Please use a PC Browser to access Register-Tadawul

Udemy (UDMY): Valuation Discount Draws Focus as Profitability Forecast Exceeds Market Growth Expectations

Udemy, Inc. UDMY | 5.19 | -1.14% |

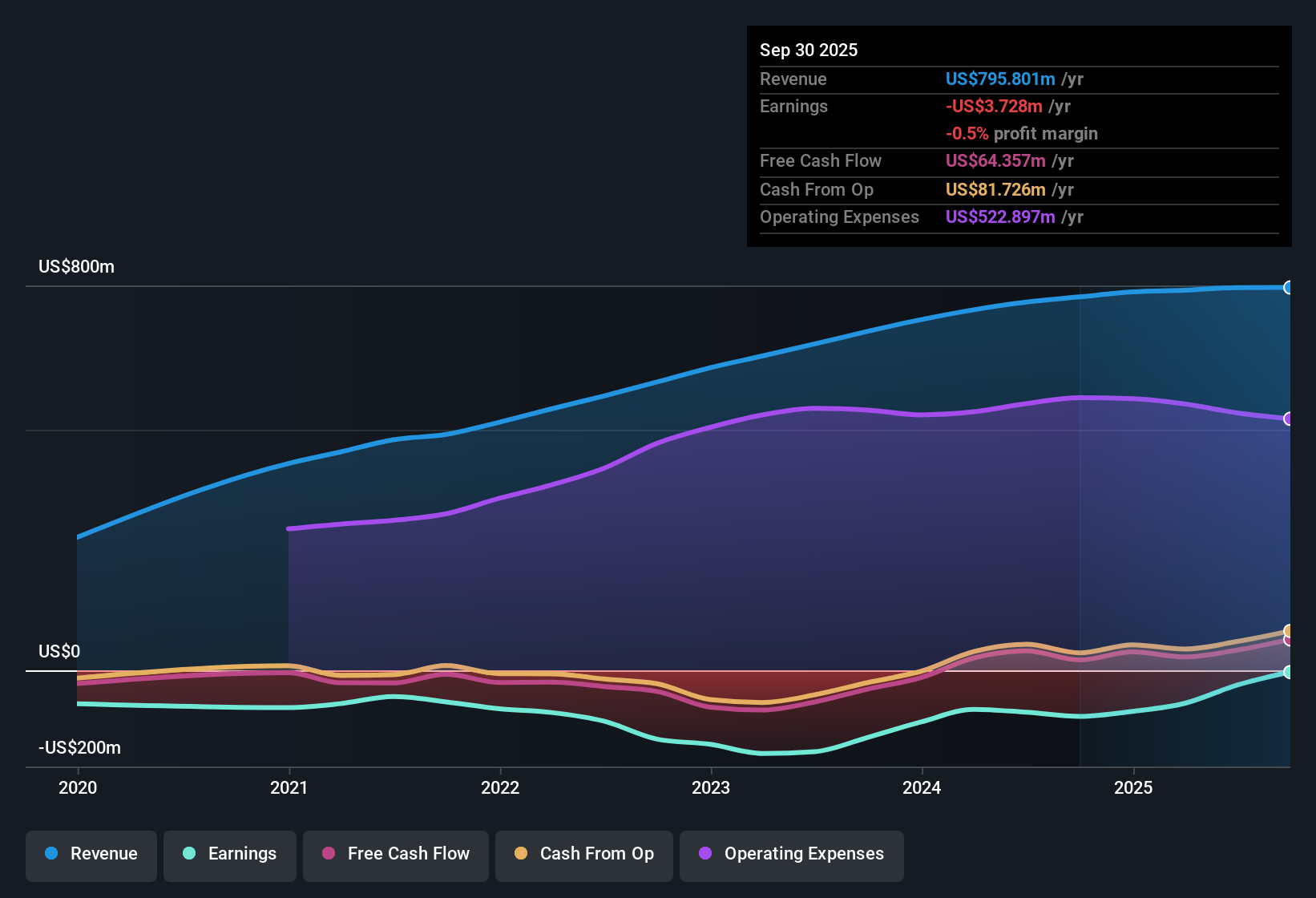

Udemy (UDMY) reported revenue growth of 4.5% per year, which trails the broader US market's expected 10.3% pace. While the company remains unprofitable, it has steadily reduced its losses by 5.9% annually over the past five years. Analysts expect EPS growth of 49.21% per year, with profitability projected within the next three years. Shares are trading at $5.63, well below the fair value estimate of $13.57. Investors are closely watching the attractive Price-To-Sales ratio of 1.1x as the company continues narrowing its losses and aims to achieve profitability.

See our full analysis for Udemy.Next up, we will see how these numbers align with the prevailing market narratives and where the story could surprise investors.

Enterprise Deals Propel Margin Outlook

- Subscription-based revenue now comprises about 70% of Udemy's total, which drives higher margin stability and produces double-digit annual recurring revenue (ARR) growth in specific international markets.

- Analysts' consensus view points out that robust demand for workforce upskilling, especially among enterprise clients, is helping lift higher contract values and improve recurring revenue. However, this also raises Udemy's reliance on a narrower set of large contracts.

- Consensus narrative notes that enterprise adoption and international expansion are gaining traction, supporting predictable cash flow and laying the groundwork for Udemy's forecasted profitability within three years.

- At the same time, this creates exposure to risk if large enterprise clients churn, emphasizing how concentrated revenue streams could challenge long-term margin expansion.

- To see all the arguments for and against Udemy's growth trajectory, read the full market consensus on performance and debate the trade-offs for yourself. 📊 Read the full Udemy Consensus Narrative.

Consumer Segment Softness Weighs On Growth

- The consumer segment is forecast to decline by around 8% year-over-year for 2025, highlighting ongoing pressure on direct-to-consumer revenue and signaling that strength in Udemy's B2B business is currently offset by challenges in retail learning demand.

