Please use a PC Browser to access Register-Tadawul

US Market Preview | Figma Jumps 20% After 250% Post-IPO Surge; Trump Imposes New Tariffs Ranging from 10% to 41%; Apple Surges on Earnings, To Invest More in AI

Marwynn Holdings MWYN | 0.84 | +1.23% |

Namib Minerals. Ordinary Shares NAMM | 1.04 | -5.45% |

Tenon Medical Inc Ordinary Shares TNON | 1.06 | -3.64% |

4D Molecular Therapeutics, Inc. FDMT | 9.21 | -20.05% |

Bioxcel Therapeutics BTAI | 1.80 | -4.26% |

- U.S. Adds 73K Jobs, Misses Forecast, DXY Falls Gold Rises

- Stock Futures Down: Futures drop on tariff revisions, Big Tech earnings.

- Tariff Rates: Trump imposes new tariffs ranging from 10% to 41%.

- Apple AI: Apple to invest more in AI.

I. Market Report

US stock futures fell on Friday due to President Trump's revised tariff rates, economic data and Big Tech earnings reports.

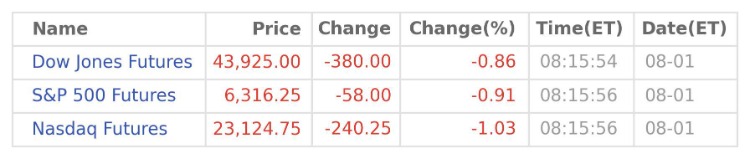

As of 03:15 PM Riyadh time, compare to the prices at 17:00:00 on the previous trading day, including any holiday-shortened sessions, the blue-chip Dow Jones Futures ebb by 380.0 points or 0.86% to 43,925, the broad-based S&P 500 Futures contract by 58.0 points or 0.91% to 6,316, the tech-heavy Nasdaq Futures capitulate by 240.25 points or 1.03% to 23,125. (Data source: Wind Quant)

Trump imposed new tariffs ranging from 10% to 41%, with an extra 40% levy on goods transshipped to avoid tariffs. Analysts warned of potential stagflationary effects on the economy.

US nonfarm payrolls rose by 73,000 in July, well below the 110,000 forecast and marking the weakest gain since October 2023. The prior figure was sharply revised down to 14,000. Unemployment rose to 4.2%. Gold climbed 0.6% to $3,310/oz, while the DXY dropped 40 points to 99.79.

Amazon shares dropped after issuing lower-than-expected operating income guidance, while Apple Inc.(AAPL.US) shares rose following an earnings and revenue beat.

Stocks had a muted trading session on Thursday, with the S&P 500 index(SPX.US) experiencing its third consecutive losing day despite solid earnings from Microsoft Corporation(MSFT.US) and Meta Platforms(META.US). Geopolitical tensions, valuation concerns, and monetary policy uncertainty pose threats to the ongoing rally.

As of 03:40 PM Riyadh Time, top pre-market movements are as follows:

Change | Price(US$) | Ticker (🌙 means "Shariah Compliant") | Additional Information |

77.8% | 1.6 | 🌙 Marwynn Holdings(MWYN.US) | After falling 8% on Thursday. |

49.8% | 5.93 | Namib Minerals. Ordinary Shares(NAMM.US) | - |

38.2% | 1.41 | 🌙 Tenon Medical Inc Ordinary Shares(TNON.US) | Acquisition of sacroiliac joint assets drives shares up. |

27.6% | 5.74 | 4D Molecular Therapeutics, Inc.(FDMT.US) | Due to 4D-150 SPECTRA clinical trial results announcement. |

24.4% | 1.63 | Bioxcel Therapeutics(BTAI.US) | Completion of Phase 3 SERENITY trial patient visits. |

23.4% | 1.58 | 🌙 Ming Shing Group Holdings(MSW.US) | - |

22.9% | 0.07 | 🌙 Erayak Power Solution Group Inc.(RAYA.US) | - |

19.8% | 138.4 | Figma(FIG.US) | Due to IPO debut surge of 250%.; Stock advanced substantially 250.0% on last trading day |

