Please use a PC Browser to access Register-Tadawul

Weatherford International (WFRD) Valuation Revisited After Mixed 2025 Earnings And US$200.01 Million Buyback Completion

Weatherford International plc Ordinary Shares - New WFRD | 104.44 | -1.04% |

Why Weatherford International (WFRD) Is Back in Focus

Weatherford International (WFRD) is drawing attention after its latest quarterly and full year 2025 earnings, which showed lower revenue alongside higher fourth quarter profitability, combined with completion of a US$200.01 million share repurchase.

The recent earnings update, combined with the completed US$200.01 million buyback, has coincided with a sharp pickup in momentum, with a 20.52% 1 month share price return and a 56.29% 1 year total shareholder return.

If Weatherford International’s move has you looking beyond a single name, this could be a good moment to see what else is setting up in oilfield services and related equipment through 24 power grid technology and infrastructure stocks.

With revenue softer, earnings mixed and the shares now trading close to analyst targets despite an indicated intrinsic discount, you have to ask yourself: is Weatherford International still mispriced, or is the market already accounting for future growth?

Most Popular Narrative: 23.8% Overvalued

Weatherford International’s most followed narrative places fair value at about $83.73, which sits well below the latest close of $103.62. This raises questions about how much optimism is already priced in.

Ongoing company transformation shifting from legacy, low-margin businesses (recent divestitures in Argentina and slimming down unprofitable offerings) toward higher-margin, technology-enabled services, digitalization, and integrated projects should drive both net-margin expansion and earnings resilience through the cycle.

Want to see what is backing that fair value call? The narrative leans on steadier margins, measured top line assumptions and a tighter share count. The full story is in how those pieces are modeled together. Curious what that implies for earnings power a few years out?

Result: Fair Value of $83.73 (OVERVALUED)

However, there are still clear pressure points, including softer activity in key international markets and ongoing pricing pressure that could challenge the margin story investors are leaning on.

Another Angle on Valuation

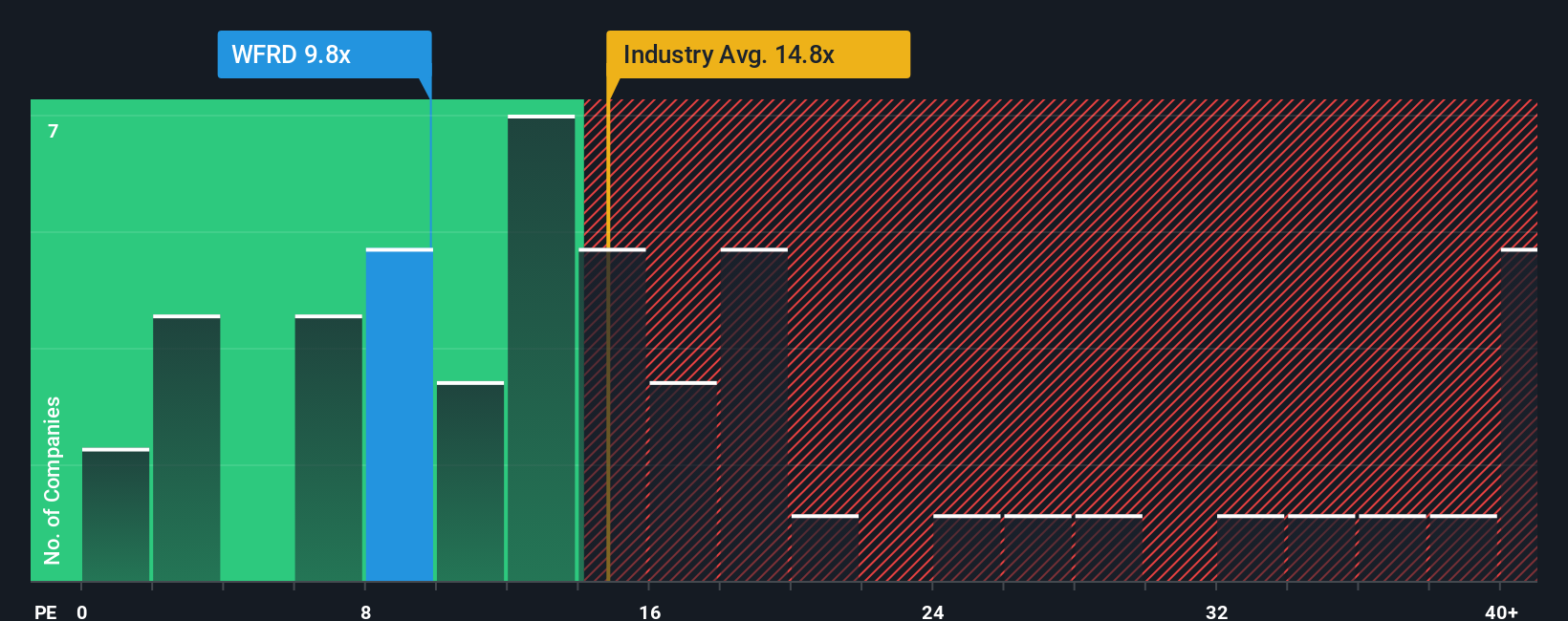

The narrative you just read leans on future earnings and implied P/E to argue Weatherford International looks 23.8% overvalued against a fair value of $83.73, versus the current $103.62. Yet on simple market ratios, the picture is very different.

Today the shares trade on a P/E of 16.9x, compared with 24.6x for the US Energy Services industry and 29.3x for peers, and only a touch below a fair ratio of 17.2x. That gap suggests the market is not paying a premium for Weatherford despite the recent run. This raises the question: is the real risk that the story is too hot, or that expectations are still too low?

Build Your Own Weatherford International Narrative

If you are not fully on board with this view, or simply prefer to test the assumptions yourself, you can build a data driven thesis in minutes: Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Weatherford International.

Looking for more investment ideas?

If Weatherford has you rethinking your next move, do not stop here. Cast a wider net now so you are not reacting after the fact.

- Spot potential value candidates early by reviewing our list of 51 high quality undervalued stocks that screen for quality alongside attractive pricing.

- Prioritize resilience by checking companies in the 83 resilient stocks with low risk scores that score well on lower risk profiles.

- Hunt for under the radar opportunities through the screener containing 24 high quality undiscovered gems that pair strong fundamentals with limited current attention.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.