakout level.

His profit-taking strategy is just as disciplined:

- First Target: Take partial profits at +2 ATR (Average True Range).

- Second Target: Take more profits at +3 ATR.

- Final Target: Leave a small portion of the position on to capture a larger, extended move.

If the Squeeze fails or momentum fades, he exits immediately to cut his losses short.

Legendary Trades: The Squeeze in Action

Here are three classic examples of Carter putting his strategy to work.

1. Tesla Motors, Inc.(TSLA.US) — The $14 Million Masterpiece (2020)

- The Setup: After a massive run-up, Tesla began consolidating. Carter spotted a powerful daily Squeeze forming, with stacked EMAs and strong momentum.

- The Action: Instead of buying shares, he used deep-in-the-money call options and long call spreads to create leverage while defining his risk.

- The Result: Tesla broke out explosively. Carter scaled out of his position, ultimately netting over $14 million in profit in one of his most legendary trades.

2. Amazon.com, Inc.(AMZN.US) — The Post-Earnings Play (2018)

- The Setup: Amazon released a strong earnings report, but the stock paused. A clear Squeeze formed on the 30-minute chart.

- The Action: Recognizing that implied volatility was still high (making options expensive), he sold put credit spreads, betting on a move higher while collecting a premium.

- The Result: The stock broke to the upside as predicted, and Carter closed the trade for a six-figure gain within days.

3. Netflix, Inc.(NFLX.US) — The Major Reversal (2019)

- The Setup: Netflix was in a steep downtrend, approaching a key support level. Carter saw institutional buying volume pick up and a Squeeze forming on the 4-hour chart, signaling a potential reversal.

- The Action: He bought call options, taking a smaller position size due to the counter-trend nature of the trade. His stop-loss was placed tightly below the support level.

- The Result: Netflix staged a sharp rally. Carter scaled out into the move, capturing over $500,000 in profit.

Caution: Exceptional Successes Are Not Representative Norms

It is important to acknowledge that the Tesla, Amazon, and Netflix trades referenced above represent extreme and rare successes achieved by professional traders with decades of experience, operating under specific market conditions. These stories are classic examples of survivorship bias—we hear about the few who succeeded, while overlooking the countless others who did not.These trades often involve complex financial derivatives and high leverage. While such tools can amplify returns, they equally—and often more severely—amplify potential losses. For retail investors lacking professional knowledge, experience, and robust risk management systems, attempting to replicate such trades can be extremely risky and may lead to catastrophic losses. These cases should be seen as outliers, not as replicable roadmaps to wealth.

Final Wisdom: Survive and Thrive

John Carter’s success isn't just about a single strategy; it's about a complete philosophy built on discipline and risk management.

💡The Ultimate Lesson: Never go all-in. Carter once nearly blew up his account by betting everything on a single options trade. He learned to never again risk his entire capital on one outcome.

His core risk rules include:

- Position Sizing: Risk no more than 5% of capital on a trade, or up to 10% for an A+ setup.

- Portfolio Hedging: Use S&P 500 (SPX) puts to protect long positions during uncertain times.

- Scaling Out: Lock in profits as a trade moves in your favor to reduce risk.

Carter's journey teaches us that mindset is the final frontier. The market will constantly test your discipline. Stay calm, follow your plan, and be patient for the highest-quality setups. And most importantly, remember that trading is a business—always pay yourself by taking profits along the way.

In summary, any narrative centered on extraordinary profits in financial markets must be approached with caution and critical thinking. John Carter’s success is not the result of a magical strategy, but rather his unwavering commitment to risk management and the psychological resilience forged through thousands of trades.

This article is for informational purposes only and does not constitute an offer or solicitation to buy or sell any security. The strategies and experiences discussed are not an endorsement and may not be suitable for all investors. Past performance is not indicative of future results. All readers should conduct their own independent research, understand the risks involved, and consult with a qualified financial advisor before making any investment decisions. Trading is a high-risk activity, and you should never invest money that you cannot afford to lose.

If you found this Trading Wisdom insightful, please share it with your friends and family. We also welcome you to discuss your own trading experiences and lessons learned in the comments below!