Please use a PC Browser to access Register-Tadawul

Virtus Investment Partners (VRTS): Assessing Valuation After Latest Assets Under Management Update

Virtus Investment Partners, Inc. VRTS | 167.01 | +0.67% |

Price-to-Earnings of 9.2x: Is it justified?

Based on the price-to-earnings multiple, Virtus Investment Partners appears undervalued compared to its peers and the broader US capital markets sector. A lower multiple suggests that the market is not pricing the company's current or future earnings as highly as those of its competitors.

The price-to-earnings ratio compares the current share price to the company’s annual earnings per share. This metric is especially relevant for financial firms like Virtus, as it helps investors gauge how much they are paying for a dollar of current earnings, relative to other firms.

Virtus trades at a price-to-earnings ratio of 9.2x, which is markedly below both the US capital markets industry average and the peer group average. This could indicate the market expects slower growth, but it may also highlight a value opportunity if earnings remain robust. The market appears to be discounting Virtus’s potential, possibly overlooking its recent improvement in profit margins and earnings growth.

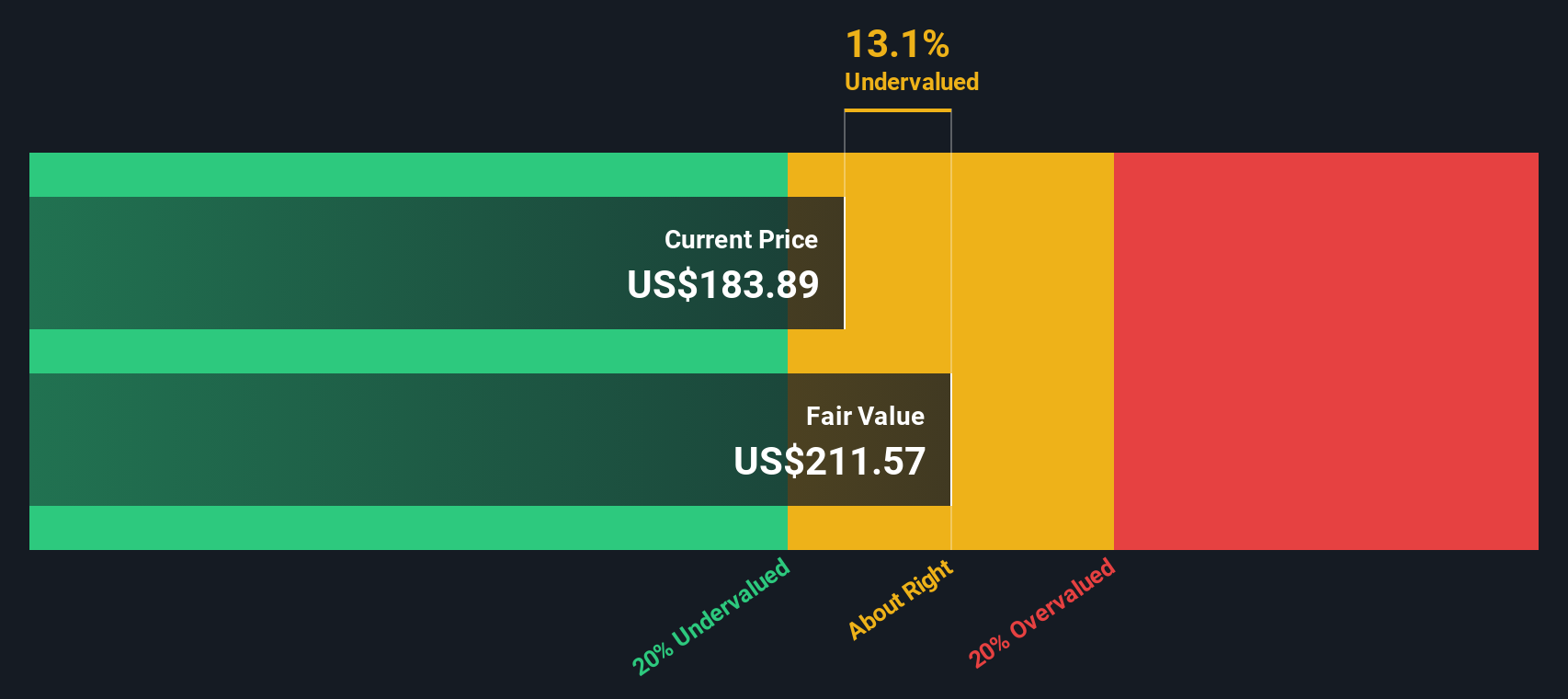

Result: Fair Value of $211.64 (UNDERVALUED)

See our latest analysis for Virtus Investment Partners.However, uncertainty remains if revenue decline persists or if market sentiment turns against smaller asset managers who are navigating rapid shifts in investor appetite.

Find out about the key risks to this Virtus Investment Partners narrative.Another View: What Does Our DCF Model Indicate?

Taking a different approach, the SWS DCF model also suggests Virtus Investment Partners is undervalued. This second lens broadly aligns with the earlier value case. However, does a single method capture the entire story?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Virtus Investment Partners Narrative

If you want to dig deeper or question these conclusions, you have the option to develop your own perspective in just a few minutes. Do it your way.

A great starting point for your Virtus Investment Partners research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Opportunities in the market move fast, but you can stay ahead by checking out tailored investment themes with the Simply Wall St Screener. Why wait for tomorrow when you could uncover your next smart move today?

- Seize the advantages of market volatility by tapping into undervalued stocks based on cash flows to spot companies trading below their true worth.

- Get ahead of tomorrow’s innovations by targeting AI penny stocks to find companies transforming industries with artificial intelligence breakthroughs.

- Maximize your passive income potential and discover sustainable returns through dividend stocks with yields > 3% yielding over 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.