Please use a PC Browser to access Register-Tadawul

There's Reason For Concern Over Centrus Energy Corp.'s (NYSE:LEU) Massive 36% Price Jump

Centrus Energy Corp. Class A LEU | 203.73 | -2.47% |

Those holding Centrus Energy Corp. (NYSE:LEU) shares would be relieved that the share price has rebounded 36% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. This latest share price bounce rounds out a remarkable 315% gain over the last twelve months.

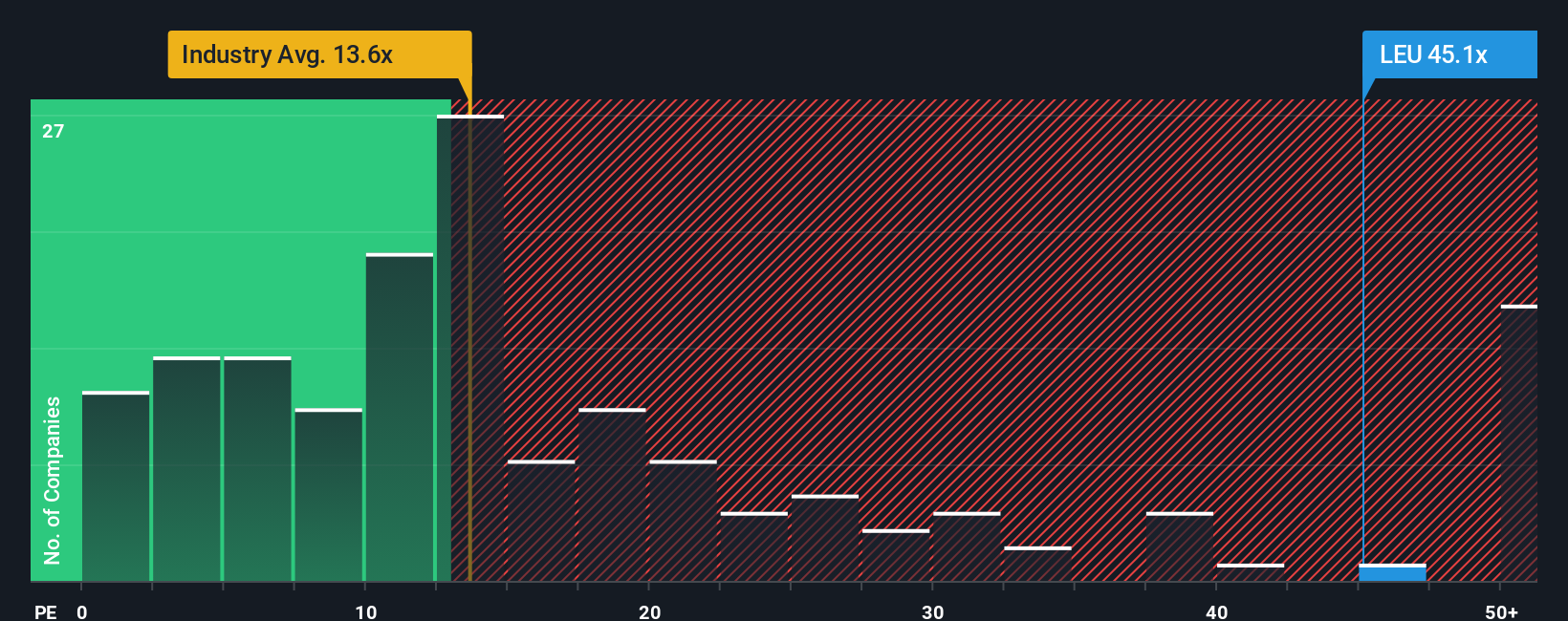

After such a large jump in price, given close to half the companies in the United States have price-to-earnings ratios (or "P/E's") below 19x, you may consider Centrus Energy as a stock to avoid entirely with its 54.1x P/E ratio. However, the P/E might be quite high for a reason and it requires further investigation to determine if it's justified.

Recent times have been advantageous for Centrus Energy as its earnings have been rising faster than most other companies. It seems that many are expecting the strong earnings performance to persist, which has raised the P/E. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

What Are Growth Metrics Telling Us About The High P/E?

The only time you'd be truly comfortable seeing a P/E as steep as Centrus Energy's is when the company's growth is on track to outshine the market decidedly.

Retrospectively, the last year delivered an exceptional 38% gain to the company's bottom line. However, this wasn't enough as the latest three year period has seen a very unpleasant 23% drop in EPS in aggregate. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Looking ahead now, EPS is anticipated to slump, contracting by 12% each year during the coming three years according to the analysts following the company. Meanwhile, the broader market is forecast to expand by 12% each year, which paints a poor picture.

In light of this, it's alarming that Centrus Energy's P/E sits above the majority of other companies. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. There's a very good chance these shareholders are setting themselves up for future disappointment if the P/E falls to levels more in line with the negative growth outlook.

The Bottom Line On Centrus Energy's P/E

Centrus Energy's P/E is flying high just like its stock has during the last month. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Centrus Energy currently trades on a much higher than expected P/E for a company whose earnings are forecast to decline. Right now we are increasingly uncomfortable with the high P/E as the predicted future earnings are highly unlikely to support such positive sentiment for long. Unless these conditions improve markedly, it's very challenging to accept these prices as being reasonable.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with Centrus Energy, and understanding should be part of your investment process.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.