Please use a PC Browser to access Register-Tadawul

What Carvana’s Soaring 2025 Stock Price Means After Latest Analyst Forecasts

Carvana CVNA | 455.68 | -3.61% |

If you own Carvana stock or are thinking about jumping in, you’re not alone in wondering what to do next. After all, last year’s wild run, with a 117.5% gain that more than doubled the stock's value, might have caught even the most optimistic bulls off guard. Year-to-date, Carvana is still up a whopping 85.1%, putting most of the market to shame. Looking back three years, the stock has skyrocketed an unbelievable 1719.2%. Of course, it hasn’t all been smooth driving. Over the past week, Carvana gave back 5.8%, and the last month has been essentially flat. Choppier trading lately hints that investors are reassessing risks and growth potential in the used car e-commerce space.

With so much action, the real question is: Is Carvana still undervalued, or has its recent rally left it looking expensive? To answer that, valuation matters. When we put Carvana through a series of six classic valuation checks, the stock didn’t score as undervalued in any of them, ending up with a value score of 0 out of 6. That’s a signal worth digging into before making any big portfolio moves.

Next, let’s break down how those valuation checks work, what they reveal (and sometimes miss), and why looking beneath the surface might hold the key to smarter investing decisions. There’s more to valuation than first meets the eye. I’ll finish this article with the best way I know to understand what Carvana is really worth right now.

Carvana scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.Approach 1: Carvana Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates what a company is worth by forecasting its future free cash flows and then discounting those projections back to their value today, using an appropriate rate. This approach aims to find an intrinsic value independent of current market sentiment.

For Carvana, the latest reported Free Cash Flow is approximately $565 million. Analysts expect this number to expand rapidly, with projections exceeding $3 billion by 2029. It is important to note that detailed analyst estimates generally only go out five years, and forecasts beyond that are modeled by data providers. In Carvana's case, the DCF model used a two-stage forecast, which extrapolates continued growth in the following years to reach those future cash flow figures. All amounts are denominated in dollars.

