Please use a PC Browser to access Register-Tadawul

Transocean (RIG) Valuation in Focus After Major Insider Buy, New Contracts, and Debt Reduction Moves

Transocean Ltd. RIG | 4.13 | -3.50% |

Transocean (NYSE:RIG) has caught the market’s attention after board member Frederik W. Mohn purchased 4 million shares during the company’s recent equity offering. This substantial insider buy, along with $243 million in new ultra-deepwater contracts, has sparked discussion among investors.

Momentum has returned in a big way for Transocean, with sharp gains grabbing headlines. Last week alone, the share price jumped nearly 20% as investors reacted to aggressive debt reduction, new contract wins, and large insider buying. Still, while the recent run has been impressive, the one-year total shareholder return sits slightly in the red. This shows just how volatile sentiment around the offshore driller has been.

If you’re watching insider moves and looking for the next wave of opportunity, take a moment to broaden your search and discover fast growing stocks with high insider ownership

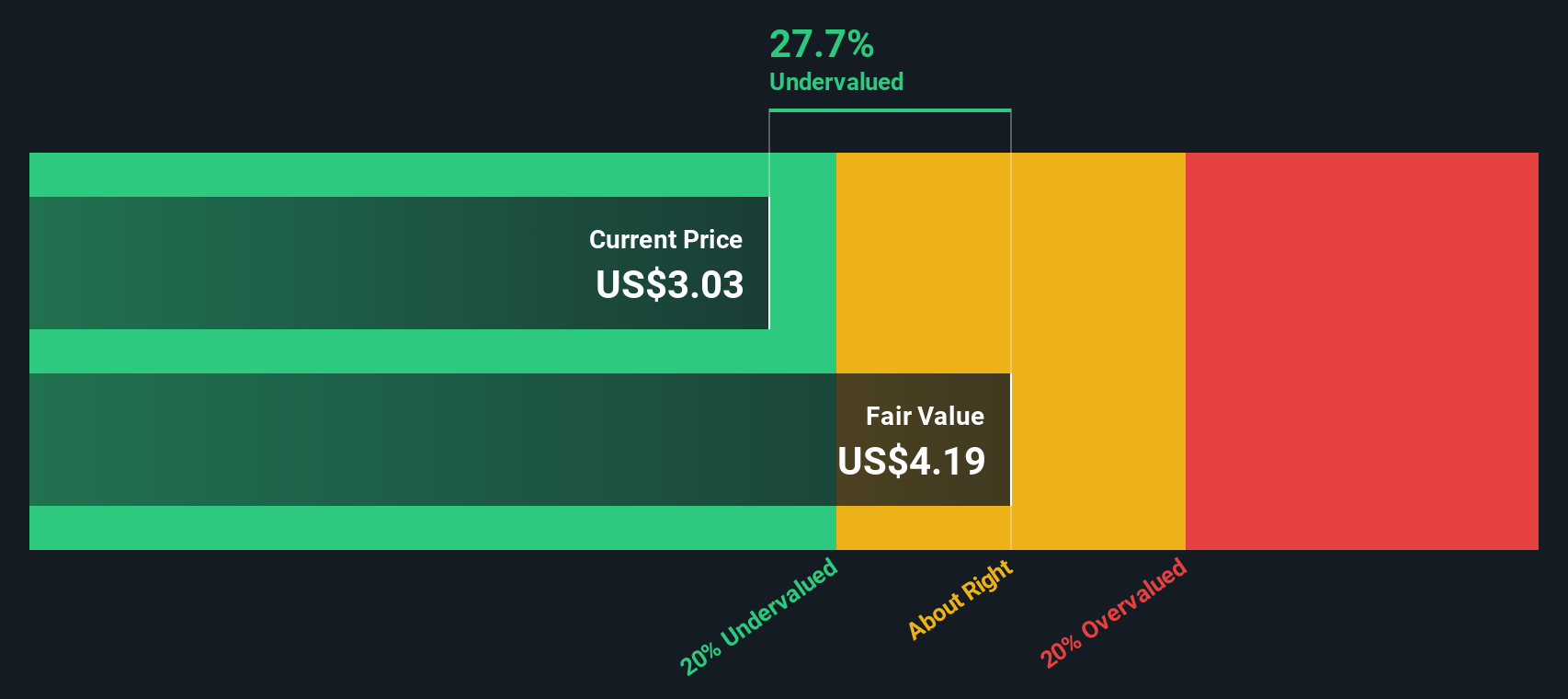

With Transocean’s stock rallying, insider purchases grabbing headlines, and the company rapidly improving its balance sheet, the question remains: is the stock truly undervalued at current levels, or is the market already pricing in a brighter future, leaving little room for upside?

Most Popular Narrative: 1% Overvalued

Transocean’s last close at $3.90 is just a touch above the fair value suggested by the most popular narrative, which calculates a fair value of $3.88 per share. This closeness reflects a market that already prices in many optimistic assumptions about the company’s future. What comes next will depend on big-picture catalysts and how they play out.

Rising global energy demand and the ongoing depletion of easily accessible onshore oil reserves are driving sustained investment in offshore and ultra-deepwater exploration, leading to a tightening rig market and rising dayrates. These trends are poised to boost Transocean's revenue and EBITDA as utilization approaches or exceeds 90% in late 2026 and 2027.

Curious what makes this outlook so bold? There is an aggressive earnings turnaround, margin expansion and an eye-popping profit multiple at the heart of the calculation. Want to peek behind the curtain and see the detailed forecast logic that drives this price?

Result: Fair Value of $3.88 (OVERVALUED)

However, persistent high debt levels and volatile offshore dayrates could easily derail the bullish case if financial or market conditions sour unexpectedly.

Another View: Discounted Cash Flow Suggests Upside

While the most popular view sees Transocean as slightly overvalued on a price-target basis, our DCF model presents a different perspective. The DCF estimates a fair value of $5.09 per share, with Transocean’s current price more than 20% below this threshold. Does this suggest hidden value in the shares, or are there factors the market is still considering?

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Transocean for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Transocean Narrative

If you have a different perspective or want to run your own numbers, building a personalized narrative is straightforward and only takes a few minutes. So why not Do it your way

A great starting point for your Transocean research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors never settle for just one opportunity. Let Simply Wall Street’s elite screeners help you uncover stocks with standout returns, robust growth, and the potential to secure your portfolio’s future.

- Tap into emerging tech transformations by checking out these 27 AI penny stocks. These companies are reshaping entire industries with fresh AI-powered solutions and dynamic business models.

- Target tomorrow’s hidden gems by starting with these 877 undervalued stocks based on cash flows. This screener is perfect for finding stocks trading below their true potential based on strong fundamentals.

- Boost your passive income by reviewing these 17 dividend stocks with yields > 3% to see which companies are rewarding investors with reliable, high-yield dividends above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.