Please use a PC Browser to access Register-Tadawul

US Market Preview | Nvidia-backed Recursion to Acquire Exscientia in All-Stock Deal; TSMC Jumps as July Sales Surge Record 44% YoY

Amazon.com, Inc. AMZN | 226.19 | -1.78% |

ARK Innovation ETF ARKK | 80.39 | -2.04% |

ARK Web x.0 ETF ARKW | 155.02 | -2.12% |

ARK Industrial Innovation ET ARKQ | 114.56 | -2.46% |

ARK Fintech Innovation ETF ARKF | 49.49 | -1.79% |

Key Takeaways

- US Money Market Assets Hit New High as Investors Flee Risky Assets;

- Cathie Wood Purchases 224K Shares of AMZN;

- TSMC Jumps Pre-Market as July Sales Surge Record 44% YoY;

I. Market Report

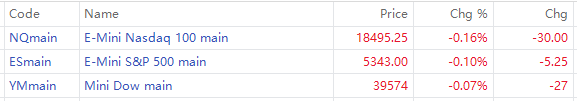

U.S. stock futures were flat Friday after investors looked to regain more ground from this week’s sell-off.

As of 08:00 am, EST (or 15:00 in Riyadh), S&P 500 futures slipped just 0.01%, while Nasdaq-100 futures inched down 0.16%. Futures tied to the Dow Jones Industrial Average were marginally lower.

II. Flash Headlines

US Money Market Assets Hit New High as Investors Flee Risky Assets, Choose 'Cash is King'

The total assets of U.S. money market funds reached a record high due to a global sell-off of risky assets, notably on Black Monday, prompting investors to seek safety in cash. According to the Investment Company Institute (ICI), approximately $52.7 billion flowed into U.S. money market funds in the week ending August 7, marking the largest single-week inflow since April 3. As a result, total assets increased to $6.19 trillion from $6.135 trillion the previous week.

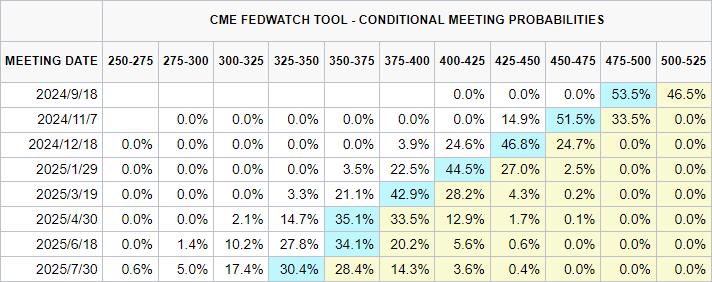

Fed Officials in 2025 Seen as 'Hawkish', Not Ready to Support Rate Cuts

Jeffrey Schmid, president of the Kansas City Fed, who will have a vote on the Fed's FOMC monetary policy in 2025, said that despite the cooling of the labor market, the US inflation rate is still above target, the Fed is still in the process of fighting inflation, and the labor market still seems to be very healthy, so he himself is not ready to support the Fed's lowering of the benchmark interest rate.

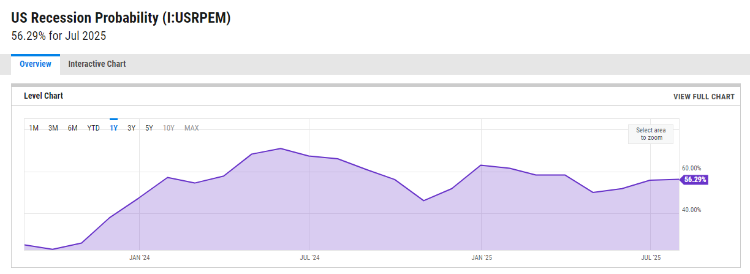

Mystery Investor Who Bet US$2.7B on US Debt: Recession is Imminent

Back in June, a mysterious investor made a record bet on long-term US Treasuries, sending ripples through the ETF market as trading professionals scramble for clues to where Wall Street is headed. Now, the persone behind the bet has been revealed and says recession predictions are finally paying off.

Market Sentiment Shifts as Over 50% of Nasdaq-100 Stocks Trade Below 200-Day Moving Average

A shift in market sentiment and a weakening trend in the broader Nasdaq-100 is becoming evident, with more than 50% of the index's stocks currently trading below their 200-day moving average.

Specifically, 48 stocks within the Nasdaq-100 are above the 200-day moving average, while the remaining 52 trade below this marker. Additionally, among the 48 stocks above the 200-day moving average, only 18 have risen by 10% or more, indicating that the remaining 30 stocks are marginally above their 200-day moving averages.

III. Stocks To Watch

Cathie Wood Purchases 224K Shares of AMZN Across 5 of Her 6 Actively Managed ETFs

Cathie Wood, the CIO and CEO of Ark Invest, recently bought nearly 225,000 shares of Amazon.com, Inc.(AMZN.US) across five of her six actively managed exchange-traded funds. The majority of the shares were purchased by the firm's flagship ARK Innovation ETF(ARKK.US) . In total, Wood and her team acquired 224,746 shares of AMZN across several ETFs, including ARK Innovation ETF, ARK Web x.0 ETF(ARKW.US) , ARK Industrial Innovation ET(ARKQ.US) , ARK Fintech Innovation ETF(ARKF.US) , and ARK Space Exploration & Innovation ETF(ARKX.US) .

Nvidia-backed Recursion to Acquire Exscientia in All-Stock Deal

Exscientia plc(EXAI.US) , an AI-driven drug discovery company, has agreed to be acquired by RECURSION PHARMACEUTICALS, INC.(RXRX.US) , a larger peer supported by chipmaker NVIDIA Corporation(NVDA.US) , in an all-stock deal. Recursion, based in Salt Lake City, Utah, announced the agreement along with its Q2 2024 financials. Following the announcement, Exscientia shares rose approximately 6% in premarket trading, while Recursion gained around 3%.

Microsoft and Palantir Partner to Offer AI Services to US Defense and Intelligence Agencies

Palantir Technologies(PLTR.US) and Microsoft Corporation(MSFT.US) have teamed up to provide secure cloud, AI, and analytics capabilities to the U.S. defense and intelligence community. As part of this collaboration, the companies will integrate Microsoft's large language models (LLMs) through the Azure OpenAI service with Palantir's AI Platform (AIP) in Microsoft's government and classified cloud environments.

TSMC Jumps Pre-Market as July Sales Surge Record 44% YoY

Taiwan Semiconductor Manufacturing Co., Ltd. Sponsored ADR(TSM.US) US stocks rose more than 2.8% before the market opened. On the news front, TSMC announced that its consolidated revenue in July was approximately NT$256.953 billion, a record high for a single month, an increase of 23.6% from the previous month and 44.7% from the same period last year. The cumulative revenue from January to July 2024 was approximately NT$1,523.17 billion, an increase of 30.5% from the same period last year.

SoundHound Announces Acquisition Deal with Amelia AI

SoundHound AI(SOUN.US) has announced its acquisition of artificial intelligence startup Amelia AI for $80M in cash and equity. The deal is anticipated to increase earnings in the second half of next year, with the combined company expecting revenue exceeding $150M. The consolidation is projected to generate meaningful revenue and cost synergies that will contribute to growth and profitability in the following years. Following the completion of the deal, the combined company will possess approximately $160M in cash and $39M in debt, according to SoundHound.