Please use a PC Browser to access Register-Tadawul

There's Reason For Concern Over MOGU Inc.'s (NYSE:MOGU) Massive 104% Price Jump

MOGU MOGU | 2.69 | 0.00% |

MOGU Inc. (NYSE:MOGU) shareholders have had their patience rewarded with a 104% share price jump in the last month. The last month tops off a massive increase of 139% in the last year.

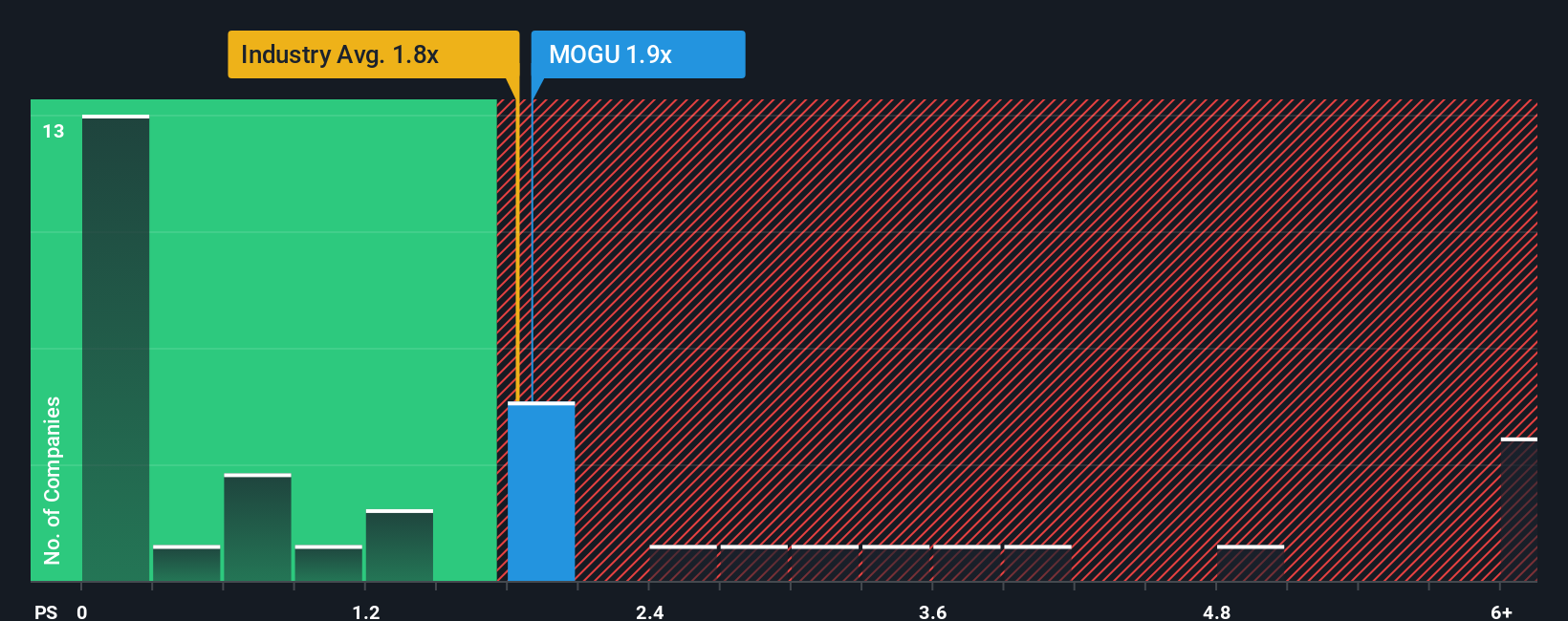

Although its price has surged higher, there still wouldn't be many who think MOGU's price-to-sales (or "P/S") ratio of 1.9x is worth a mention when the median P/S in the United States' Multiline Retail industry is similar at about 1.8x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

How Has MOGU Performed Recently?

For example, consider that MOGU's financial performance has been poor lately as its revenue has been in decline. It might be that many expect the company to put the disappointing revenue performance behind them over the coming period, which has kept the P/S from falling. If you like the company, you'd at least be hoping this is the case so that you could potentially pick up some stock while it's not quite in favour.

Although there are no analyst estimates available for MOGU, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.How Is MOGU's Revenue Growth Trending?

There's an inherent assumption that a company should be matching the industry for P/S ratios like MOGU's to be considered reasonable.

Retrospectively, the last year delivered a frustrating 12% decrease to the company's top line. As a result, revenue from three years ago have also fallen 58% overall. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Weighing that medium-term revenue trajectory against the broader industry's one-year forecast for expansion of 12% shows it's an unpleasant look.

With this in mind, we find it worrying that MOGU's P/S exceeds that of its industry peers. It seems most investors are ignoring the recent poor growth rate and are hoping for a turnaround in the company's business prospects. There's a good chance existing shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the recent negative growth rates.

The Key Takeaway

MOGU appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

The fact that MOGU currently trades at a P/S on par with the rest of the industry is surprising to us since its recent revenues have been in decline over the medium-term, all while the industry is set to grow. When we see revenue heading backwards in the context of growing industry forecasts, it'd make sense to expect a possible share price decline on the horizon, sending the moderate P/S lower. Unless the the circumstances surrounding the recent medium-term improve, it wouldn't be wrong to expect a a difficult period ahead for the company's shareholders.

If these risks are making you reconsider your opinion on MOGU, explore our interactive list of high quality stocks to get an idea of what else is out there.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.