- Bears argue that weakness in the consumer side, as well as higher churn among small and medium business (SMB) contracts up for renewal, could continue to put downward pressure on total top-line growth.

- This headwind may limit overall earnings potential even as margins improve with enterprise deals and recurring subscription revenue.

- Critics highlight the risk that declining SMB and consumer sales not only push Udemy towards a more concentrated client base, but may also dampen the pace at which the company closes its earnings gap with market leaders.

Valuation Remains Attractive Versus Peers

- Udemy trades at a Price-To-Sales ratio of 1.1x, which is below both the US Consumer Services industry average (1.4x) and main peer average (1.3x). The current share price of $5.63 is not only 33% below the analyst consensus target of $10.01 but also at a substantial 59% discount to the DCF fair value estimate of $13.57.

- Analysts' consensus view notes that this valuation gap could reflect skepticism regarding the pace and reliability of Udemy's transition to sustained profitability and margin growth. It also suggests that any upside surprise on recurring revenue or operating leverage could quickly close the current price gap.

- What’s surprising is that, even after accounting for forecasts of $75.1 million in earnings (EPS $0.56) by 2028, the implied future PE ratio (27.3x) remains above the industry’s current level, potentially setting a higher bar for what “fair value” will mean in coming years.

- Consensus narrative further highlights that Udemy’s discounted valuation offers room for rerating if the company accelerates execution on B2B growth, improves net margins, and demonstrates predictability in recurring revenue.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Udemy on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a different take on the figures? You can quickly share your perspective and shape your own view in under three minutes. Do it your way

A good starting point is our analysis highlighting 5 key rewards investors are optimistic about regarding Udemy.

See What Else Is Out There

Udemy faces ongoing softness in its consumer segment and an increased reliance on large enterprise contracts, which challenges the consistency of its overall growth.

If steady progress and reliable results matter most to you, use our stable growth stocks screener (2108 results) to focus on companies with continuous revenue and earnings momentum, even through market volatility.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.