Please use a PC Browser to access Register-Tadawul

Tyler Technologies (TYL): Assessing Valuation Following Major Public Sector Contracts in Oklahoma and Georgia

Tyler Technologies, Inc. TYL | 455.64 455.64 | +0.42% 0.00% Pre |

If you have been wondering what’s driving Tyler Technologies (TYL) right now, the company’s latest deals might be just what you’re looking for. Tyler has inked two significant agreements: one with Service Oklahoma to standardize payment and revenue management at 44 sites statewide, and another with Georgia’s Fulton County for a cloud-based records management upgrade. These contracts not only boost Tyler’s client roster, but also shine a spotlight on growing demand for its government-focused tech solutions and the willingness of US states to modernize with trusted partners.

Looking at the bigger picture, Tyler’s momentum hasn’t translated into gains for shareholders this year, with the stock down nearly 6% over the past twelve months. Still, these new wins add to Tyler’s steady string of public sector clients, building on its previous work in Oklahoma and long-standing relationships across state and local governments. Despite the dip in share price, Tyler’s multi-year track record shows strong total returns of over 50% in the past three years and 64% in five, suggesting that its offerings continue to resonate even as broader market sentiment cools.

So after a year of lackluster performance and some high-profile client signings, is Tyler Technologies undervalued at current levels, or is the market already pricing in the next phase of growth?

Most Popular Narrative: 19.7% Undervalued

According to the most widely followed narrative, Tyler Technologies shares trade below what is seen as their fair value. The stock is currently considered nearly 20% undervalued based on future earnings expectations and profit margin expansion.

The accelerating digital transformation initiatives across state and local governments are intensifying demand for cloud-based, integrated solutions. This directly supports Tyler's ongoing success in SaaS client migrations (cloud flips) and recurring revenue growth. This secular momentum is reflected in a pipeline of large deals and an expected 25% annual increase in cloud flips, which is projected to translate to sustained double-digit top-line revenue expansion.

Craving the numbers behind this bullish price target? Core to this narrative are aggressive assumptions about recurring revenue, cloud migration, and margin improvement that push valuations into rare territory. Want to know what growth rates and profitability upgrades could be fueling this forecast? The details might surprise you.

Result: Fair Value of $678.78 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, Tyler’s reliance on government budgets and lumpy deal cycles could slow growth if public sector spending softens or large contracts become less predictable.

Find out about the key risks to this Tyler Technologies narrative.Another View: Market-Based Valuation Poses a Challenge

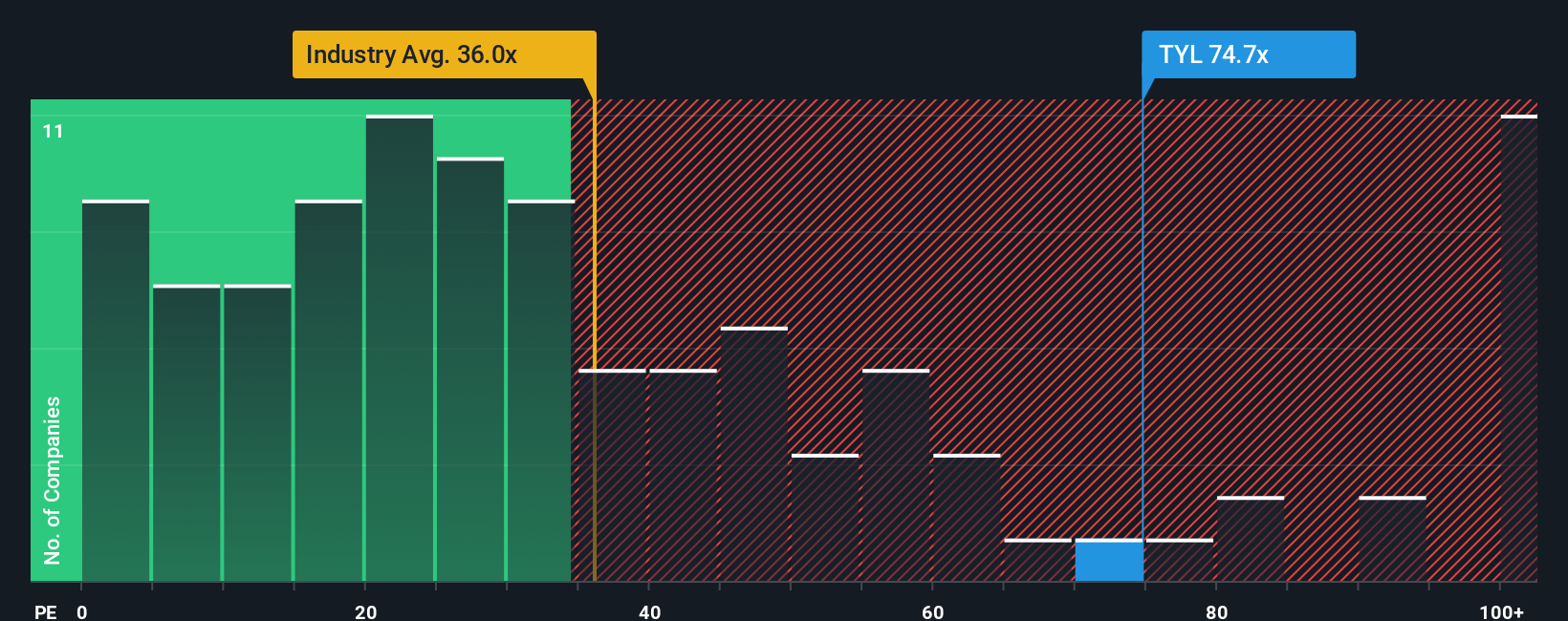

Looking from another angle, a market comparison based on the main earnings ratio hints that Tyler Technologies is priced higher than most software industry peers. The question remains: Does this higher valuation reflect real growth potential, or is the optimism overdone?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Tyler Technologies Narrative

If you have a different perspective or want to dig into the details yourself, you can easily craft your own Tyler Technologies analysis in just a few minutes, and Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Tyler Technologies.

Looking for More Smart Investment Ideas?

There’s a world of compelling opportunities waiting beyond Tyler Technologies. Stay ahead of the curve and position yourself for tomorrow’s gains by using the Simply Wall Street Screener.

- Target high income potential and spot generous yields by using the list of dividend stocks with yields > 3% to unlock stable returns.

- Identify tomorrow’s sector leaders by scanning for trailblazing companies with strong fundamentals among penny stocks with strong financials before they hit the mainstream.

- Strengthen your portfolio with companies at the forefront of technology through our curated picks of AI penny stocks that are transforming industries with innovation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.