Please use a PC Browser to access Register-Tadawul

Vanda Pharmaceuticals (VNDA) Q4 Loss Surge Challenges Bullish Valuation Narratives

Vanda Pharmaceuticals Inc. VNDA | 5.76 | -5.57% |

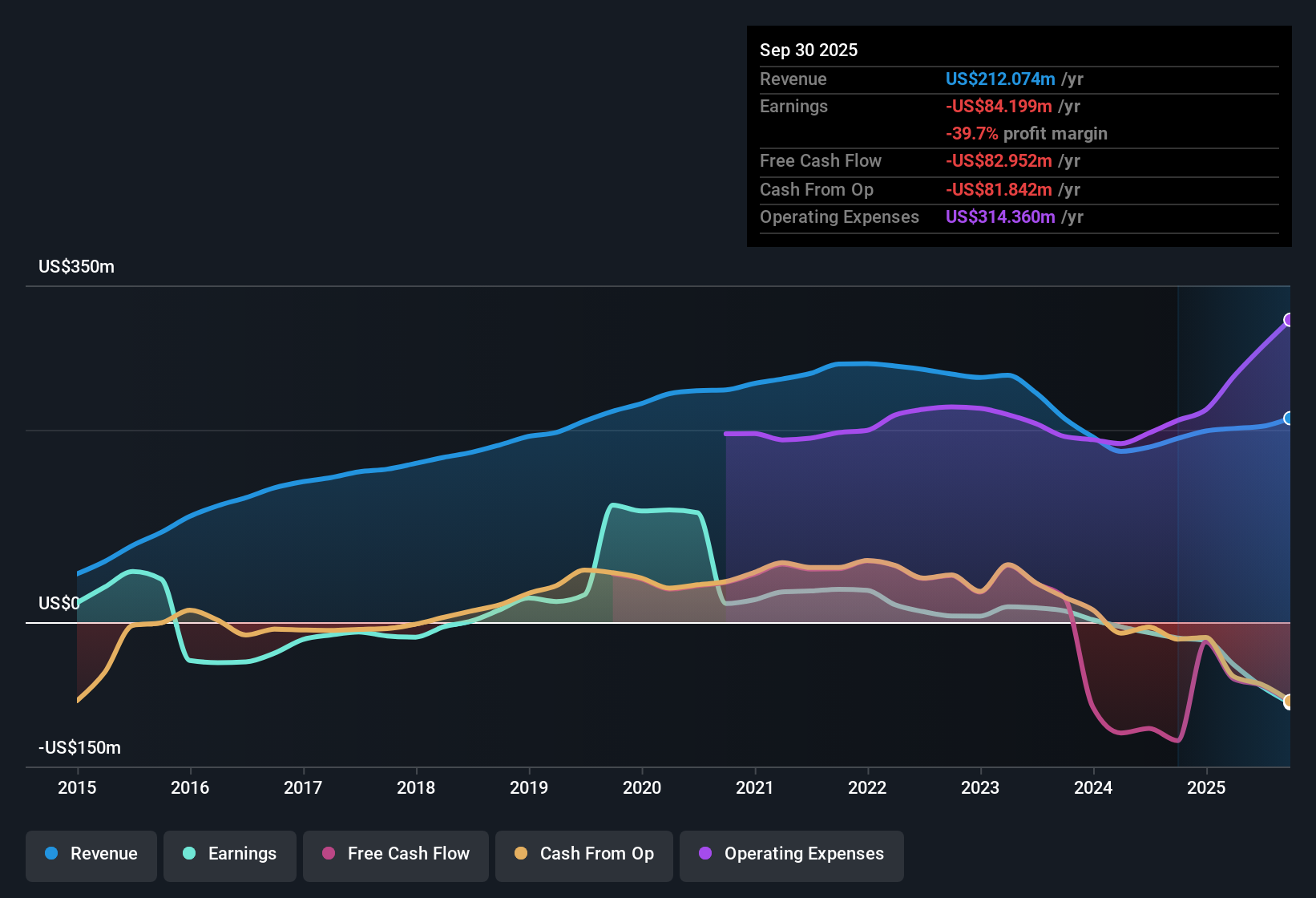

Vanda Pharmaceuticals (VNDA) has just posted its FY 2025 results with fourth quarter revenue of US$57.2 million and a quarterly loss per share of US$2.39, while trailing 12 month revenue came in at US$216.1 million alongside a loss per share of US$3.74. Over recent quarters the company has seen revenue move from US$47.7 million in Q3 2024 to US$57.2 million in Q4 2025, as quarterly EPS moved from a loss of US$0.09 to a loss of US$2.39. This has left investors focused squarely on how quickly that top line can support healthier margins.

See our full analysis for Vanda Pharmaceuticals.With the headline numbers on the table, the next step is to stack these results against the most common narratives around Vanda, highlighting where the data backs the story and where it pushes back.

Losses widen sharply to US$141 million in Q4

- Q4 2025 net income, excluding extra items, was a loss of US$141.2 million, compared with losses between about US$22.6 million and US$29.5 million in each of the first three quarters of 2025, and a loss of US$4.9 million in Q4 2024.

- Bears point to this step up in losses as evidence that high spending is biting hard, and the latest numbers back up that concern:

- On a trailing 12 month basis, the company reported a loss of US$220.5 million, larger than the quarterly pattern alone might suggest when you look at earlier periods like the US$18.9 million loss in the trailing window to Q4 2024.

- Basic EPS over the last 12 months was a loss of US$3.74 compared with a loss of US$0.33 in the trailing window to Q4 2024, which lines up with the bearish narrative that losses have grown quickly over the past five years.

Revenue holds around US$216 million while losses deepen

- Trailing 12 month revenue to Q4 2025 was US$216.1 million, modestly above the US$198.8 million level seen in the trailing window to Q4 2024, yet trailing 12 month net income swung from a loss of US$18.9 million to a loss of US$220.5 million over the same comparison.

- The consensus narrative talks about expanding launches and a broader pipeline supporting long term earnings, and these figures highlight the tension in that story:

