Please use a PC Browser to access Register-Tadawul

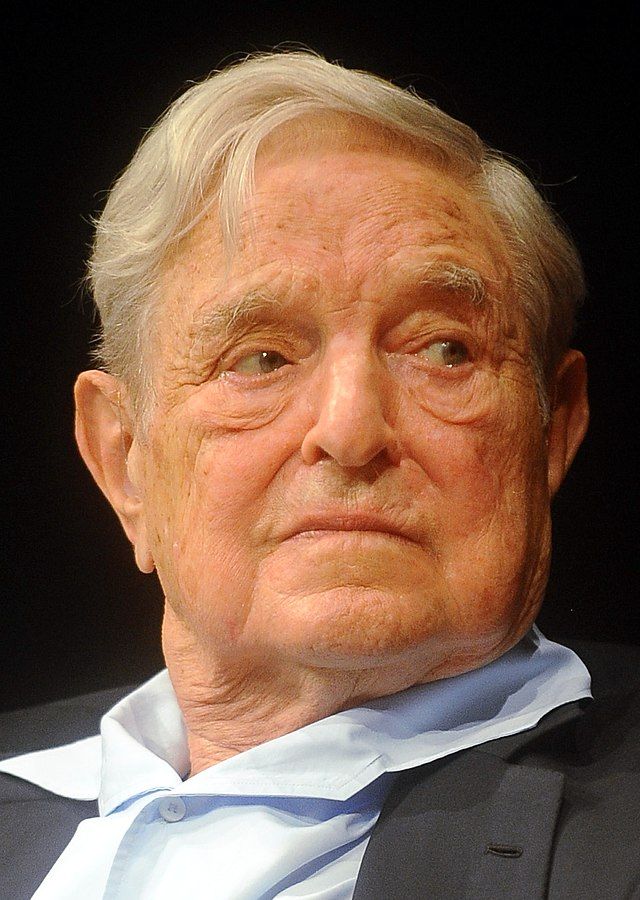

Trading Wisdom | Soros: Truly Good Investments Are Boring

PowerShares QQQ Trust,Series 1 QQQ | 613.97 | +0.06% |

Apple Inc. AAPL | 274.65 | -1.30% |

Like other great investors, Soros focuses heavily on "intrinsic value." Intrinsic value is essentially the weighted average of potential investment outcomes. An investment idea that deviates from the consensus is only wise if its intrinsic value is positive. On one hand, Soros is capable of making significantly larger bets than most other investors; on the other hand, he handles the investment process in a fundamentally similar way as other investors do.

Financial markets are often unpredictable, so an investor must have various preemptive scenarios in mind.

Markets are "sometimes" predictable, but this does not mean that markets are "always" unpredictable. If an investor is patient and can wait for an opportunity to bet on a pricing anomaly, he can outperform the market.

The hardest thing to determine is: what level of risk is safe enough to assume?

Risk is the likelihood of incurring a loss. Three types of scenarios need to be addressed: sometimes you know both the nature and the probability of a risk event (like flipping a coin); sometimes you know the nature but not the probability (like the price of a particular stock in 20 years); sometimes you don't even know the nature of future events that could harm you (like a severe black swan event).

Soros once noted that these decisions are made in a certain environment, which may include many feedback loops, some positive and some negative, interacting to create the dominant pricing patterns most of the time. However, in individual cases, some bubbles unleash their full potential, overshadowing other influencing factors.

To be "safe," the best method is to have a "margin of safety."

It's not most important whether you are right or wrong; the most important thing is how much you make when you're right and how much you lose when you're wrong.

For an investor, the most important thing is the "magnitude of correctness," not the "frequency of being right."

Having confidence or a small position amounts to nothing.

If the odds are significantly in your favor in a bet, then bet big. When Soros thinks he's right, few investors can bet bigger than he does.

I only go to work when there's a reason, and on those days I am genuinely productive.

Constantly staying busy with trades generates lots of costs and mistakes. Sometimes doing less can actually turn out to be the best thing an investor can do.

If investing is entertaining, if you're having fun, you're probably not making any money. Good investing is boring.

If you’re feeling over-excited due to your investments, you're probably gambling, not investing. The best way to avoid seeing yourself as a gambler is to bet only when the odds are in your favor.

The current price in the market is always wrong if it’s meant to reflect future prices.

Soros is clearly not a proponent of the efficient market hypothesis. This is not surprising because if markets were always efficient, he wouldn't be a billionaire.

Markets can influence the events they anticipate.

This essentially refers to the theory of "reflexivity" in markets. From Soros's perspective, markets and people's views on markets interact with each other.

Soros says, "There is a two-way reflexive connection between cognition and reality, which initiates a process that reinforces itself but eventually leads to self-defeat, or what can be called a bubble. Every bubble is a product of an interplay between a trend and a misconception that reinforces itself reflexively."

In real life, true equilibrium is rare—market prices always tend to fluctuate.

Equilibrium is the basis for many macroeconomic assumptions, yet Soros views equilibrium as an illusion. While equilibrium can make mathematical calculations perfect, it often does not align with reality.

Soros once said, "Economic thinking needs to start addressing real-world policy issues instead of simply creating more mathematical equations." Soros's investment views are not primarily based on rationality; for example, "When a long-term trend loses momentum, short-term volatility tends to increase, simply because the trend-following crowd loses direction." He also believes, "The boom-bust process is asymmetrical in form, typically featuring a long, gradual buildup followed by a rapid, short-lived collapse."

Economic history is a never-ending series of falsehoods and lies, not truths.

Being able to explain past events verbally does not mean those explanations are accurate or that any underlying theories can predict the future. Humanity has a flaw of "hindsight bias." (This is inductive reasoning based on past statistics and does not predict the future. We need deductive reasoning, which is about universal causal relationships.)

Soros said, "The entire framework of economic theory needs to be rethought from the ground up because the paradigms once supported by the efficient market hypothesis and rational choice theory ultimately collapsed, much like the global financial system did after the Lehman Brothers bankruptcy."

I am rich because I know when I’m wrong. I survive by recognizing my mistakes.

We should recognize that being wrong is not disgraceful; failing to correct oneself is.