18.2% | 3.69 | Heart Test Laboratories, Inc.(HSCS.US) | - |

16.8% | 1.88 | AIRNET TECHNOLOGY INC SPON ADS EACH REPR 10 ORD SHS(ANTE.US) | - |

II. Flash Headlines

U.S. Adds 73K Jobs, Misses Forecast, DXY Falls Gold Rises

U.S. nonfarm payrolls rose by 73,000 in July, well below the 110,000 forecast and marking the weakest gain since October 2023. The prior figure was sharply revised down to 14,000. Unemployment rose to 4.2%. Gold climbed 0.6% to $3,310/oz, while the DXY dropped 40 points to 99.79.

US Adjusts Reciprocal Tariffs Deadline

US President Donald Trump has adjusted several "reciprocal tariff" rates domestically ahead of Friday's deadline, prompting responses from various countries.

USD to Regain Safe-Haven Status

The US dollar is anticipated to reclaim its role as a safe-haven currency, while the Japanese yen and Swiss franc are forecasted to weaken. The dollar is poised to gain from the Swiss franc and yen's unstable status as currency safe havens.

Treasury Secretary Expects Fed Chair Pick By Year-End

US Treasury Secretary Scott Bessent is compiling a list of potential candidates for the Federal Reserve's leadership and anticipates announcing appointments by the end of the year.

US Inflation Gauge Rises Due To Tariffs

The Federal Reserve's preferred inflation gauge increased last month as US President Donald Trump's tariffs pushed up commodity prices, indicating that the broad tariff policy is beginning to impact the cost of various goods.

US Stocks Heading Towards Bubble Peak?

Marko Kolanovic, former JPMorgan strategist, warns US stocks are nearing a bubble peak due to outsized influence of large tech stocks. He says recent valuation surge distorts market strength, with tech giant share price rises inflating overall US stock market capitalization.

Mortgage Rates Drop Slightly

FEDERAL HOME LOAN MORTGAGE CORP(FMCC.US) reports 30-year mortgage rate declined to 6.72% this week, but Fed Chair Jerome Powell's cautious tone on rates fuels 'higher for longer' fears, pressuring housing market. 15-year fixed rate also fell to 5.85%.

III. Stocks To Watch

Wallstreetbets Stocks Mixed Premarket

Stocks mentioned in Reddit's Wallstreetbets forum are mixed premarket Friday. Reddit(RDDT.US) is poised to advance, while Amazon.com, Inc.(AMZN.US) is set to decline.

Figma Stock Up Post-IPO

Figma(FIG.US) are trading higher on momentum following Thursday's initial public offering.

Figma Stock Soars Despite Cramer's Skepticism

Design platform Figma(FIG.US) shares surged 250% to US$115.50 on market debut despite Jim Cramer calling it 'too expensive' at 50x sales. The company priced its IPO at US$33 per share on Wednesday evening.

Apple's Plan for AI Catch-Up

Apple Inc.(AAPL.US) CEO Tim Cook stated the company is prepared to invest more in AI by building more data centers or acquiring larger firms in the field.

Qualcomm's 2029 Revenue Target

QUALCOMM Incorporated(QCOM.US) aims to achieve US$22 billion in AI-driven automotive and IoT business revenue by 2029.

HOOD Stock Declines 5.5% In Pre-Market

Robinhood(HOOD.US) shares fall 5.5% in Friday pre-market on worries about profitability of smaller accounts and decreased crypto trading volumes.

Chinese EVs Surge In Europe

BYD COMPANY LIMITED(BYDDY.US) and XPENG INC.(XPEV.US) lead Chinese EV companies to secure over 10.6% of Europe's total EV market share in June despite tariffs imposed by the European Union last year.

Palantir Wins US$10B Army Deal

Palantir(PLTR.US) has landed a 10-year US$10 billion contract with the US Army to unify 75 contracts into one AI-powered defense software framework. The contract value is the maximum potential rather than guaranteed obligations.

