Please use a PC Browser to access Register-Tadawul

There's Reason For Concern Over Navitas Semiconductor Corporation's (NASDAQ:NVTS) Massive 26% Price Jump

Navitas Semiconductor Corp Ordinary Shares - Class A NVTS | 7.88 | -2.48% |

Navitas Semiconductor Corporation (NASDAQ:NVTS) shareholders are no doubt pleased to see that the share price has bounced 26% in the last month, although it is still struggling to make up recently lost ground. The last month tops off a massive increase of 185% in the last year.

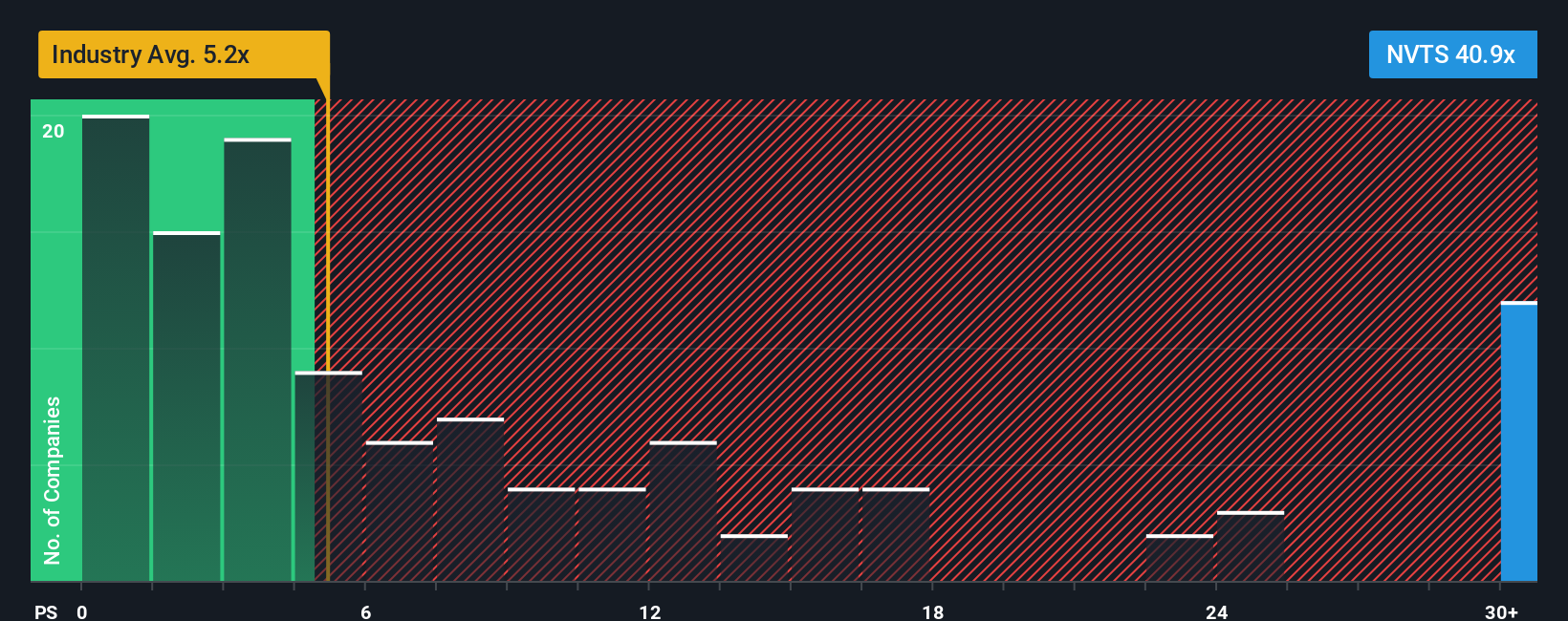

Following the firm bounce in price, Navitas Semiconductor may be sending strong sell signals at present with a price-to-sales (or "P/S") ratio of 40.9x, when you consider almost half of the companies in the Semiconductor industry in the United States have P/S ratios under 5.2x and even P/S lower than 2x aren't out of the ordinary. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

How Has Navitas Semiconductor Performed Recently?

Navitas Semiconductor could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. Perhaps the market is expecting the poor revenue to reverse, justifying it's current high P/S.. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Keen to find out how analysts think Navitas Semiconductor's future stacks up against the industry? In that case, our free report is a great place to start.Do Revenue Forecasts Match The High P/S Ratio?

The only time you'd be truly comfortable seeing a P/S as steep as Navitas Semiconductor's is when the company's growth is on track to outshine the industry decidedly.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 38%. Even so, admirably revenue has lifted 72% in aggregate from three years ago, notwithstanding the last 12 months. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been more than adequate for the company.

Shifting to the future, estimates from the eight analysts covering the company suggest revenue should grow by 26% each year over the next three years. With the industry predicted to deliver 29% growth per year, the company is positioned for a weaker revenue result.

In light of this, it's alarming that Navitas Semiconductor's P/S sits above the majority of other companies. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. There's a good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

What Does Navitas Semiconductor's P/S Mean For Investors?

Shares in Navitas Semiconductor have seen a strong upwards swing lately, which has really helped boost its P/S figure. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

It comes as a surprise to see Navitas Semiconductor trade at such a high P/S given the revenue forecasts look less than stellar. When we see a weak revenue outlook, we suspect the share price faces a much greater risk of declining, bringing back down the P/S figures. At these price levels, investors should remain cautious, particularly if things don't improve.

If you're unsure about the strength of Navitas Semiconductor's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.