Please use a PC Browser to access Register-Tadawul

"Weaker Dollar" Emerges as Biggest Tailwind for US Earnings Season! Which Stocks Benefit Most?

PepsiCo, Inc. PEP | 150.37 | -0.56% |

Johnson & Johnson JNJ | 209.30 | -2.27% |

Levi Strauss & Co. LEVI | 22.55 | +2.78% |

Edwards Lifesciences Corporation EW | 85.32 | +2.33% |

S&P 500 index SPX | 6800.26 | -0.24% |

① The current weakness of the US dollar is proving to be a "savior" for some large US multinationals this earnings season;

② This naturally raises a question: if investors want to capitalize on the potential upside from the dollar's depreciation during this earnings season, how exactly should they select stocks?

Whether this reflects the end of "American exceptionalism" or merely a long-overdue adjustment, the dollar has suffered its worst first half in 50 years...

Market data shows the US Dollar Index (DXY) has fallen approximately 10% year-to-date, driven by abrupt shifts in US trade policy, coupled with concerns over economic growth and ballooning government debt.

For Americans planning summer vacations abroad, this is bad news, potentially eroding their purchasing power. But for many large US companies that have already reported or are about to report Q2 earnings, it may instead be a significant boon.

The dollar's current weakness is emerging as a lifeline for some large US multinationals this earnings season – the depreciation has significantly mitigated the impact of President Trump's tariffs, which have increased costs and disrupted financial planning.

This is because a weaker dollar boosts the value of US companies' overseas revenue – the most immediate effect being the conversion of foreign currency earnings into more dollars. Simultaneously, it makes US exports more competitive.

This has already been evident in the results of some US companies that reported earnings last week.

For instance, PepsiCo's EPS (PepsiCo, Inc.(PEP.US)) last week beat analyst expectations by 4.5 percentage points, and its stock rose 7.5% post-earnings. Johnson & Johnson's (Johnson & Johnson(JNJ.US)) Q2 sales also rose 5.8% year-over-year, exceeding expectations; the company raised its full-year revenue outlook, specifically citing forex factors. Levi Strauss (Levi Strauss & Co.(LEVI.US)) reported similarly positive results.

Scott Ullem, CFO of medical device maker Edwards Lifesciences (Edwards Lifesciences Corporation(EW.US)), candidly stated on the June 4th earnings call, "We initially anticipated a headwind of over $100 million from a stronger dollar, but the opposite occurred."

"A weaker dollar could provide an additional tailwind to earnings, helping reinforce the market consensus of 'exceptionally solid' results this quarter," noted Angelo Kourkafas, Senior Global Investment Strategist at Edward Jones.

Which Sectors and Stocks Benefit Most?

According to LSEG data, based on the past two decades, a 1% depreciation in the dollar typically boosts the EPS growth rate of S&P 500 (S&P 500 index(SPX.US)) companies by an average of about 0.6 percentage points.

This naturally raises a question: if investors want to capitalize on the potential upside from the dollar's depreciation during this earnings season, how exactly should they select stocks?

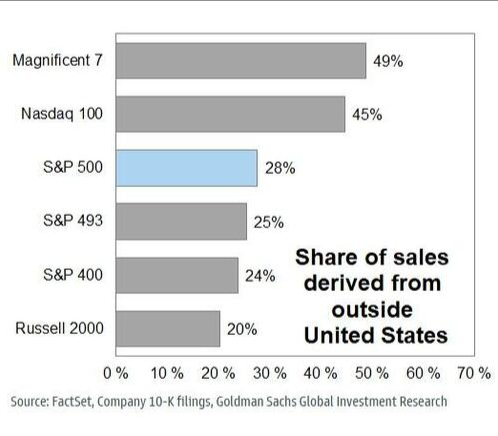

John Flood, Chief Equity Trader at Goldman Sachs (Goldman Sachs Group, Inc.(GS.US)), addressed this in a recent report. The report notes that, based on company 10-K filings, international sales currently account for about 28% of S&P 500 company revenue. This is higher than the international sales exposure in the Russell 2000 (Russell 2000 ETF(IWM.US)) (20%), but lower than the Nasdaq 100 (NASDAQ(IXIC.US)) (45%).

