Please use a PC Browser to access Register-Tadawul

Wayfair (W) Valuation Check After Google AI Commerce Partnership And Strong Recent Share Returns

Wayfair, Inc. Class A W | 81.43 | +2.34% |

Wayfair (W) is back in focus after helping Google create the Universal Commerce Protocol, an open standard that connects AI agents with retailers and supports direct checkout from Google product listings.

The Google partnership lands at a time when momentum in Wayfair’s shares has been strong, with a 1 month share price return of 22.34% and a 90 day share price return of 46.41%, while the 1 year total shareholder return of 178.74% contrasts with a 5 year total shareholder return of 60.30% decline. This suggests that recent optimism has come after a tougher, longer stretch.

If this kind of AI driven commerce catches your attention, it could be worth scanning high growth tech and AI stocks for other companies tying their growth plans to similar technology shifts.

With the shares posting very strong 1 year and 3 year total returns but still carrying an estimated 45% intrinsic discount and a recent analyst target below the current US$119.05 price, is there genuine value left here, or is the market already pricing in future growth?

Most Popular Narrative: 4.4% Overvalued

Against Wayfair’s last close of US$119.05, the most followed narrative places fair value at US$114, creating a small valuation gap that hinges on specific growth and margin assumptions.

The analysts have a consensus price target of $81.207 for Wayfair based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $105.0, and the most bearish reporting a price target of just $51.0.

Want to see what justifies paying a premium today? Revenue steps higher, margin repair, and a punchy future earnings multiple sit at the core of this narrative. Curious which assumptions really move the fair value line and how far they are stretched? The full story connects those dots.

Result: Fair Value of $114 (OVERVALUED)

However, there are still clear pressure points, including a tough housing backdrop for big ticket home goods, and heavy advertising and tech spending that may weigh on margins.

Another View: SWS DCF Points To Big Upside

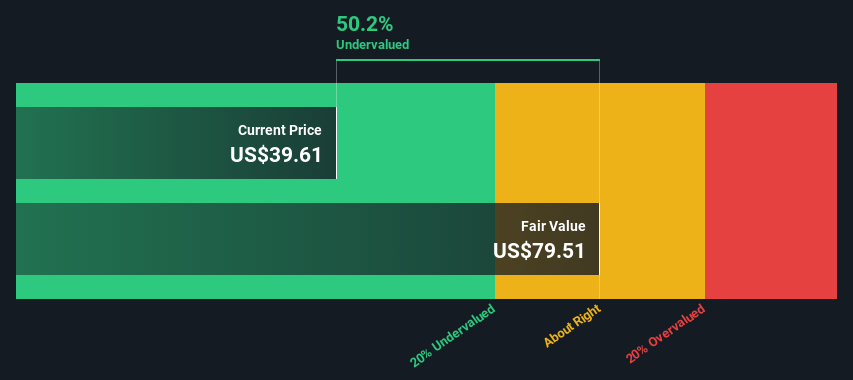

While the most popular narrative has Wayfair at about 4.4% overvalued using its own growth and margin assumptions, our DCF model comes out very differently. On this view, the shares trade around 45% below an estimated fair value of US$216.57, which frames current pricing as a large potential gap rather than a small premium.

The contrast between a modest premium to the US$114 fair value narrative and a sizeable discount to the SWS DCF fair value raises a simple question for you: which set of assumptions about margins, growth and risk feels more realistic over the next few years?

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Wayfair for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 885 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Wayfair Narrative

If you see the numbers differently or would rather weigh the assumptions yourself, you can build a custom Wayfair view in just a few minutes, then Do it your way.

A great starting point for your Wayfair research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If Wayfair has sharpened your thinking, do not stop here. Lining up a few fresh stock ideas now could make a real difference to your portfolio.

- Target strong cash flow potential by scanning these 885 undervalued stocks based on cash flows that might be trading at prices that do not fully reflect their fundamentals.

- Tap into the AI trend by reviewing these 25 AI penny stocks that blend cutting edge technology with real business models.

- Build your income stream by checking out these 13 dividend stocks with yields > 3% that already offer yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.