Please use a PC Browser to access Register-Tadawul

Top 3 Dividend Stocks To Consider For Your Portfolio

United Parcel Service, Inc. Class B UPS | 99.92 | -0.15% |

As the U.S. market experiences volatility with stocks fluctuating between gains and losses amid political and economic developments, investors are keenly observing how these factors impact their portfolios. In such an environment, dividend stocks can offer a stable income stream, making them an appealing consideration for those looking to balance growth with consistent returns.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Universal (UVV) | 5.98% | ★★★★★★ |

| Peoples Bancorp (PEBO) | 5.28% | ★★★★★☆ |

| Huntington Bancshares (HBAN) | 3.74% | ★★★★★☆ |

| First Interstate BancSystem (FIBK) | 6.27% | ★★★★★★ |

| Ennis (EBF) | 5.61% | ★★★★★★ |

| Douglas Dynamics (PLOW) | 4.03% | ★★★★★☆ |

| Dillard's (DDS) | 6.11% | ★★★★★★ |

| CompX International (CIX) | 4.64% | ★★★★★★ |

| Columbia Banking System (COLB) | 6.04% | ★★★★★★ |

| Citizens & Northern (CZNC) | 5.76% | ★★★★★☆ |

Here we highlight a subset of our preferred stocks from the screener.

Calavo Growers (CVGW)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Calavo Growers, Inc. markets and distributes avocados, prepared avocados, and other perishable foods to a variety of global retail and wholesale customers, with a market cap of approximately $477.14 million.

Operations: Calavo Growers, Inc. generates revenue through its Fresh segment, contributing $632.30 million, and its Prepared segment, which adds $62.19 million.

Dividend Yield: 3%

Calavo Growers' dividend payments, with a cash payout ratio of 43.8%, are well covered by cash flows but have been volatile over the past decade. Although the dividend yield of 3.05% is below top-tier levels in the US market, recent earnings growth and a declared quarterly dividend of $0.20 per share suggest some stability. An acquisition proposal valued at $32 per share could impact future dividends if completed, pending due diligence and financing arrangements.

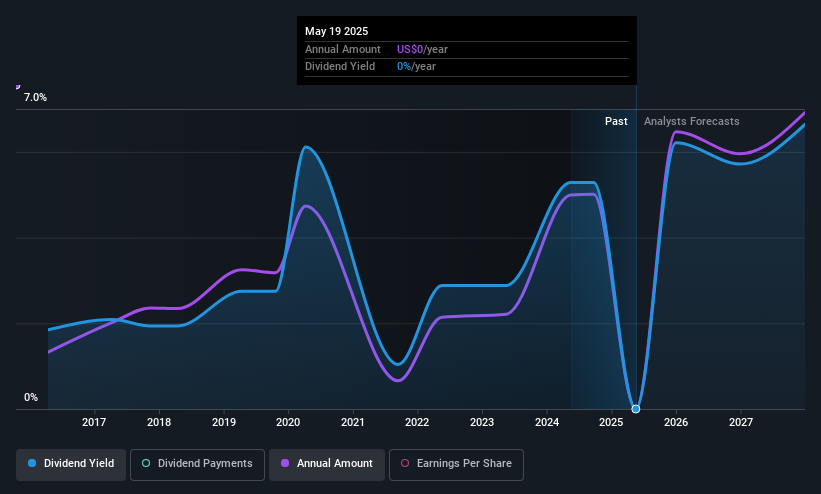

Credicorp (BAP)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Credicorp Ltd. operates in financial, insurance, and health services sectors in Peru and internationally, with a market cap of $17.59 billion.

Operations: Credicorp Ltd.'s revenue is primarily derived from Universal Banking through Banco De Crédito Del Perú (PEN 13.40 billion), followed by Microfinance at Mibanco (PEN 1.55 billion), Insurance and Pension Funds via Pacífico Seguros and Subsidiaries (PEN 1.24 billion), Investment Management and Advisory (PEN 988 million), Universal Banking through Banco De Crédito De Bolivia (PEN 288 million), Insurance and Pension Funds - Prima AFP (PEN 367 million), and Microfinance at Mibanco Colombia including Edyficar S.A.S. (PEN 298 million).

Dividend Yield: 4.9%

Credicorp's dividend payments, with a payout ratio of 55.1%, are covered by earnings but have been volatile over the past decade. The recent annual dividend increase to US$11.01 per share reflects growth, yet the company's high level of bad loans (5.2%) poses risks to future stability. Trading at 29.8% below fair value and offering a top-tier yield of 4.93%, Credicorp remains attractive despite its unstable dividend history and potential loan challenges.

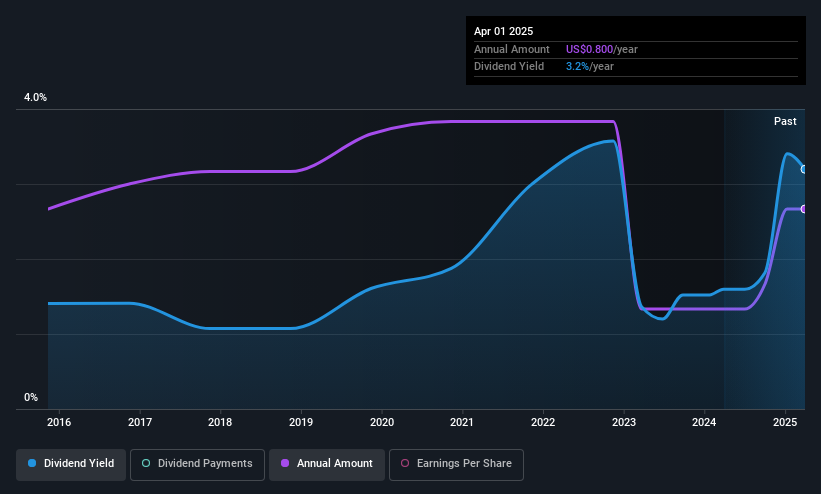

United Parcel Service (UPS)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: United Parcel Service, Inc. is a package delivery and logistics provider that offers transportation and delivery services, with a market cap of approximately $84.78 billion.

Operations: United Parcel Service, Inc. generates revenue through its key segments: U.S. Domestic at $60.57 billion, International at $18.08 billion, and Supply Chain Solutions at $12.26 billion.

Dividend Yield: 6.6%

United Parcel Service's dividend, yielding 6.59%, ranks in the top 25% of US dividend payers but is not well covered by earnings or free cash flow, with a high payout ratio of 95.2%. Despite stable and growing dividends over the past decade, its financials are strained by significant debt and a cash payout ratio exceeding 100%. Recent board changes and fixed-income offerings highlight ongoing strategic adjustments amidst these challenges.

Summing It All Up

- Gain an insight into the universe of 143 Top US Dividend Stocks by clicking here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.