- On one hand, revenue has moved from US$47.7 million in Q3 2024 to US$57.2 million in Q4 2025, which is consistent with the idea that newer products and indications are contributing to the top line.

- On the other hand, basic EPS went from a loss of US$0.09 in Q3 2024 to a loss of US$2.39 in Q4 2025, echoing the consensus concern that heavy SG&A and R&D tied to launches and late stage programs are keeping margins negative.

Low 1.7x P/S and DCF fair value of US$65.46 contrast with deep losses

- With a current share price of US$6.12, Vanda is trading on a trailing P/S of 1.7x, well below the US Biotech industry average of 11.6x, while a DCF fair value of US$65.46 implies a large gap between price and that model based estimate.

- Bullish investors argue that this combination of low sales multiple and high DCF fair value points to meaningful upside potential, and the trailing numbers give that view some support but also raise questions:

- Revenue is presented as forecast to grow around 17.8% a year, which fits the bullish focus on product launches and a larger pipeline, yet the company is still unprofitable with losses that have grown at about 83.8% per year over the past five years.

- Share price volatility over the last three months has been higher than the broader US market, so even if bulls are attracted to the valuation gap, they are doing so against a backdrop of wide and persistent losses in the trailing 12 month figures.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Vanda Pharmaceuticals on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

See the numbers differently? If this data points you in another direction, take a couple of minutes to shape that view into your own story, starting with Do it your way.

A great starting point for your Vanda Pharmaceuticals research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

Vanda is carrying deep and widening losses, with trailing 12 month net income at a loss of US$220.5 million despite revenue of US$216.1 million.

If that loss profile feels too intense right now, shift your focus toward companies with steadier fundamentals by checking out our solid balance sheet and fundamentals stocks screener (45 results) today and see how they compare.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.