Please use a PC Browser to access Register-Tadawul

V.F. Corporation (VFC): Gauging Valuation After Lawsuits and Vans Turnaround Setback

V.F. Corporation VFC | 20.91 20.91 | -0.90% 0.00% Post |

If you own shares of V.F (VFC), the last few months have likely raised all sorts of questions about the stock’s direction, and for good reason. Multiple class action lawsuits have been filed against the company, accusing management of misrepresenting the turnaround efforts for its flagship Vans brand. The entire story came to a head when V.F announced, back in May, a much steeper-than-expected decline in Vans’ revenue and revealed that the company’s efforts to reset and streamline its business had been far deeper and more disruptive than previously described. Investors digested all this with a sharp sell-off, and the lawsuits started flying almost immediately.

For anyone keeping score, V.F’s share price hasn’t just been volatile over the short term. It’s down about 20% over the past year and remains well below levels seen in recent years. While there was a quick bounce recently, with the stock up 22% in the last three months, longer-term performance is deeply negative and recent news has done little to reverse those losses. This legal drag, mixed results from turnaround efforts, and patchy momentum are exactly what make valuation a tricky and possibly interesting conversation for investors right now.

After this year’s mix of turbulence and a brief rally, is V.F a bargain waiting to be discovered, or has the market already priced in everything, including future risk and potential growth?

Most Popular Narrative: 7.5% Undervalued

According to the most closely followed narrative, V.F is currently considered undervalued by about 7.5% based on analysts' expectations for operational improvements and future growth.

The strategic focus on expanding higher-margin channels, including direct-to-consumer and e-commerce, is beginning to drive improved gross margins and deeper customer engagement. This is expected to lift both revenue growth and net margins over time as V.F. capitalizes on the sustained consumer shift toward digital and premium shopping experiences.

Curious what’s behind this surprising undervaluation? The analysts' growth story hinges on ambitious projections for revenue, profits, and margins. This has raised eyebrows across the market. Want to know which specific numbers and bold assumptions fuel that discounted fair value? This narrative pulls back the curtain on the future drivers that could reshape V.F’s market standing.

Result: Fair Value of $15.49 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent double-digit revenue declines at Vans, or failure to deliver on turnaround efforts, could quickly undermine optimism about V.F’s recovery and future value.

Find out about the key risks to this V.F narrative.Another View: Market-Based Valuation Raises Questions

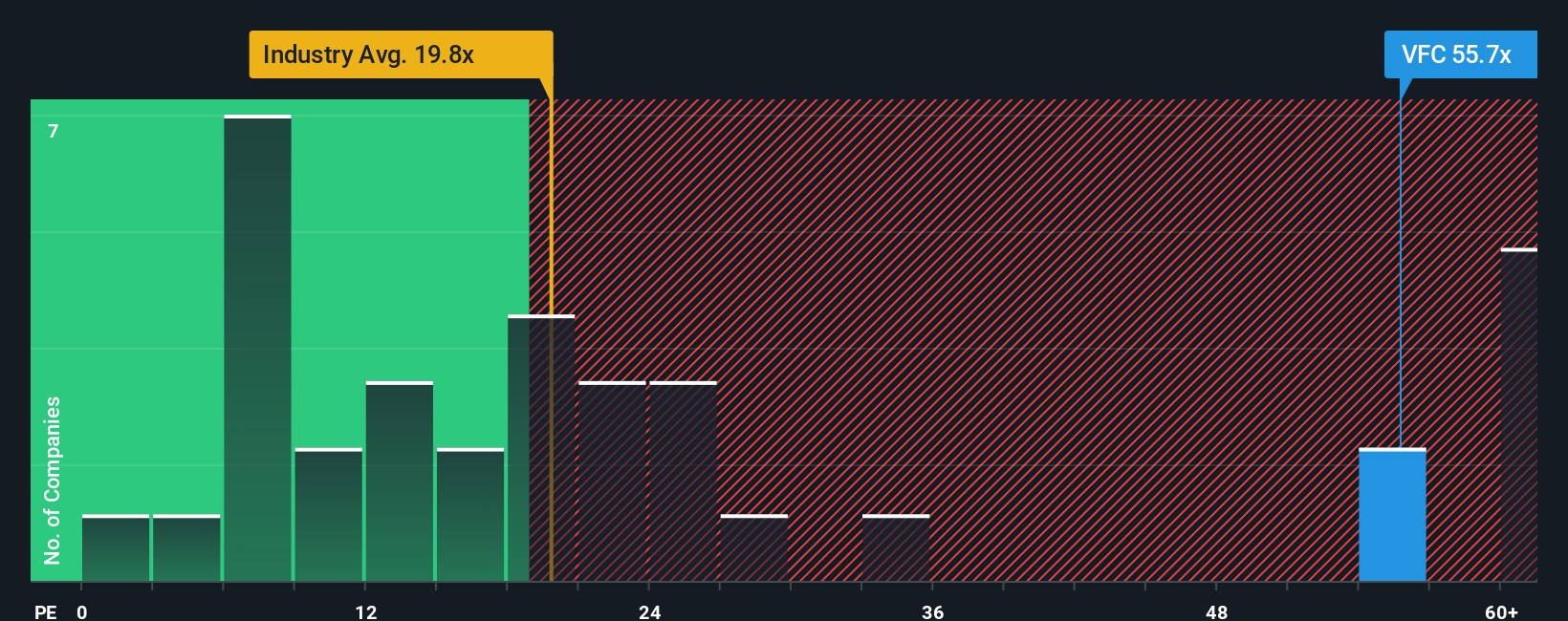

Looking from another angle, market-based valuation tells a different story. Based on its price compared to earnings, V.F shares appear expensive next to the US luxury sector. This casts doubt over claims of deep value in this case. Could the premium be justified, or is the market pricing in more risk than the forecasts suggest?

Build Your Own V.F Narrative

If you think the story runs deeper or would rather dig into the numbers firsthand, you can craft your own analysis in just a few minutes. Do it your way.

A great starting point for your V.F research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t get stuck focusing on just one company when smarter opportunities are only a click away. Challenge your thinking and get a head start on tomorrow’s big trends with these handpicked stock ideas:

- Boost your income strategy by targeting companies offering consistent returns through dividend stocks with yields > 3%.

- Follow technology disruptors shaping the future by browsing the most promising AI penny stocks.

- Get ahead of the crowd and spot market bargains hiding in plain sight with our picks for undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.