Thermon Group Holdings (NYSE:THR) ascends 4.8% this week, taking three-year gains to 76%

Thermon Group Holdings, Inc. THR | 0.00 |

By buying an index fund, investors can approximate the average market return. But if you choose individual stocks with prowess, you can make superior returns. For example, Thermon Group Holdings, Inc. (NYSE:THR) shareholders have seen the share price rise 76% over three years, well in excess of the market return (15%, not including dividends). On the other hand, the returns haven't been quite so good recently, with shareholders up just 46%.

After a strong gain in the past week, it's worth seeing if longer term returns have been driven by improving fundamentals.

View our latest analysis for Thermon Group Holdings

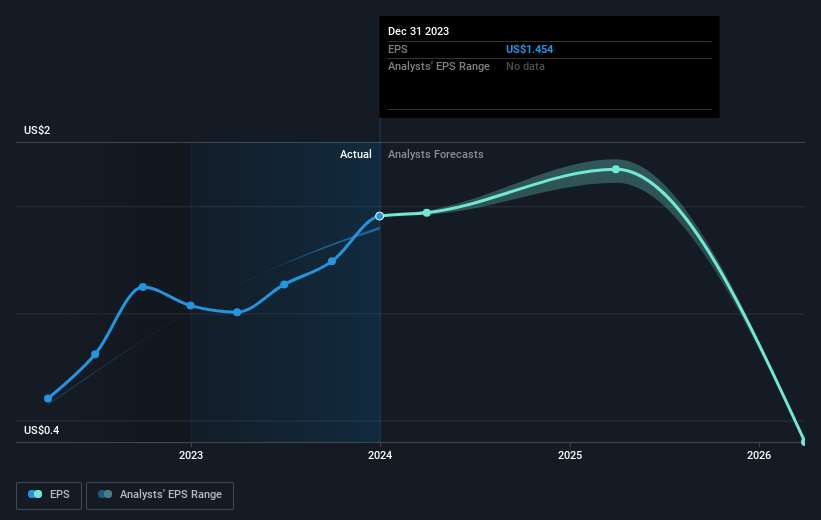

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During three years of share price growth, Thermon Group Holdings moved from a loss to profitability. That would generally be considered a positive, so we'd expect the share price to be up.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

It's probably worth noting we've seen significant insider buying in the last quarter, which we consider a positive. That said, we think earnings and revenue growth trends are even more important factors to consider. It might be well worthwhile taking a look at our free report on Thermon Group Holdings' earnings, revenue and cash flow.

A Different Perspective

It's good to see that Thermon Group Holdings has rewarded shareholders with a total shareholder return of 46% in the last twelve months. That gain is better than the annual TSR over five years, which is 5%. Therefore it seems like sentiment around the company has been positive lately. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Consider for instance, the ever-present spectre of investment risk. We've identified 1 warning sign with Thermon Group Holdings , and understanding them should be part of your investment process.

Thermon Group Holdings is not the only stock insiders are buying. So take a peek at this free list of growing companies with insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Recommend

- Sahm Platform 11/11 14:34

UBS Maintains Buy on Life360, Lowers Price Target to $110

Benzinga News 11/11 20:51Hesai Group (NasdaqGS:HSAI): Exploring Valuation After Recent Share Price Uptick

Simply Wall St 11/11 22:21EXCLUSIVE: Brokerages Using AI To Help Customers - 'At The Forefront Of Where We're Heading'

Benzinga News 11/11 22:44Evaluating Viatris (VTRS) Valuation After Strong Q3 Results and Upbeat 2025 Guidance

Simply Wall St 11/11 23:35Rising Revenue and Falling Profits Might Change the Case for Investing in Blue Owl Capital (OWL)

Simply Wall St 12/11 00:33Breakthrough And Pullback | 2 Stocks Deserve Close Attention: REAL And HNRG

Insights 12/11 02:37Investing with Cathie Wood: Buying the Dip in Circle, Slashing Tesla and SOFI Holdings

Insights Today 08:14