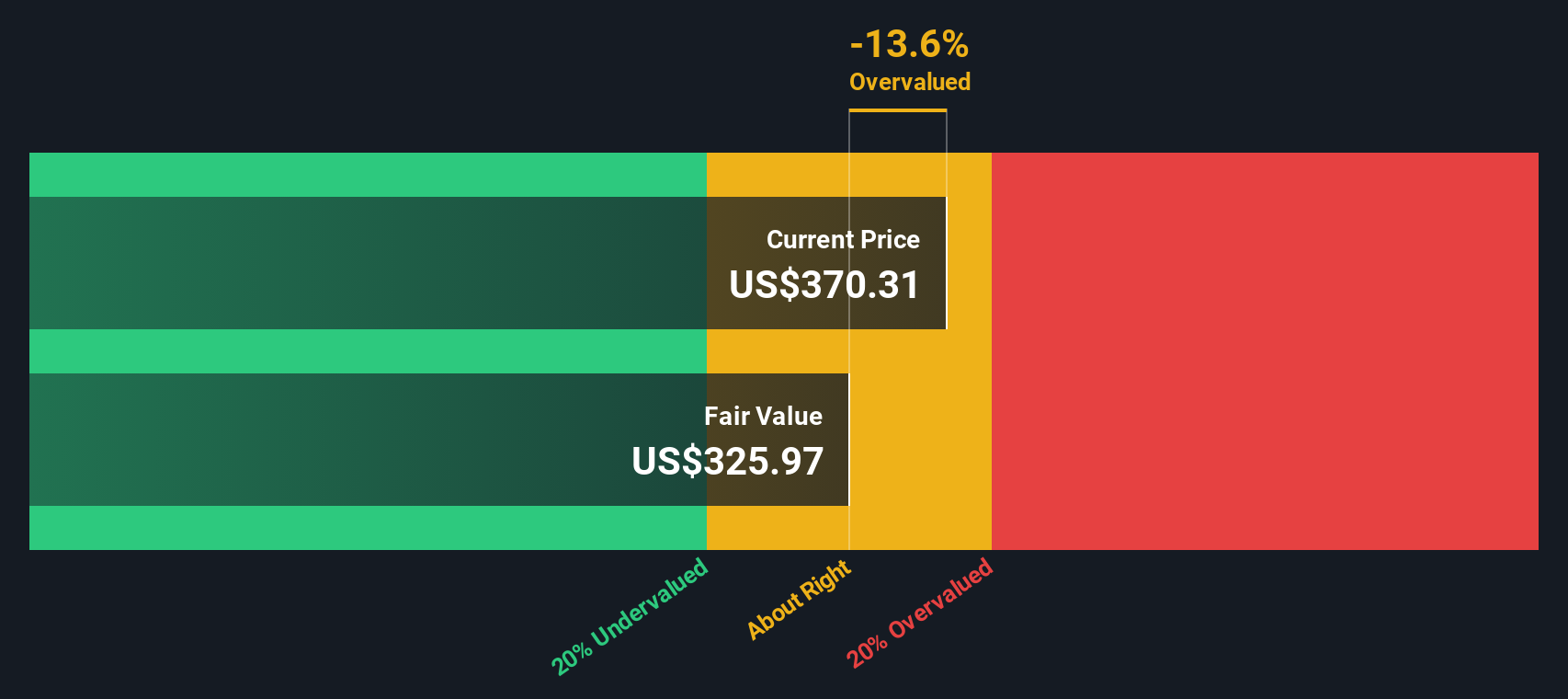

Based on these projections, the estimated intrinsic value for Carvana comes out to $328.15 per share. Comparing this to the current market price, the DCF result suggests the stock is about 12.5% overvalued right now. In other words, the recent rally has pushed Carvana slightly beyond what its long-term cash flows alone would justify.

Result: OVERVALUED

Head to the Valuation section of our Company Report for more details on how we arrive at this Fair Value for Carvana.

Approach 2: Carvana Price vs Earnings

The Price-to-Earnings (PE) ratio is a widely used valuation metric, especially for profitable companies like Carvana. It measures how much investors are willing to pay today for a dollar of the company's current earnings. This makes it a helpful shortcut for evaluating whether a stock is expensive or cheap relative to profits.

A company’s PE ratio can reflect both expectations for future growth and the risks investors perceive. High-growth companies or firms with more stability often command higher multiples. In contrast, higher-risk or slower-growing companies tend to trade at a discount.

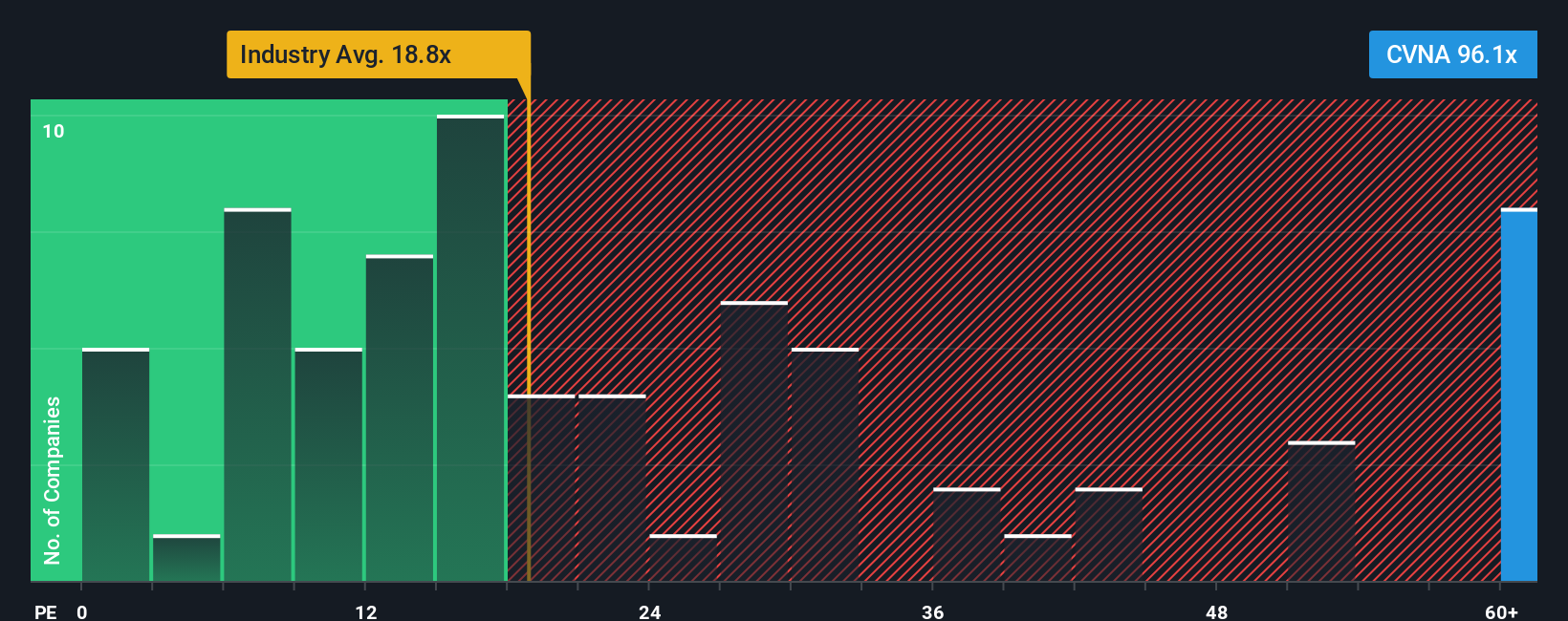

Carvana’s current PE ratio stands at 90.6x, which far exceeds the Specialty Retail industry average of 17.7x and the average among its peers, at 22.5x. At first glance, this seems extremely expensive compared to competitors.

