Please use a PC Browser to access Register-Tadawul

There's No Escaping ProFrac Holding Corp.'s (NASDAQ:ACDC) Muted Revenues Despite A 36% Share Price Rise

ProFrac Holding Corp. Class A ACDC | 5.21 | +3.99% |

ProFrac Holding Corp. (NASDAQ:ACDC) shares have had a really impressive month, gaining 36% after a shaky period beforehand. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 41% over that time.

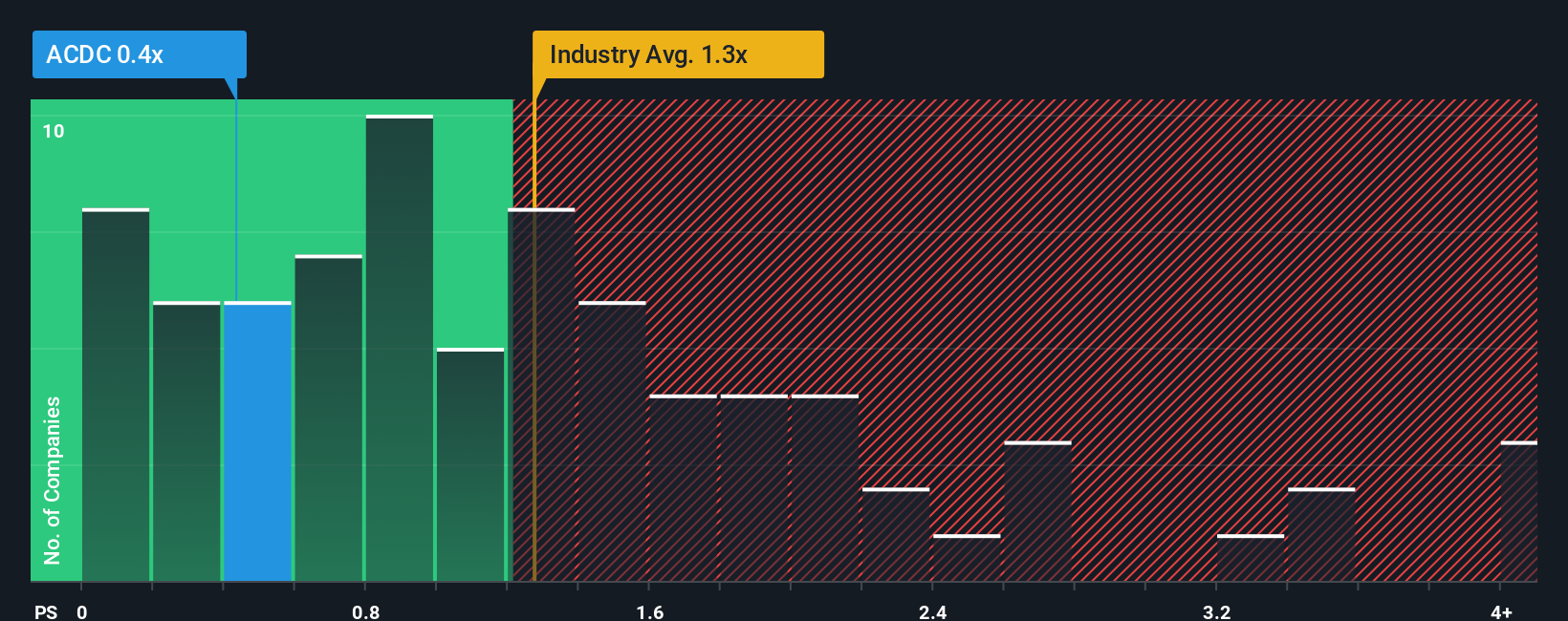

In spite of the firm bounce in price, when close to half the companies operating in the United States' Energy Services industry have price-to-sales ratios (or "P/S") above 1.3x, you may still consider ProFrac Holding as an enticing stock to check out with its 0.5x P/S ratio. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

What Does ProFrac Holding's Recent Performance Look Like?

ProFrac Holding hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. It seems that many are expecting the poor revenue performance to persist, which has repressed the P/S ratio. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on ProFrac Holding.Is There Any Revenue Growth Forecasted For ProFrac Holding?

The only time you'd be truly comfortable seeing a P/S as low as ProFrac Holding's is when the company's growth is on track to lag the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 12%. This has erased any of its gains during the last three years, with practically no change in revenue being achieved in total. So it appears to us that the company has had a mixed result in terms of growing revenue over that time.

Turning to the outlook, the next three years should bring diminished returns, with revenue decreasing 1.6% per annum as estimated by the four analysts watching the company. With the industry predicted to deliver 4.2% growth per year, that's a disappointing outcome.

With this in consideration, we find it intriguing that ProFrac Holding's P/S is closely matching its industry peers. However, shrinking revenues are unlikely to lead to a stable P/S over the longer term. There's potential for the P/S to fall to even lower levels if the company doesn't improve its top-line growth.

The Key Takeaway

The latest share price surge wasn't enough to lift ProFrac Holding's P/S close to the industry median. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

With revenue forecasts that are inferior to the rest of the industry, it's no surprise that ProFrac Holding's P/S is on the lower end of the spectrum. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.