Dollar weakness should help support stocks with greater international sales exposure. Among these, the "Magnificent Seven" have significantly higher-than-average international revenue exposure, meaning they stand to benefit more from dollar depreciation.

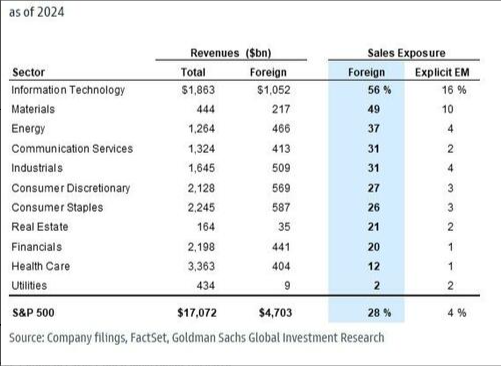

From a sector perspective, the Technology sector is the only one in the S&P 500 where more than half of revenue comes from outside the US...

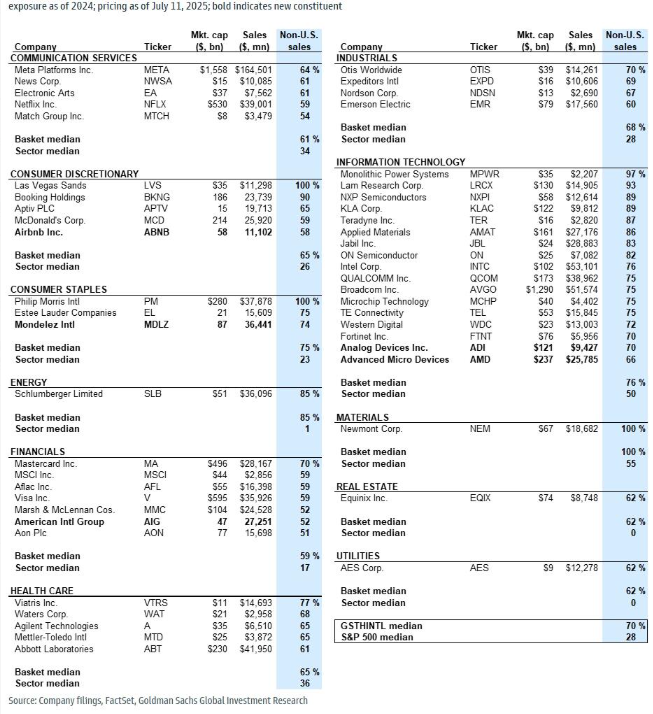

Goldman Sachs also previously compiled a "High International Sales" basket index (GSTHINTL). This index, based on 2024 company filings, selects 50 S&P 500 companies with the highest percentage of international revenue across 11 sectors, as shown in the chart below:

The median revenue exposure for constituents in this basket is 70% from outside the US. Many currently exhibit high-quality long characteristics.

Regarding the dollar exchange rate, Flood points out that the trade-weighted dollar index has depreciated 7% year-to-date, and Goldman Sachs forecasts a further 4% depreciation by year-end.

Of course, the earnings boost from forex isn't a cure-all. While dollar depreciation can mask corporate weaknesses to some extent, it cannot cure them. In fact, Netflix, Inc.(NFLX.US) last week provided the most telling case: despite beating earnings expectations, its stock plunged over 5% on Friday after industry insiders highlighted that this was driven more by dollar weakness than operational improvement.

Goldman Sachs strategists emphasized in their report, "Investors generally don't assign the same premium to revenue beats driven purely by FX as they do to organic revenue growth."

"Investors should recognize that gains of this kind (from forex factors) are largely unsustainable and transitory adjustments," stated Michael Arone, Chief Investment Strategist at State Street Global Advisors, bluntly.