Please use a PC Browser to access Register-Tadawul

Twilio (TWLO) Valuation Check As Bullish Analyst Call And Voice AI Position Draw Investor Interest

Twilio, Inc. Class A TWLO | 113.14 | +1.96% |

Twilio (TWLO) shares moved higher after a Citizens analyst reiterated a positive view on the company, citing strong user engagement metrics and Twilio’s position in voice AI as key drivers of investor attention.

That bullish call on Twilio comes after a busy stretch, including a new multi-year partnership with AEG and an upcoming earnings release on 12 February 2026. The stock has shown an 11.8% 7 day share price return, a 19.93% 90 day share price return and a 3 year total shareholder return of around 2.3x, even as the 1 year total shareholder return is negative.

If voice AI and customer engagement platforms are on your radar, it can help to see what else is out there alongside Twilio, including high growth tech and AI stocks.

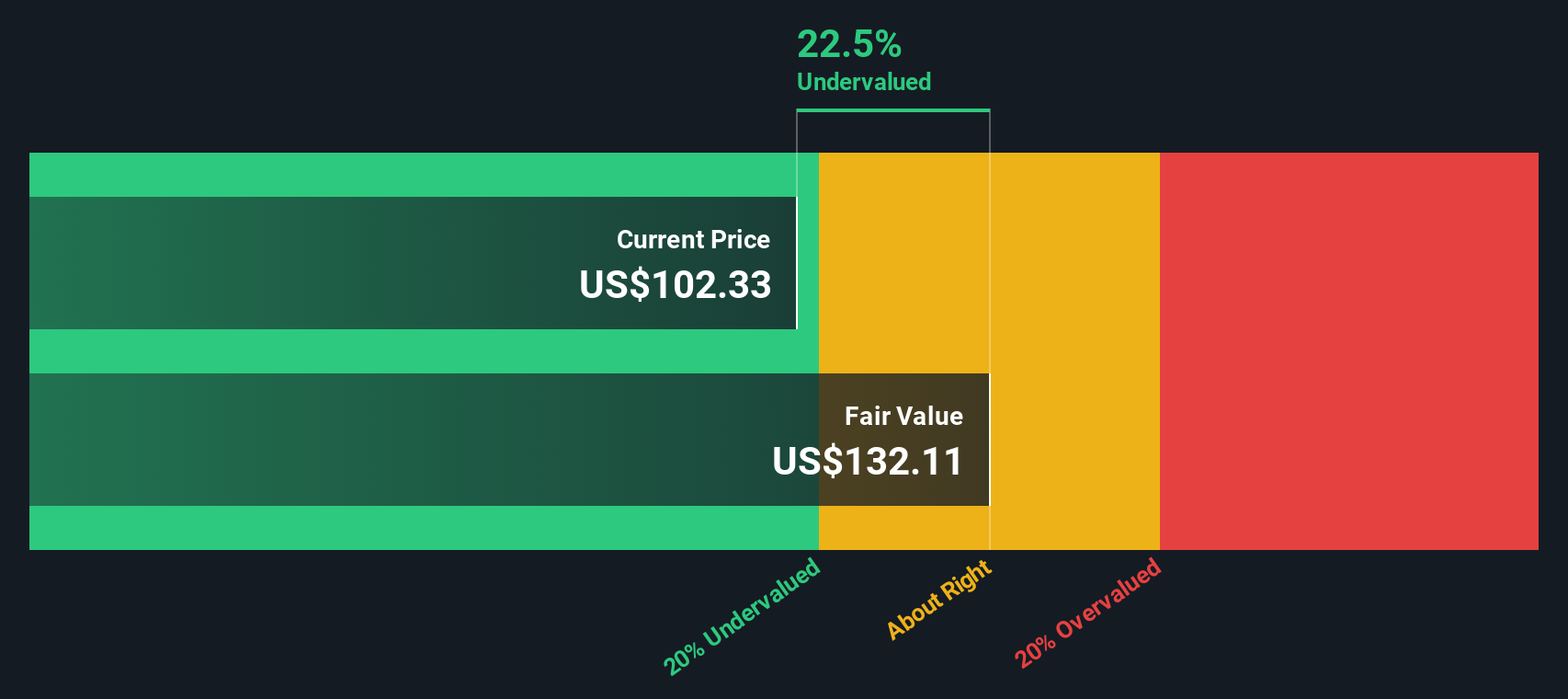

Twilio’s shares have seen mixed recent returns, with a negative 1-year total shareholder return but a 3-year total shareholder return of about 2.3x. So is today’s price still leaving upside on the table, or already assuming strong growth ahead?

Most Popular Narrative: 3% Undervalued

Twilio’s most followed narrative puts fair value at about $138 per share, slightly above the last close of $133.85, which keeps expectations finely balanced.

Growing adoption of AI-powered communications and automation is fueling incremental demand for Twilio's programmable infrastructure and platform products (e.g., ConversationRelay, conversational intelligence). This is expanding the company's addressable market and driving higher-margin revenue growth, which supports future revenue and net margin expansion.

Curious what sits behind that fair value call? The narrative leans on steadily rising revenue, a meaningful lift in profit margins, and a richer earnings profile than today. It also assumes the market will still pay a premium P/E multiple for those future earnings. Want to see exactly how those pieces fit together, and which forecasts do the heavy lifting in the model?

Result: Fair Value of $138.04 (UNDERVALUED)

However, there are still real watchpoints here, including pressure from low margin messaging and the risk that AI heavyweights or in house tools might sidestep Twilio altogether.

Another Angle On Value

Our DCF model presents a different perspective compared to the $138 fair value narrative. On that framework, Twilio’s current price of $133.85 is above an estimated future cash flow value of $120.30, which suggests it is overvalued. Which interpretation do you think better reflects how Twilio actually generates cash?

Build Your Own Twilio Narrative

If you see the data differently or just prefer to test your own assumptions, you can spin up a personalised Twilio view in minutes. Do it your way

A great starting point for your Twilio research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If Twilio is on your radar, do not stop there. Broaden your watchlist now so you are not the one hearing about the next opportunity after it moves.

- Scan the market for income potential by checking out these 13 dividend stocks with yields > 3% that might fit a yield focused approach.

- Hunt for high conviction growth angles across these 24 AI penny stocks that are tied to artificial intelligence trends.

- Spot opportunities that may be mispriced by the market using these 881 undervalued stocks based on cash flows grounded in cash flow estimates.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.