Please use a PC Browser to access Register-Tadawul

Vontier (VNT) TTM Margin Dip To 13.3% Tests Bullish Earnings Inflection Narrative

Vontier Corp VNT | 40.96 | -0.12% |

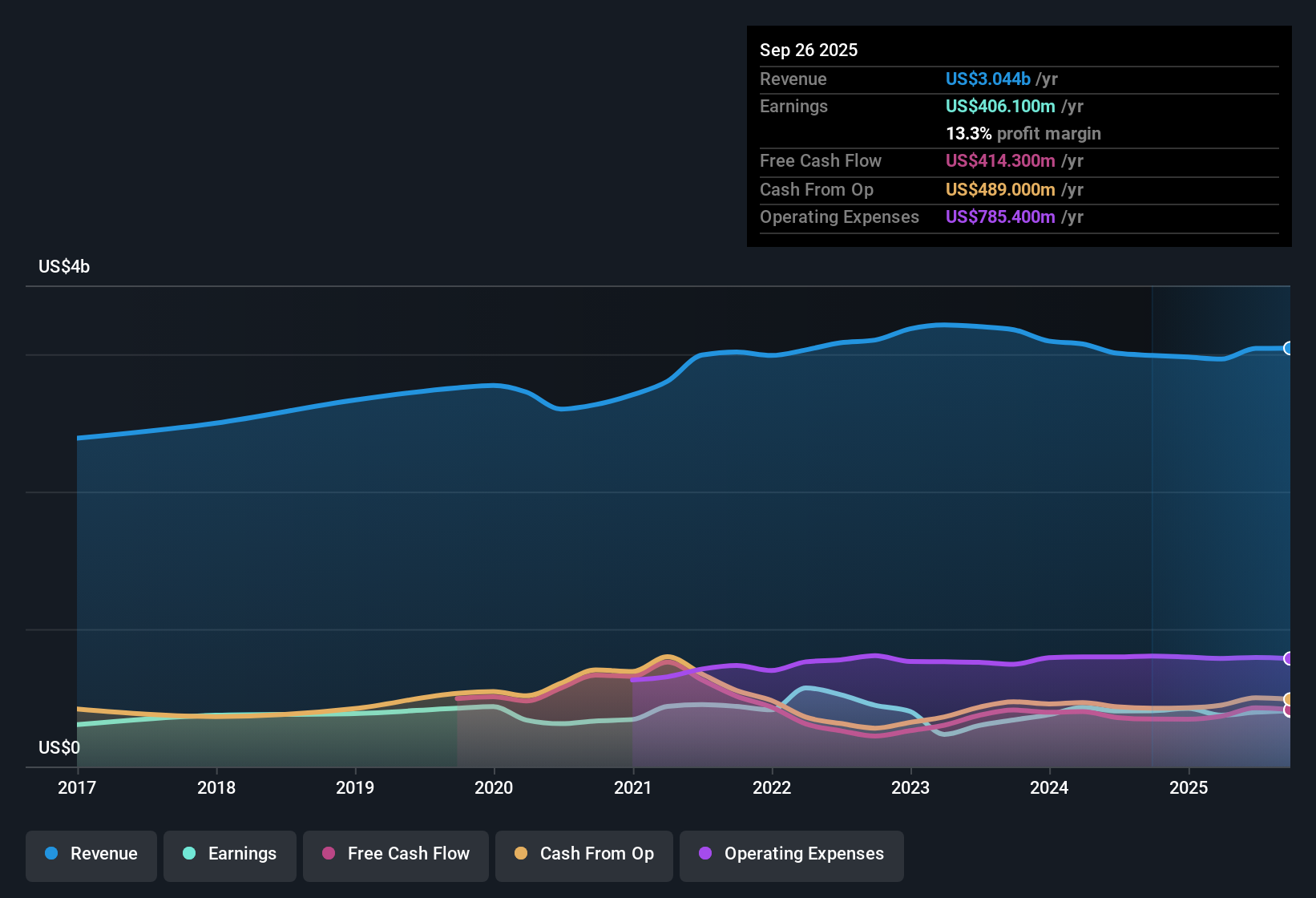

Vontier (VNT) has put solid numbers on the table for FY 2025 so far, with Q3 revenue of US$752.5 million, basic EPS of US$0.70 and trailing twelve month revenue of about US$3.0 billion and EPS of US$2.74, giving investors a clear read on recent performance. The company has seen quarterly revenue move from US$696.4 million in Q2 2024 to US$773.5 million in Q2 2025. Over that span, basic EPS ranged from US$0.45 to US$0.82 and now sits at US$0.70 in Q3 2025. These results are framed by forecasts for earnings and revenue growth and a trailing net profit margin of 13.3% that keeps the focus squarely on how efficiently those sales are turning into profit.

See our full analysis for Vontier.With the headline numbers in place, the next step is to see how this earnings profile lines up with the widely shared stories around Vontier, highlighting where the financials support the current narrative and where they start to push back.

TTM earnings steady around US$406 million

- Over the last 12 months, Vontier earned US$406.1 million on US$3.0b of revenue, with TTM EPS at US$2.74 and a net margin of 13.3% compared with 13.5% a year earlier.

- Consensus narrative talks about higher margin digital and SaaS revenue improving earnings quality, and the TTM figures line up with that story but also show the limits:

- One year earnings growth is 0.3% even though the five year trend is a 2.7% per year decline, so the inflection is modest rather than dramatic so far.

- Analysts are assuming earnings growth of about 7.9% per year and revenue growth of about 7% per year, which is above the recent 0.3% earnings growth and puts some pressure on execution to match those expectations.

P/E of 15x and US$61.74 DCF fair value

- At a share price of US$42.10, Vontier trades on a P/E of about 15x versus a stated peer average of 68.9x and Electronic industry average of 27.1x, and a DCF fair value of US$61.74 is about 31.8% above the current price.

- Bulls lean on this valuation gap and the digital growth angle, and the numbers give that view some support but not without caveats:

- Analysts use a price target of US$45.77 based on revenue of US$3.4b and earnings of US$549.8 million by around 2028, which is a step up from today’s US$3.0b revenue and US$406.1 million earnings and assumes margins rising from about 13% to 15.9%.

- To reach that target, the assumed P/E of 15.4x is close to today’s 15x, so most of the upside case relies on those earnings and margin forecasts actually being delivered rather than multiple expansion.

Debt load and Fueling reliance in focus

- The risk summary flags a high level of debt alongside a net margin that has edged from 13.5% to 13.3%, while the business still leans heavily on traditional Fueling Solutions and a Repair Solutions segment that has faced revenue pressure.

- Bears focus on that leverage and segment mix, and the data give their concerns some grounding as well as some context:

- Analysts expect earnings of US$549.8 million and EPS of US$3.81 by about 2028, which assumes that fuel related replacement cycles, SaaS adoption and portfolio moves offset any drag from legacy fueling and repair exposure.

- If high debt and Repair Solutions weakness limit how much cash can be reinvested, then the forecast 7.9% earnings growth and margin lift to 15.9% could prove harder to reach than the simple TTM snapshot of US$406.1 million earnings and 13.3% margin might suggest.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Vontier on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

See the numbers differently? Take a fresh look at the figures, shape your own view in just a few minutes and share it with the community: Do it your way

A great starting point for your Vontier research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

Vontier’s earnings story leans on higher margin software and valuation upside, but modest recent earnings growth, high debt and pressured segments keep the risk dial turned up.

If that mix of leverage and execution risk feels a bit tense, you can immediately compare it with companies in our 85 resilient stocks with low risk scores that aim to keep balance sheets and risk profiles tighter.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.