Please use a PC Browser to access Register-Tadawul

There's Reason For Concern Over Lexicon Pharmaceuticals, Inc.'s (NASDAQ:LXRX) Massive 34% Price Jump

Lexicon Pharmaceuticals, Inc. LXRX | 1.20 | -2.85% |

Despite an already strong run, Lexicon Pharmaceuticals, Inc. (NASDAQ:LXRX) shares have been powering on, with a gain of 34% in the last thirty days. But the last month did very little to improve the 52% share price decline over the last year.

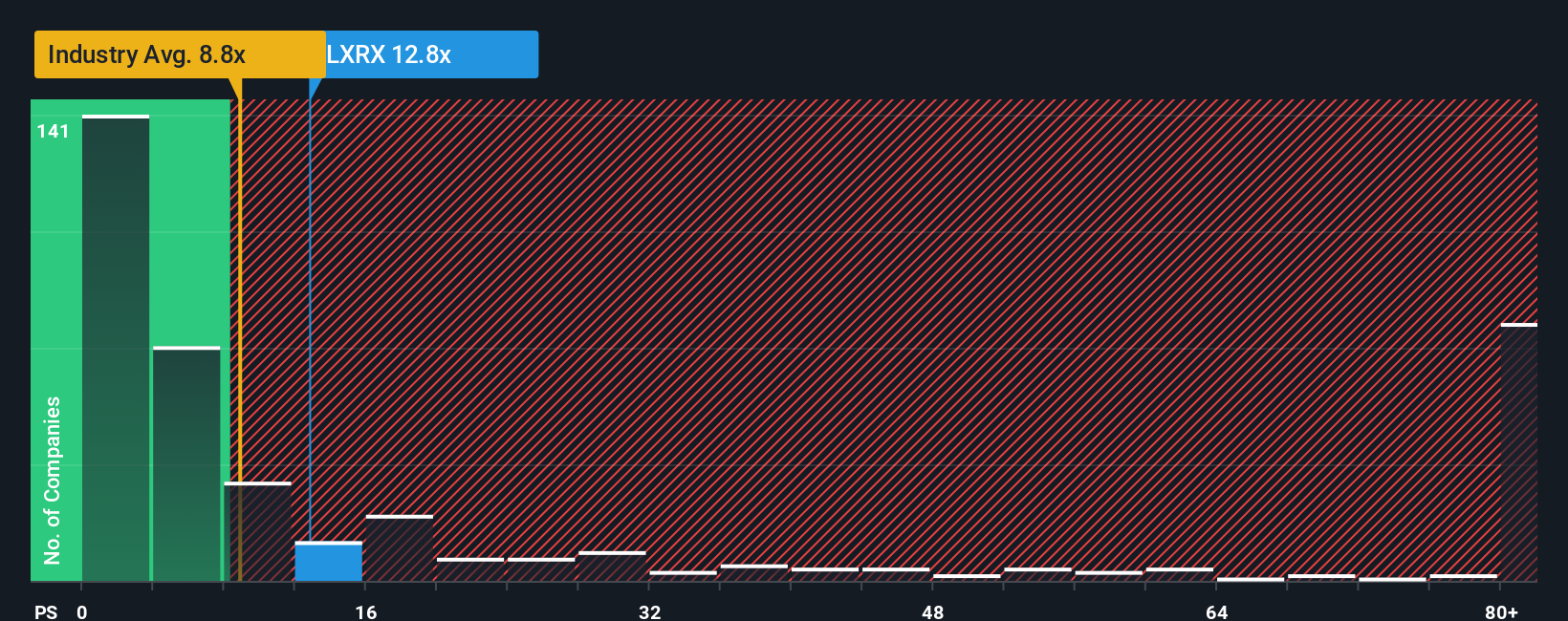

Following the firm bounce in price, Lexicon Pharmaceuticals' price-to-sales (or "P/S") ratio of 12.8x might make it look like a sell right now compared to the wider Biotechs industry in the United States, where around half of the companies have P/S ratios below 8.8x and even P/S below 3x are quite common. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

What Does Lexicon Pharmaceuticals' Recent Performance Look Like?

Lexicon Pharmaceuticals could be doing better as it's been growing revenue less than most other companies lately. Perhaps the market is expecting future revenue performance to undergo a reversal of fortunes, which has elevated the P/S ratio. However, if this isn't the case, investors might get caught out paying too much for the stock.

Keen to find out how analysts think Lexicon Pharmaceuticals' future stacks up against the industry? In that case, our free report is a great place to start.Do Revenue Forecasts Match The High P/S Ratio?

In order to justify its P/S ratio, Lexicon Pharmaceuticals would need to produce impressive growth in excess of the industry.

Taking a look back first, we see that the company's revenues underwent some rampant growth over the last 12 months. The amazing performance means it was also able to deliver huge revenue growth over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Shifting to the future, estimates from the five analysts covering the company suggest revenue should grow by 12% per year over the next three years. That's shaping up to be materially lower than the 103% per year growth forecast for the broader industry.

With this in consideration, we believe it doesn't make sense that Lexicon Pharmaceuticals' P/S is outpacing its industry peers. Apparently many investors in the company are way more bullish than analysts indicate and aren't willing to let go of their stock at any price. Only the boldest would assume these prices are sustainable as this level of revenue growth is likely to weigh heavily on the share price eventually.

The Key Takeaway

Lexicon Pharmaceuticals' P/S is on the rise since its shares have risen strongly. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Despite analysts forecasting some poorer-than-industry revenue growth figures for Lexicon Pharmaceuticals, this doesn't appear to be impacting the P/S in the slightest. Right now we aren't comfortable with the high P/S as the predicted future revenues aren't likely to support such positive sentiment for long. Unless these conditions improve markedly, it's very challenging to accept these prices as being reasonable.

If these risks are making you reconsider your opinion on Lexicon Pharmaceuticals, explore our interactive list of high quality stocks to get an idea of what else is out there.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.