Please use a PC Browser to access Register-Tadawul

What Oppenheimer’s New $92 Price Target Means for Block Shares in 2025

Block, Inc. Class A XYZ | 63.00 | -2.25% |

Deciding what to do with Block stock right now feels a bit like standing at a crossroads with several interesting paths ahead. If you’ve been watching the price action lately, you know it hasn’t exactly been a smooth ride. Over the past week, shares have gained 3.2%, and they’re up 3.8% for the month. But zoom out and the story gets more complicated. Year-to-date, Block is still down 10.3%. Stretch that timeline out to one year, and suddenly Block looks much more robust with an 18.4% gain. Yet over five years, the stock is down a staggering 58.0%.

So, what’s moving the needle? Some of the latest headline-grabbing news includes analysts now raising their price targets for Block on the back of better-than-expected company performance and notable growth for its Cash App and Square platforms. That’s likely helped boost investor sentiment in recent weeks. And in the bigger picture, increased valuations for major fintech peers like Stripe may be sparking renewed interest in the sector, Block included. However, new regulatory moves by giants like JPMorgan are a reminder that risks and competitive pressures are constantly shifting.

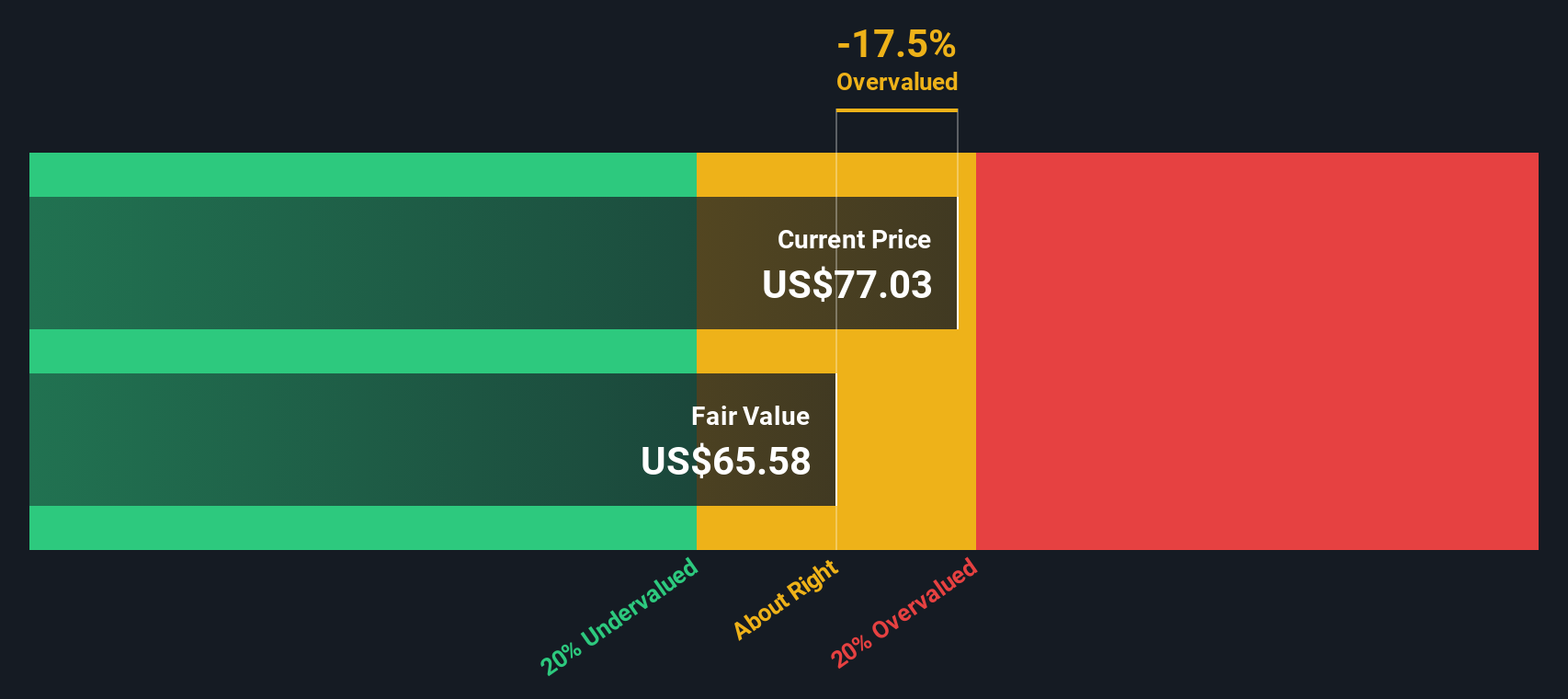

But let’s get to what really matters: is Block undervalued at its current price of $77.78? According to our valuation score, which tests six separate criteria for undervaluation, Block meets three checks, landing it a value score of 3 out of 6. Of course, that’s only the starting point. Up next, we’ll unpack exactly how each valuation approach interprets Block’s potential, and we’ll also explore whether there’s a smarter way to look at value before you make your move.

