Please use a PC Browser to access Register-Tadawul

Waldencast plc's (NASDAQ:WALD) Stock Retreats 30% But Revenues Haven't Escaped The Attention Of Investors

Waldencast plc Class A WALD | 1.80 | -0.55% |

Waldencast plc (NASDAQ:WALD) shareholders won't be pleased to see that the share price has had a very rough month, dropping 30% and undoing the prior period's positive performance. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 49% share price drop.

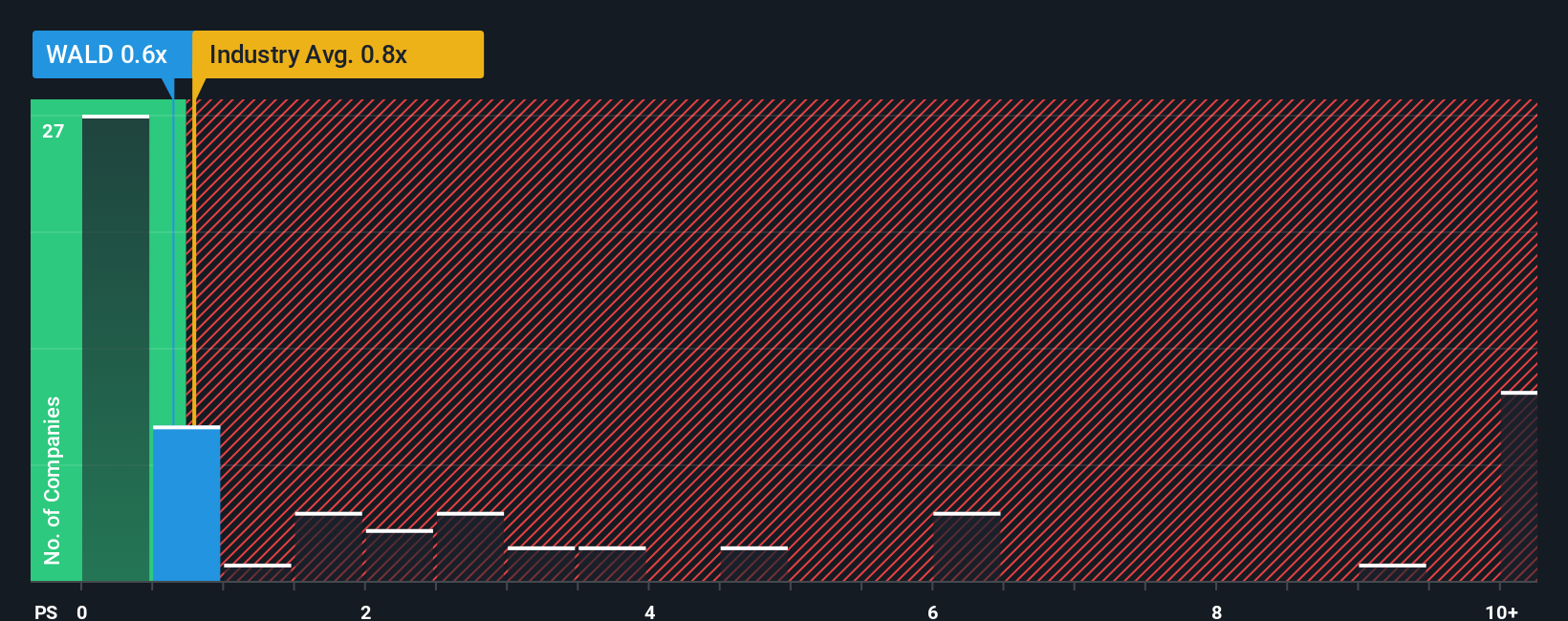

In spite of the heavy fall in price, there still wouldn't be many who think Waldencast's price-to-sales (or "P/S") ratio of 0.6x is worth a mention when the median P/S in the United States' Personal Products industry is similar at about 0.8x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

How Has Waldencast Performed Recently?

Recent times have been pleasing for Waldencast as its revenue has risen in spite of the industry's average revenue going into reverse. It might be that many expect the strong revenue performance to deteriorate like the rest, which has kept the P/S ratio from rising. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Waldencast.Do Revenue Forecasts Match The P/S Ratio?

The only time you'd be comfortable seeing a P/S like Waldencast's is when the company's growth is tracking the industry closely.

Taking a look back first, we see that the company managed to grow revenues by a handy 14% last year. Although, the latest three year period in total hasn't been as good as it didn't manage to provide any growth at all. So it appears to us that the company has had a mixed result in terms of growing revenue over that time.

Turning to the outlook, the next year should generate growth of 4.6% as estimated by the six analysts watching the company. Meanwhile, the rest of the industry is forecast to expand by 5.2%, which is not materially different.

With this in mind, it makes sense that Waldencast's P/S is closely matching its industry peers. Apparently shareholders are comfortable to simply hold on while the company is keeping a low profile.

The Bottom Line On Waldencast's P/S

With its share price dropping off a cliff, the P/S for Waldencast looks to be in line with the rest of the Personal Products industry. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our look at Waldencast's revenue growth estimates show that its P/S is about what we expect, as both metrics follow closely with the industry averages. At this stage investors feel the potential for an improvement or deterioration in revenue isn't great enough to push P/S in a higher or lower direction. All things considered, if the P/S and revenue estimates contain no major shocks, then it's hard to see the share price moving strongly in either direction in the near future.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.