TTM Technologies, Inc.'s (NASDAQ:TTMI) Stock On An Uptrend: Could Fundamentals Be Driving The Momentum?

TTM Technologies, Inc. TTMI | 0.00 |

Most readers would already be aware that TTM Technologies' (NASDAQ:TTMI) stock increased significantly by 76% over the past three months. As most would know, fundamentals are what usually guide market price movements over the long-term, so we decided to look at the company's key financial indicators today to determine if they have any role to play in the recent price movement. Specifically, we decided to study TTM Technologies' ROE in this article.

Return on equity or ROE is an important factor to be considered by a shareholder because it tells them how effectively their capital is being reinvested. Simply put, it is used to assess the profitability of a company in relation to its equity capital.

How Is ROE Calculated?

ROE can be calculated by using the formula:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for TTM Technologies is:

4.9% = US$78m ÷ US$1.6b (Based on the trailing twelve months to March 2025).

The 'return' is the amount earned after tax over the last twelve months. That means that for every $1 worth of shareholders' equity, the company generated $0.05 in profit.

What Is The Relationship Between ROE And Earnings Growth?

So far, we've learned that ROE is a measure of a company's profitability. Depending on how much of these profits the company reinvests or "retains", and how effectively it does so, we are then able to assess a company’s earnings growth potential. Assuming all else is equal, companies that have both a higher return on equity and higher profit retention are usually the ones that have a higher growth rate when compared to companies that don't have the same features.

TTM Technologies' Earnings Growth And 4.9% ROE

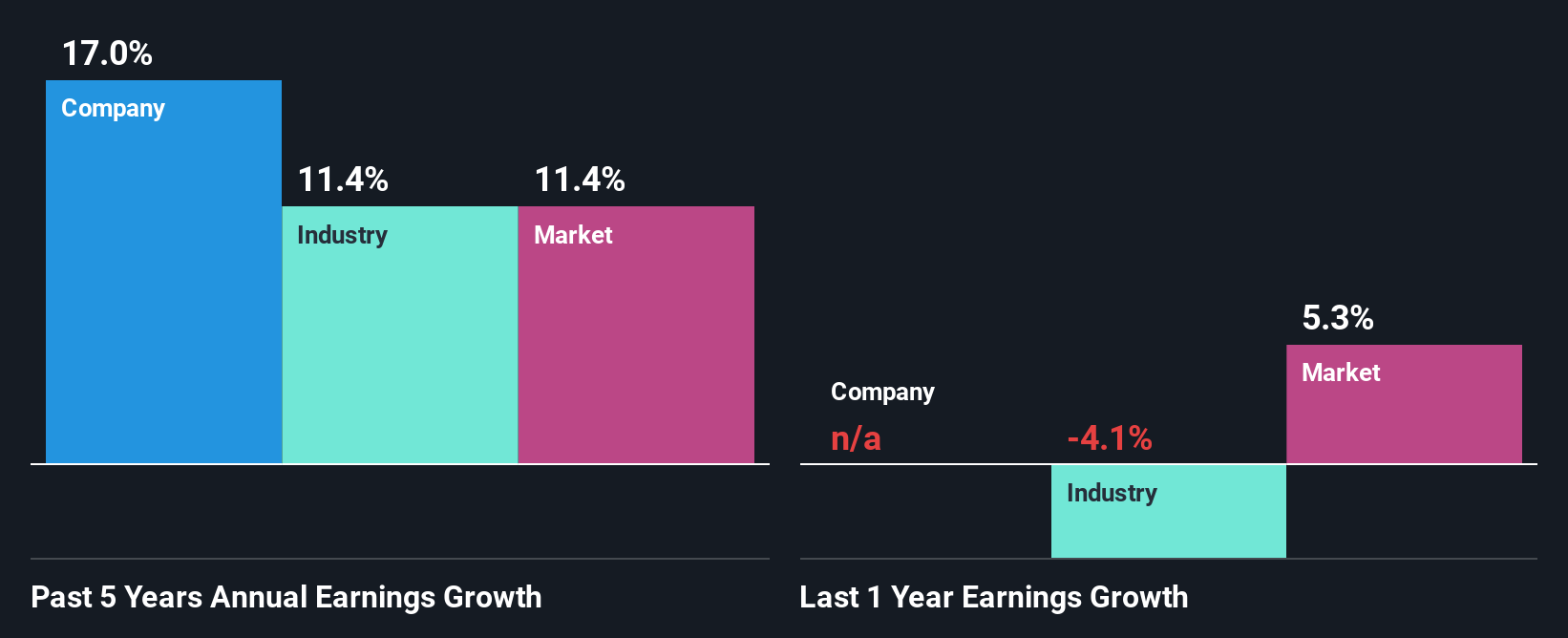

It is quite clear that TTM Technologies' ROE is rather low. Even compared to the average industry ROE of 11%, the company's ROE is quite dismal. However, the moderate 17% net income growth seen by TTM Technologies over the past five years is definitely a positive. We believe that there might be other aspects that are positively influencing the company's earnings growth. For example, it is possible that the company's management has made some good strategic decisions, or that the company has a low payout ratio.

We then compared TTM Technologies' net income growth with the industry and we're pleased to see that the company's growth figure is higher when compared with the industry which has a growth rate of 11% in the same 5-year period.

Earnings growth is an important metric to consider when valuing a stock. What investors need to determine next is if the expected earnings growth, or the lack of it, is already built into the share price. This then helps them determine if the stock is placed for a bright or bleak future. One good indicator of expected earnings growth is the P/E ratio which determines the price the market is willing to pay for a stock based on its earnings prospects. So, you may want to check if TTM Technologies is trading on a high P/E or a low P/E, relative to its industry.

Is TTM Technologies Using Its Retained Earnings Effectively?

TTM Technologies doesn't pay any regular dividends, meaning that all of its profits are being reinvested in the business, which explains the fair bit of earnings growth the company has seen.

Conclusion

In total, it does look like TTM Technologies has some positive aspects to its business. With a high rate of reinvestment, albeit at a low ROE, the company has managed to see a considerable growth in its earnings. With that said, the latest industry analyst forecasts reveal that the company's earnings are expected to accelerate. Are these analysts expectations based on the broad expectations for the industry, or on the company's fundamentals? Click here to be taken to our analyst's forecasts page for the company.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Recommend

- Reuters 02/12 21:35

How Investors Are Reacting To TTM Technologies (TTMI) High-Profile AI And Leveraged Finance Conference Appearances

Simply Wall St 03/12 05:16NASDAQ TRADE HALT CONTINUES <OST.O> REASON NOT AVAILABLE AT 09:40 AM

Reuters 03/12 14:40Does Q3 Miss Amid AI Pivot Momentum Change The Bull Case For Penguin Solutions (PENG)?

Simply Wall St 03/12 15:294 Stocks to Buy for the Next Leg of the AI Rally

Benzinga News 03/12 17:39B. Riley Securities Maintains Buy on TTM Technologies, Raises Price Target to $81

Benzinga News 03/12 18:01Brady Corporation Elected Board of Directors and Declared Dividend

Reuters 03/12 22:12Sanmina Corporation's (NASDAQ:SANM) Financials Are Too Obscure To Link With Current Share Price Momentum: What's In Store For the Stock?

Simply Wall St Today 10:42