Novo, Lilly Rise on US Drug Trial Plan

The US government may include weight-loss drugs such as Ozempic, Wegovy, Mounjaro, and Zepbound in Medicare and Medicaid coverage under a five-year trial starting April 2026. The proposed plan signals broader insurance access to GLP-1 drugs. Novo Nordisk A/S Sponsored ADR Class B(NVO.US), Eli Lilly and Company(LLY.US) rose pre-market.

AMZN Stock Falls On AWS Miss

Amazon.com, Inc.(AMZN.US) reported a strong Q2 but missed whisper number on AWS growth. Shares tanked as analysts expressed concern over Amazon Web Services' momentum, with Gene Munster stating, 'I don't know what's wrong with it.'

Exxon Mobil Q2 Earnings Decline

Exxon Mobil Corporation(XOM.US) reported Q2 earnings of US$1.64 per share, down from US$2.14 a year ago.

Chevron Beats Q2 Profit Estimates

Chevron Corporation(CVX.US) beats second-quarter profit estimates and reports record production.

Apple Q3 FY25 Financial Results

Apple Inc.(AAPL.US) reports Q3 FY2025 revenue of US$94.036B, up 10% YoY; net profit up 9% YoY at US$23.434B. Greater China revenue was US$15.369B, up 4% YoY.

Amazon Q2 Revenue Jumps

Amazon.com, Inc.(AMZN.US) second-quarter revenue reached US$167.7B, up 13% YoY, with net profit up 35% to US$18.2B. Diluted EPS was US$1.68, up from US$1.26 last year.

Reddit's Profitability Rises

Reddit(RDDT.US) reported a strong Q2 with EBITDA margins hitting 33% in early monetization efforts. Revenue per user is still low but remains an opportunity, as profitability metrics approach those of mature social networking companies like Meta Platforms(META.US).

IV. Calendar

Day's Notable Event(s):

| Riyadh Time | Event | Previous Value | Forecast Value |

| 03:30 PM | Non Farm Payrolls | 147K | 110K |

| 03:30 PM | Unemployment Rate | 4.1% | 4.2% |

| 03:30 PM | Average Hourly Earnings MoM | 0.2% | 0.2% |

| 03:30 PM | Average Hourly Earnings YoY | 3.7% | 3.6% |

| 03:30 PM | Participation Rate | 62.3% | 62.3% |

| 03:30 PM | Average Weekly Hours | 34.2 | 34.2 |

| 03:30 PM | Government Payrolls | 73K | 5K |

| 03:30 PM | Manufacturing Payrolls | -7K | 1K |

| 03:30 PM | Nonfarm Payrolls Private | 74K | 105K |

| 03:30 PM | U-6 Unemployment Rate | 7.7% | 7.8% |

| 04:45 PM | S&P Global Manufacturing PMI Final | 52.9 | 49.5 |

| 05:00 PM | ISM Manufacturing PMI | 49 | 49.4 |

| 05:00 PM | ISM Manufacturing Employment | 45 | 45.3 |

| 05:00 PM | Michigan Consumer Sentiment Final | 60.7 | 61.8 |

| 05:00 PM | Construction Spending MoM | -0.3% | 0.1% |

| 05:00 PM | ISM Manufacturing New Orders | 46.4 | 47.2 |

| 05:00 PM | ISM Manufacturing Prices | 69.7 | 69.9 |

| 05:00 PM | Michigan 5 Year Inflation Expectations Final | 4% | 3.6% |

| 05:00 PM | Michigan Consumer Expectations Final | 58.1 | 58.6 |

| 05:00 PM | Michigan Current Conditions Final | 64.8 | 66.8 |

| 05:00 PM | Michigan Inflation Expectations Final | 5% | 4.4% |

| 08:00 PM | Baker Hughes Oil Rig Count | 415 | |

| 08:00 PM | Baker Hughes Total Rigs Count | 542 |