Approach 1: Block Excess Returns Analysis

The Excess Returns model provides insight by comparing how much profit Block generates from shareholder equity over and above what investors require as a minimum rate of return. Simply put, it focuses on how well Block turns its assets into profitable growth, taking into account both its cost of equity and its actual returns.

For Block, here is how the numbers stack up:

- Book Value: $36.31 per share

- Stable EPS: $4.33 per share (Source: Weighted future Return on Equity estimates from 9 analysts.)

- Cost of Equity: $3.22 per share

- Excess Return: $1.11 per share

- Average Return on Equity: 10.29%

- Stable Book Value: $42.12 per share (Source: Weighted future Book Value estimates from 8 analysts.)

Based on this model, the estimated intrinsic value for Block is $66.44 per share. Compared to the current share price of $77.78, the stock appears 17.1% overvalued according to the Excess Returns approach. This suggests a disconnect between market optimism and Block's projected capacity to generate value above its cost of equity.

Result: OVERVALUED

Our Excess Returns analysis suggests Block may be overvalued by 17.1%. Find undervalued stocks or create your own screener to find better value opportunities.

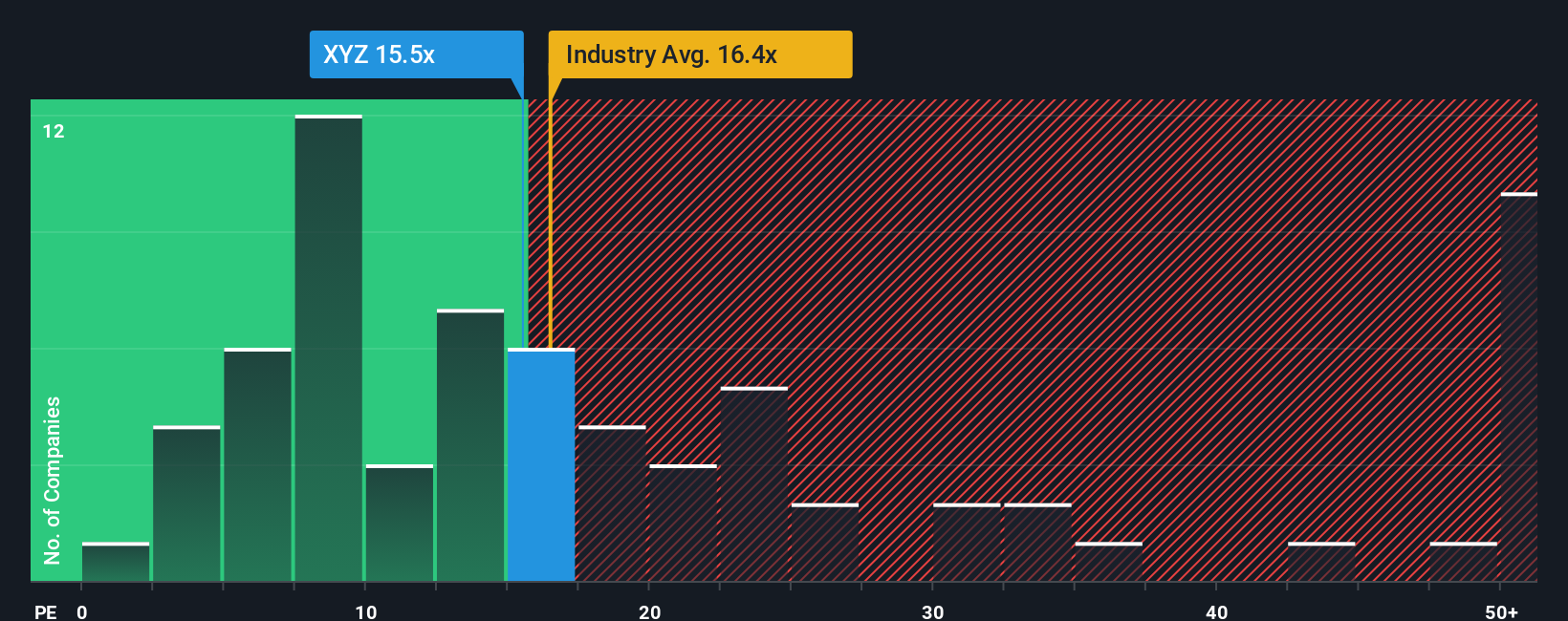

Approach 2: Block Price vs Earnings

The price-to-earnings (PE) ratio is widely used to value profitable companies like Block, as it relates the company’s share price to its per-share earnings, offering a fast check on how much investors are willing to pay for current profits. For companies that generate steady earnings, the PE ratio gives a snapshot of market expectations. Growth prospects and risks both play a big role in what’s considered a normal or fair PE. Fast-growing, stable companies typically command higher PE ratios, while those facing pressure or risk might see lower figures.

