Please use a PC Browser to access Register-Tadawul

USANA Health Sciences, Inc. (NYSE:USNA) Looks Inexpensive After Falling 31% But Perhaps Not Attractive Enough

USANA Health Sciences, Inc. USNA | 19.87 | +1.33% |

USANA Health Sciences, Inc. (NYSE:USNA) shareholders that were waiting for something to happen have been dealt a blow with a 31% share price drop in the last month. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 44% share price drop.

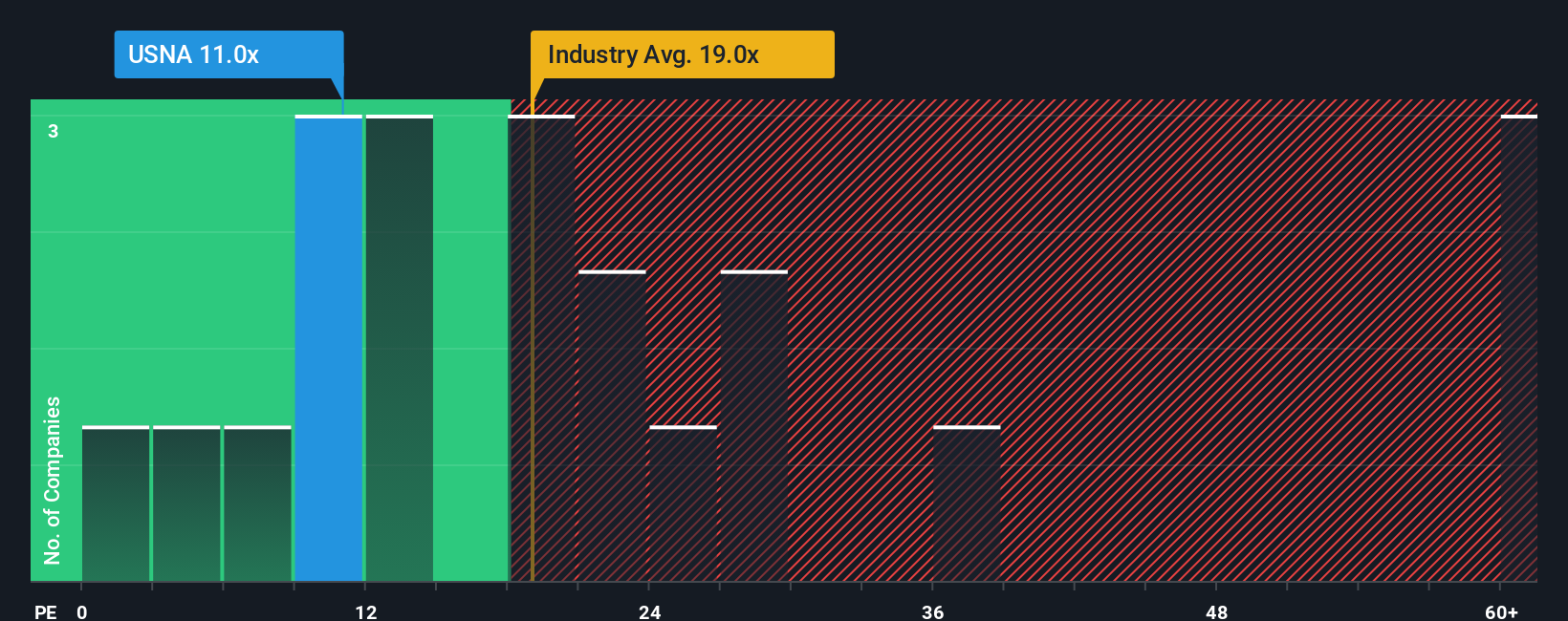

Since its price has dipped substantially, given about half the companies in the United States have price-to-earnings ratios (or "P/E's") above 19x, you may consider USANA Health Sciences as an attractive investment with its 11x P/E ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/E.

USANA Health Sciences hasn't been tracking well recently as its declining earnings compare poorly to other companies, which have seen some growth on average. The P/E is probably low because investors think this poor earnings performance isn't going to get any better. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

What Are Growth Metrics Telling Us About The Low P/E?

In order to justify its P/E ratio, USANA Health Sciences would need to produce sluggish growth that's trailing the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 37%. This means it has also seen a slide in earnings over the longer-term as EPS is down 59% in total over the last three years. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Shifting to the future, estimates from the one analyst covering the company suggest earnings growth is heading into negative territory, declining 21% over the next year. With the market predicted to deliver 15% growth , that's a disappointing outcome.

With this information, we are not surprised that USANA Health Sciences is trading at a P/E lower than the market. However, shrinking earnings are unlikely to lead to a stable P/E over the longer term. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

What We Can Learn From USANA Health Sciences' P/E?

USANA Health Sciences' P/E has taken a tumble along with its share price. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As we suspected, our examination of USANA Health Sciences' analyst forecasts revealed that its outlook for shrinking earnings is contributing to its low P/E. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.