However, Simply Wall St’s “Fair Ratio” offers a more tailored benchmark. The Fair Ratio for Carvana, calculated at 41.5x, considers its earnings growth prospects, profit margins, business risks, industry context, and market cap. This approach gives a more nuanced sense of what a reasonable PE should look like for this specific company instead of relying solely on broad industry or peer comparisons.

Since Carvana’s current PE of 90.6x is much higher than its Fair Ratio of 41.5x, the stock appears significantly overvalued using this lens.

Result: OVERVALUED

Upgrade Your Decision Making: Choose your Carvana Narrative

As promised earlier, there is an even better way to think about valuation by using Narratives. A Narrative is your story about a company: it is how you connect your view of Carvana’s business, growth outlook, and risks with specific financial forecasts and what you believe is a fair value for the stock.

Narratives bridge the gap between cold numbers and real conviction, letting you distill your assumptions about future revenue, margins, and business potential into actionable decisions. On Simply Wall St’s platform, millions of investors use Narratives within the Community page to clarify their thesis and see how it stacks up against others. No spreadsheets or complex models are required.

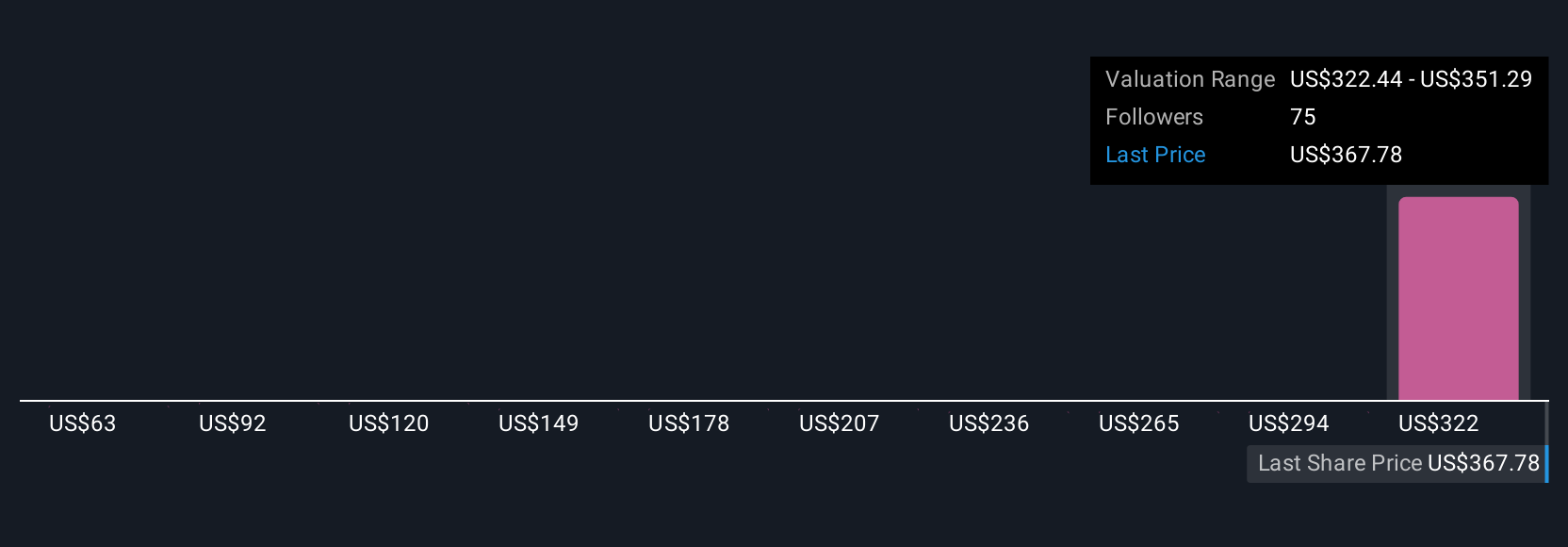

This approach is powerful because it makes buy, sell, or hold decisions clearer and more personalized. You can continually compare your Narrative’s Fair Value to the actual share price, and Narratives automatically update as new data or news arrives. For example, right now some Carvana Narratives reflect bullish analyst targets above $500, while others see fair value closer to $330. This highlights that investors are using different stories and expectations behind their calculations.

Do you think there's more to the story for Carvana? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.