Block currently trades at a PE ratio of 16.1x. For perspective, the average PE for the Diversified Financial industry sits at 16.1x, and Block’s immediate peers average 17.1x. This means Block is priced similarly to most of its industry and slightly below its peers. However, the proprietary “Fair Ratio” designed by Simply Wall St goes a step further. It weighs not just industry and peer averages, but also Block’s specific earnings growth outlook, profit margins, market cap, and company-specific risks. This offers a more tailored benchmark for what the stock should trade at. Block’s Fair Ratio is 17.8x.

Because the Fair Ratio takes into account more granular factors unique to Block, it arguably offers a more “real world” fair value guide than industry or peer comparisons. With Block trading at 16.1x and a Fair Ratio of 17.8x, the stock looks undervalued on this metric alone.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Block Narrative

Earlier we mentioned that there's an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is simply the story you believe about a company, such as why it will succeed, how it will grow, or what risks it faces, brought to life through numbers like what you think fair value, future earnings, or profit margins could be.

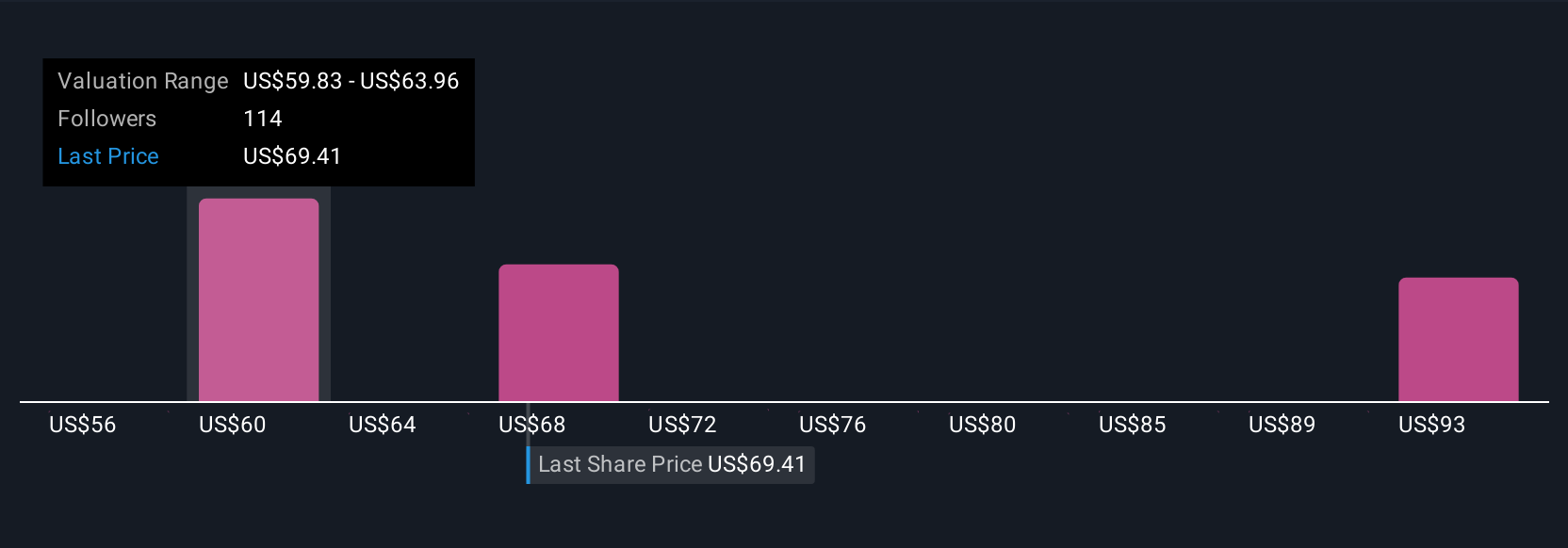

Narratives connect your outlook with a clear financial forecast and an up-to-date fair value, making it easy to see how your point of view translates into a buy or sell decision. On Simply Wall St's Community page, Narratives are available for anyone to explore or create, and are used by millions of investors to anchor their decisions to their own research rather than just analyst consensus.

Thanks to dynamic updates as soon as new news or earnings arrive, Narratives reflect the latest information, so you can adjust your story, forecast, or conviction in real time. For example, some investors see Block ultimately trading well above $100 if Cash App expansion and margin growth outpace expectations, while others remain cautious, believing the fair value could fall closer to $35 if competition and crypto risks weigh heavier than hoped.

Do you think there's more to the story for Block? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.